Pre-Market

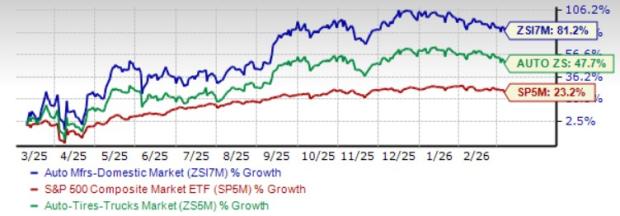

Promising Domestic Auto Stocks to Monitor Amid Geopolitical Tensions

The U.S. auto industry is facing a challenging outlook, with vehicle sales showing consistent declines for five months, according to Cox Automotive. High vehicle ...

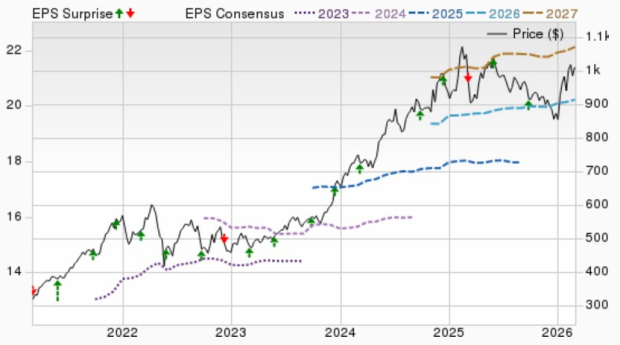

Costco Shares Show Limited Response Following Strong Earnings Performance

Costco Wholesale Corporation (COST) reported strong fiscal second-quarter 2026 results on Thursday, revealing total revenue of $69.597 billion and net income of $2.035 billion. ...

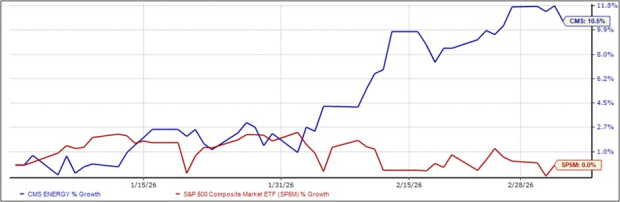

Top Energy Stocks Gaining Insider Investment

Insiders from several energy companies recently made significant stock purchases, highlighting their confidence in the future performance of their firms. In 2026, CMS Energy’s ...

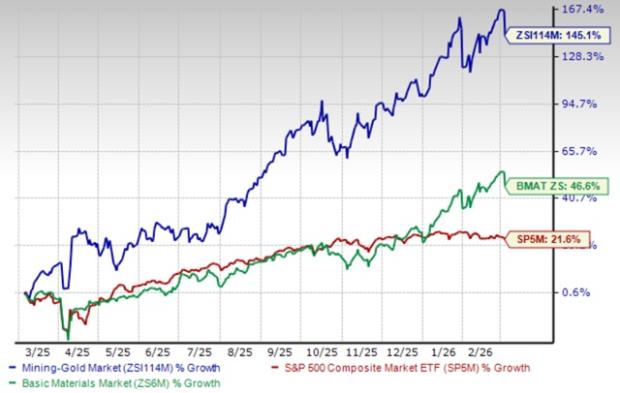

Top 5 Gold Stocks to Purchase for Benefiting from Strong Price and Demand Growth

The Zacks Mining – Gold industry is experiencing significant momentum, driven by strong gold prices and robust demand. As of October 2026, gold prices ...

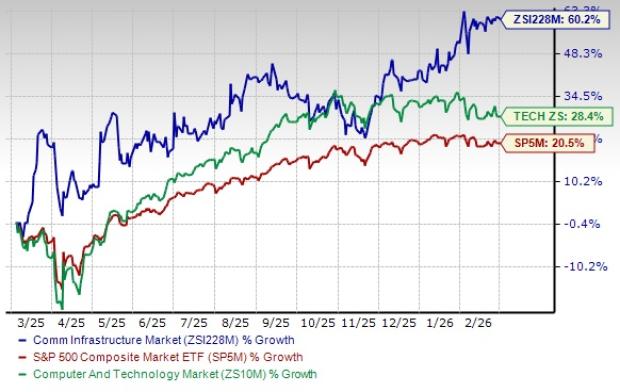

Top Communication Stocks Poised for Growth Amid Positive Industry Trends

The Zacks Communication – Infrastructure industry has surged by 60.2% over the past year, outperforming both the S&P 500 and the broader tech sector, ...

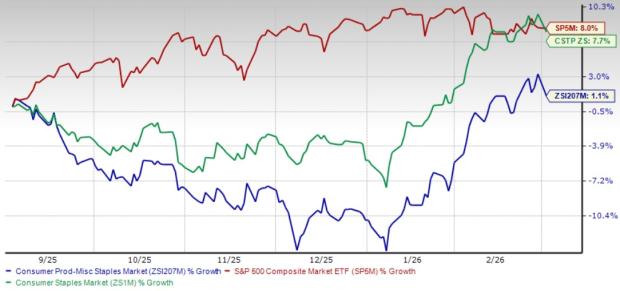

Four Consumer Stocks Poised for Growth Amid Industry Surge

The Consumer Products-Staples industry is currently focused on strategic optimization initiatives to enhance revenue streams and position for long-term growth. Companies like Procter & ...

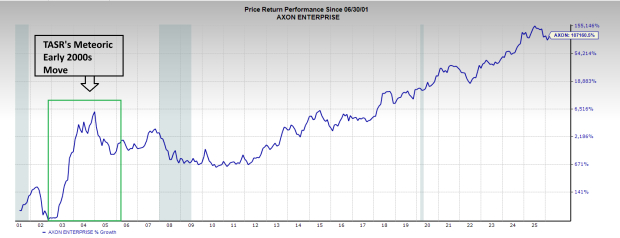

Sandisk Unveils Innovative High Tight Flags with Taser 2.0 Technology

Taser’s Remarkable Wall Street Surge in the Early 2000s In 2002, Taser, now known as Axon Enterprise (AXON), experienced unprecedented growth on Wall Street, ...

Top Discount Retail Stocks to Monitor: Costco and Three Additional Picks

The Retail – Discount Stores industry remains robust, reportedly achieving an 11.8% growth in stock performance over the past year, outperforming the broader Retail ...

Promising Small-Cap AI Stock to Monitor: RFIL

Lumentum (LITE) has emerged as a leader in optical networking technology amid a consolidation in the AI infrastructure sector, with its shares surging in ...

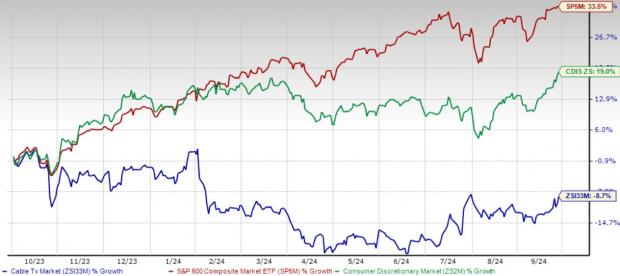

Top Cable TV Stocks to Watch Amid Industry Growth

The Zacks Cable Television industry is facing significant challenges as consumers continue to shift from traditional pay-TV options to streaming services. Industry players like ...