Stocks

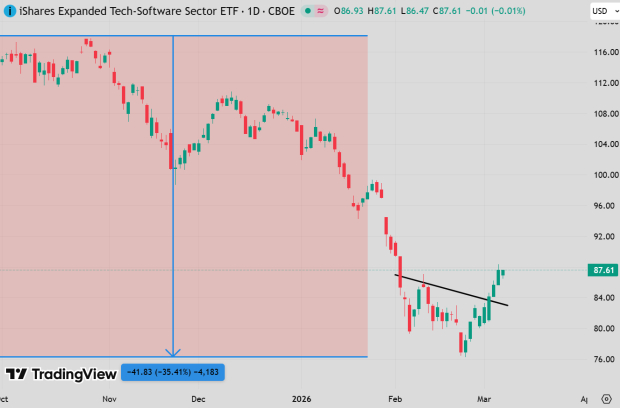

Five Stocks to Purchase as Software Recovery Gains Momentum

Over the past few months, the iShares Expanded Tech-Software ETF (IGV) has dropped by as much as 35%, with many individual stocks in the ...

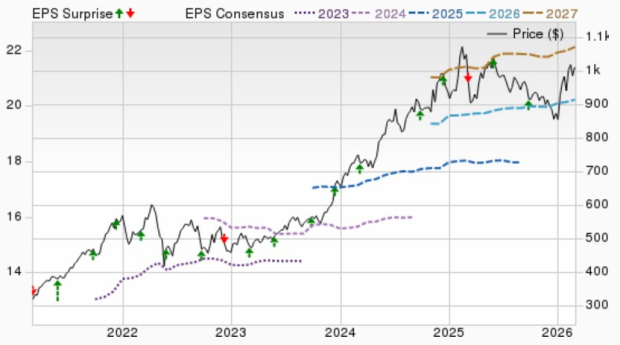

Costco Shares Show Limited Response Following Strong Earnings Performance

Costco Wholesale Corporation (COST) reported strong fiscal second-quarter 2026 results on Thursday, revealing total revenue of $69.597 billion and net income of $2.035 billion. ...

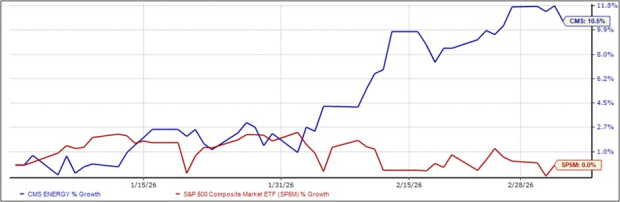

Top Energy Stocks Gaining Insider Investment

Insiders from several energy companies recently made significant stock purchases, highlighting their confidence in the future performance of their firms. In 2026, CMS Energy’s ...

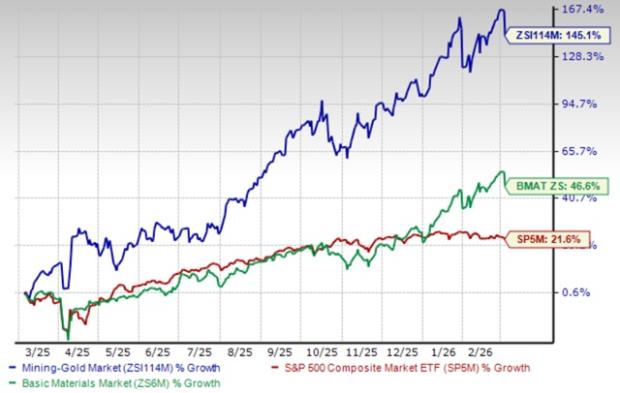

Top 5 Gold Stocks to Purchase for Benefiting from Strong Price and Demand Growth

The Zacks Mining – Gold industry is experiencing significant momentum, driven by strong gold prices and robust demand. As of October 2026, gold prices ...

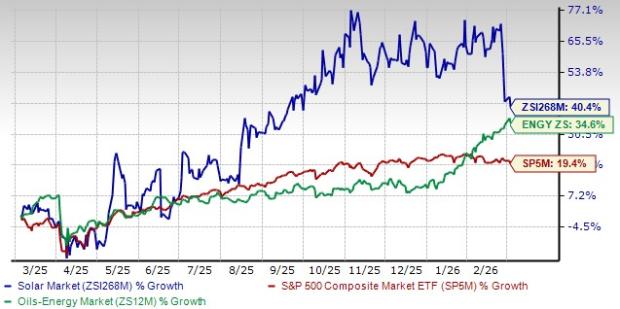

Top Solar Stocks to Monitor Despite Regulatory Challenges and Tariff Concerns

The U.S. solar industry is facing new challenges following the enactment of the One Big Beautiful Bill Act in July 2025, which reduces tax ...

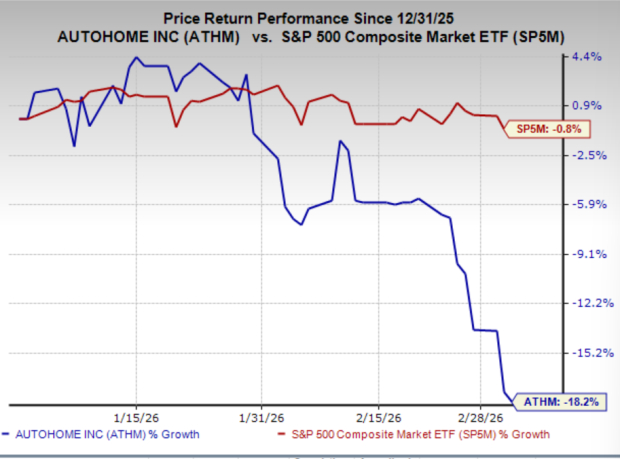

Autohome (ATHM) Faces Bearish Sentiment

Autohome Inc. (ATHM), one of China’s largest online platforms for automotive consumers, is currently facing significant financial challenges. The company’s annual revenue has declined ...

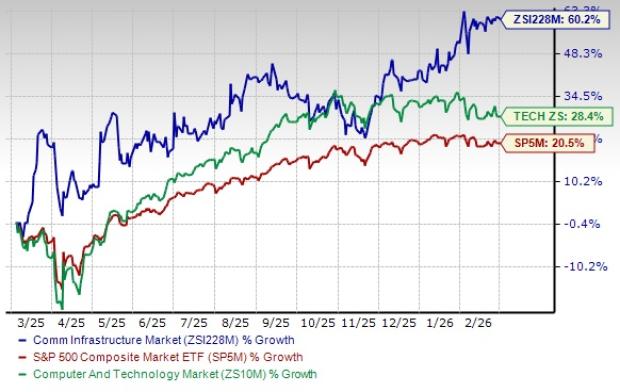

Top Communication Stocks Poised for Growth Amid Positive Industry Trends

The Zacks Communication – Infrastructure industry has surged by 60.2% over the past year, outperforming both the S&P 500 and the broader tech sector, ...

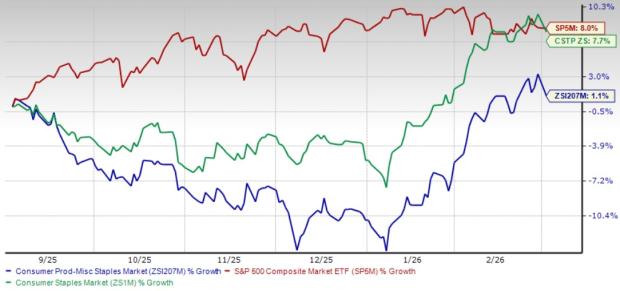

Four Consumer Stocks Poised for Growth Amid Industry Surge

The Consumer Products-Staples industry is currently focused on strategic optimization initiatives to enhance revenue streams and position for long-term growth. Companies like Procter & ...

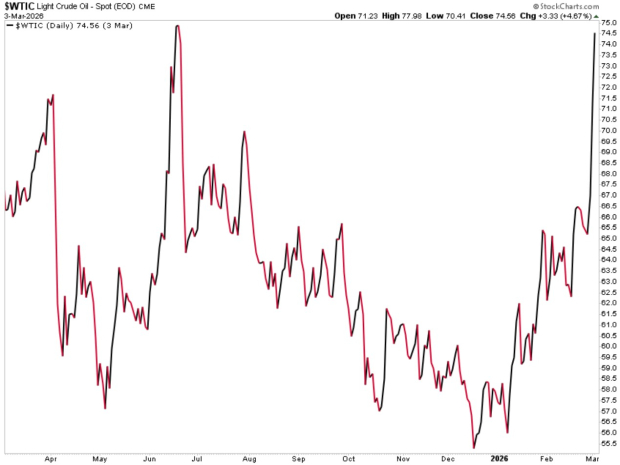

Navigating Rising Oil Prices: Strategies for Increasing Market Volatility

The recent escalation in the Middle East has created significant tensions in equity and oil markets. Following a major U.S.-Israeli military operation dubbed “Operation ...

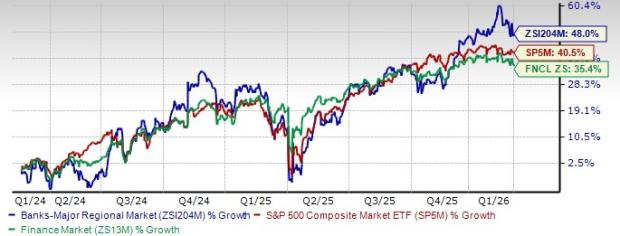

Key Regional Banks to Invest in Taking Advantage of Positive Industry Trends

The Zacks Major Regional Banks industry is projected to experience improvements in net interest income (NII) and margins as the Federal Reserve lowers interest ...