Mutual Funds

“Stock Spotlight: Comfort Systems USA (FIX) Shines Bright”

Comfort Systems USA (FIX): A Strong Buy Amidst Growth in AI Infrastructure Comfort Systems USA (FIX) specializes in comprehensive heating, ventilation, and air conditioning ...

Stock Spotlight: e.l.f. Beauty Faces Challenges Today

https://www.youtube.com/watch?v=HTtQxybfDvE[/embed> e.l.f. Beauty Faces Tough Times: Analysts Predict Difficult Road Ahead e.l.f. Beauty, known for its array of cosmetic products including makeup, lip treatments, ...

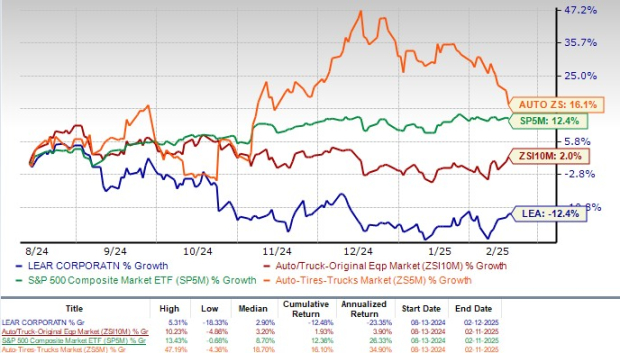

Why It’s Time to Sell Lear Stock After a 12% Decline in Six Months

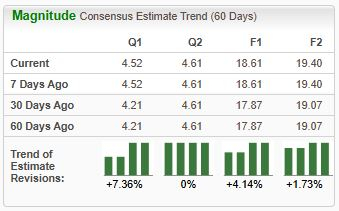

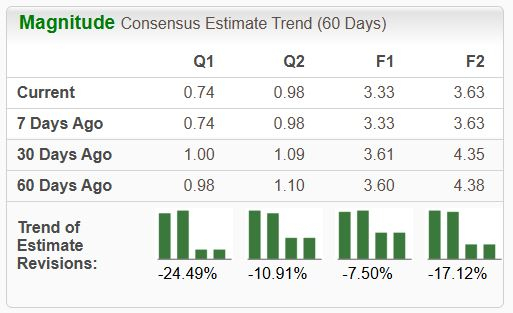

Lear Corporation Faces Challenges: A Look at Recent Performance and Future Outlook Lear Corp. (LEA) has seen its stock value decrease by 12.4% over ...

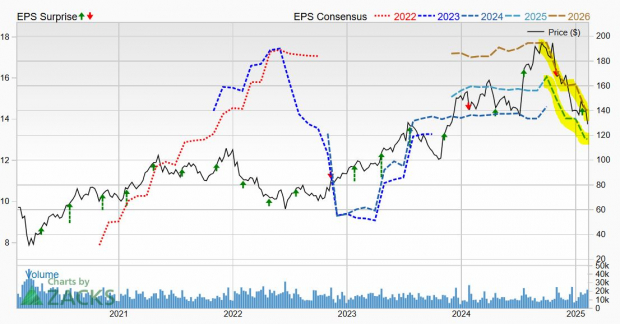

D.R. Horton, Inc. (DHI) Faces Downward Pressure: Today’s Bear of the Day

https://www.youtube.com/watch?v=xpg033SpcN8[/embed> D.R. Horton, Inc. (DHI) has seen its stock decline by 10% since the company released its financial results for the first quarter of ...

Daily Bear Spotlight: Goosehead Insurance (GSHD)

Goosehead Insurance (GSHD): A Tough Sell Amid Rising Risks Goosehead Insurance GSHD, currently holding a Zacks Rank #5 (Strong Sell), is becoming a stock ...

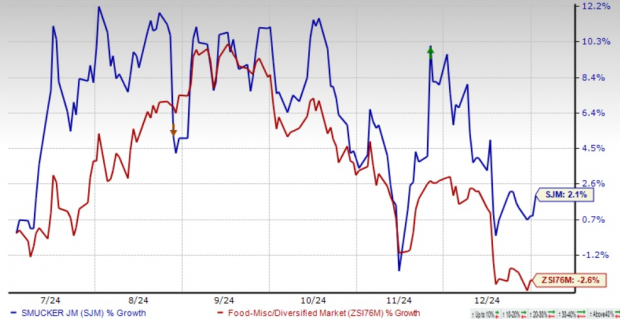

Evaluating the Potential for SJM’s Coffee and Snacks Portfolio in 2025

The J. M. Smucker Company SJM is showing strength in a changing market, proving its resilience through core brand performance and smart strategies. Brands ...

“Top Reasons to Keep Wingstop Stock in Your Investment Portfolio”

Wingstop Inc. WING stands poised for growth through increased sales, restaurant openings, and new technology. Strategic partnerships are promising for the company, but rising ...

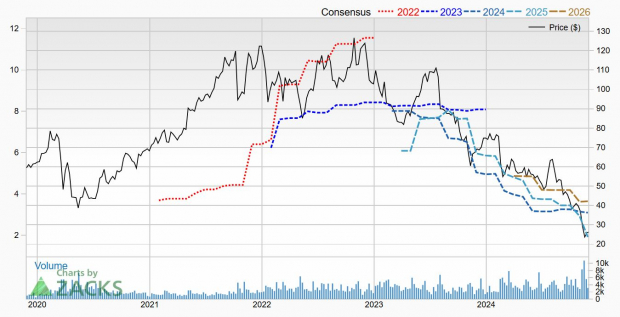

Stock Spotlight: AMN Healthcare Services Declares Bearish Trends

Downtown Dilemma: AMN Healthcare Faces Growing Financial Challenges AMN Healthcare Services, Inc. continues to struggle in the healthcare staffing market. This Zacks Rank #5 ...

Kronos Worldwide (KRO) Scales 52-Week High: What’s Driving It?

Kronos Worldwide, Inc.’s KRO shares hit a fresh 52-week high of $14.28 on May 28, before retracing to close the session at $14.17. The ...

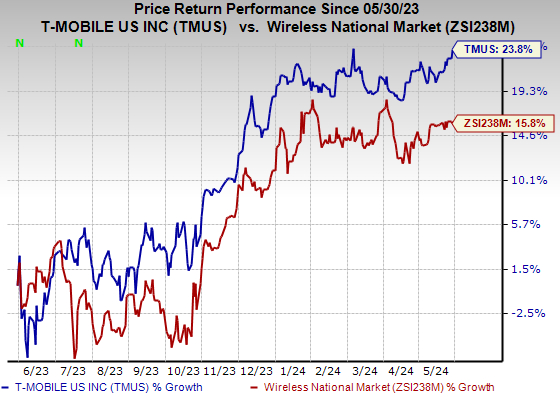

T-Mobile (TMUS) Boosts Network With US Cellular Asset Buyout

In a concerted effort to bridge the digital divide and strengthen its leading market position, T-Mobile US Inc. TMUS has inked a definitive agreement ...