Stocks

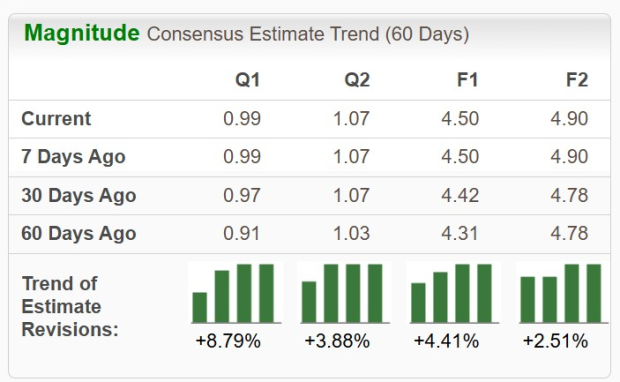

Dillard’s (DDS) Positioned for Strong Q4 Earnings: A Prudent Buy the Dip Opportunity

Dillard’s (DDS) is set to report its Q4 earnings on February 24, 2026, with expectations of flat sales at approximately $2.02 billion and a ...

Spring Surge Ahead: Unpacking Market Optimism Amidst Concerns

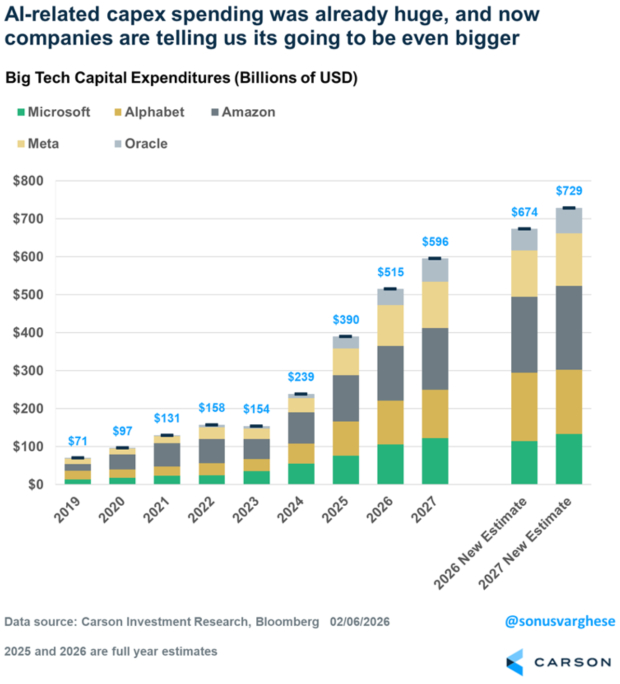

AI spending is set to surge, contradicting recent market fears. Major tech companies including Microsoft, Alphabet, and Amazon anticipate capital expenditure (CAPEX) spending to ...

Top Medical Instrument Stocks Leveraging GenAI to Overcome Industry Challenges

Over the past year, the application of generative AI (GenAI) in the Medical Instruments industry has evolved from experimental to operational, significantly enhancing diagnostics, ...

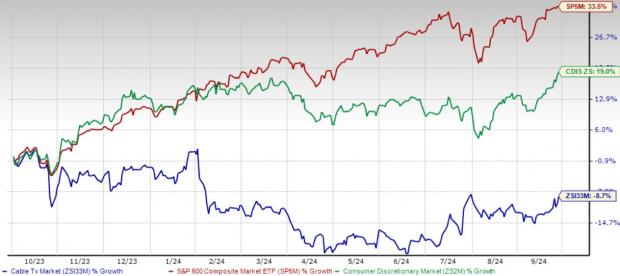

Top Cable TV Stocks to Watch Amid Industry Growth

The Zacks Cable Television industry is facing significant challenges as consumers continue to shift from traditional pay-TV options to streaming services. Industry players like ...

Top Two Heating and Air Conditioning Stocks to Monitor Amidst Market Challenges

The Zacks Building Products – Air Conditioner & Heating industry, currently ranked #223 out of over 250 industries, faces challenges from housing market softness, ...

Investing in Leading Asset Management Firms Now

### Asset Managers Highlighted for Strong Performance Brookfield Asset Management (BAM) and Janus Henderson Group (JHG) are two asset managers currently on the Zacks ...

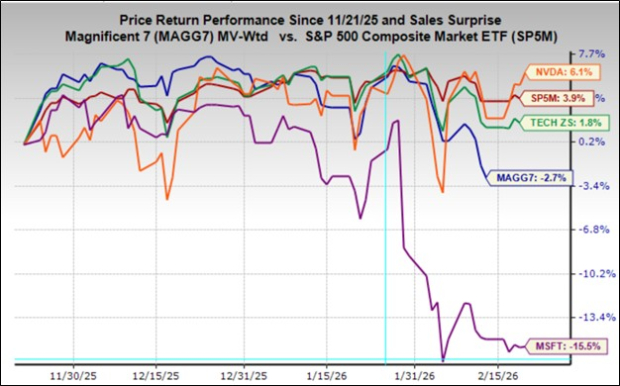

Anticipating Nvidia’s Earnings: Insights on the Mag 7 Performance

Recent sentiment regarding the Magnificent 7 tech stocks, including Amazon, Alphabet, and Microsoft, has been overwhelmingly negative. These stocks are experiencing significant underperformance, with ...

Top Affordable Stocks Under $10 to Invest in This February

The S&P 500 is trading slightly below its all-time highs in early 2026, amidst recent selling across sectors such as software and AI. While ...

Top Software Stocks Resilient to AI Disruption (NET, APP, MDB)

As artificial intelligence (AI) reshapes the software industry, key players Cloudflare (NET), AppLovin (APP), and MongoDB (MDB) are expected to remain resilient. These companies ...

Top 3 Refining and Marketing Stocks Worth Monitoring

The Zacks Oil and Gas – Refining & Marketing industry, consisting of 15 stocks, is currently ranked #197 out of 243 industries, placing it ...