Resources

Perpetua Resources Secures Final Federal Approval for Stibnite Gold Project in Idaho

Perpetua Resources Secures Final Approval for $1.3 Billion Gold Project Perpetua Resources (Nasdaq: PPTA) (TSX: PPTA) announced on Monday that it has received final ...

Mayur Resources fully funded for Central Lime project in Papua New Guinea

Under the terms, Appian is providing a $63 million senior facility and a US$7 million royalty on the CLP, along with a $22.2 million ...

Taranis Resources wins exploration permit after legal battle

Taranis also requested the court to ask the Mines Minister Josie Osbourne for clarification on her statement that First Nations were “the rightful owners ...

Nexa Resources looks to broaden horizons in Peru

Nexa Resources looks to broaden horizons in Peru

When other enterprises are playing it safe, Nexa Resources is seizing the day, peering across the horizon towards Peru. Following on the heels of ...

Exploring Partnerships: Freeport Resources and the Yandera Copper Project Feasibility Study

Abundant Resources Unveiled In a revelation akin to striking copper, the NI 43-101 report conducted by SRK Consulting in late 2016 for Era Resources ...

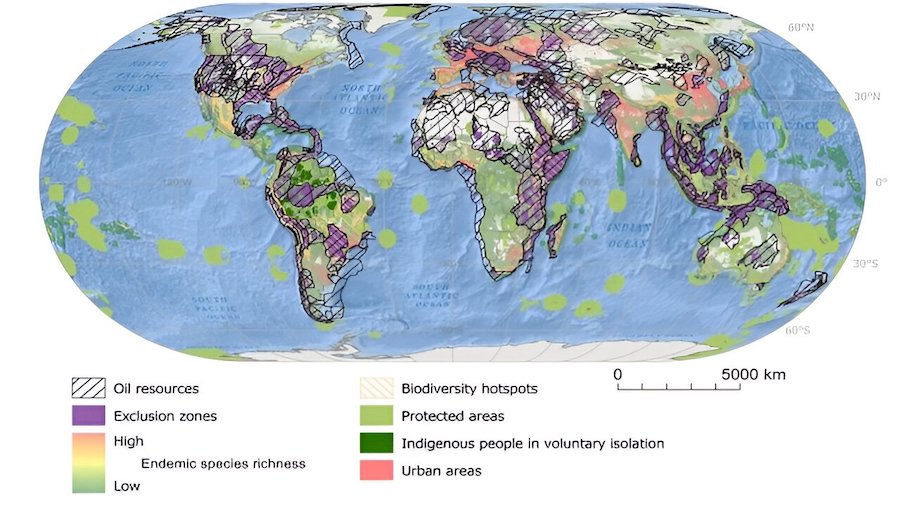

The Imperative to Preserve Earth’s Vital Ecosystems: A Call to Action for Investors and Governments

The latest study presents a chilling reality – to adhere to the Paris Agreement and sustain global temperatures within a 1.5°C threshold, the sanctity ...

The Sparkling Triumph of Lucapa: A Diamond in the Rough

Shining Brighter: Lucapa’s Ascendance Lucapa’s recent meteoric rise is a testament to the unwavering spirit of exploration and innovation in the mining industry. The ...

Seabridge updates Kerr, Iron Cap inferred resources

Seabridge Gold Announces Updates to Kerr and Iron Cap Inferred Resources Seabridge Gold Announces Resource Updates Seabridge Gold, a leading resource exploration and development ...