Technology

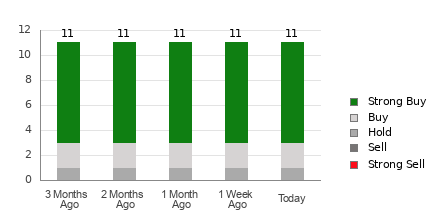

Is Docebo (DCBO) a Buy as Wall Street Analysts Look Optimistic?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports ...

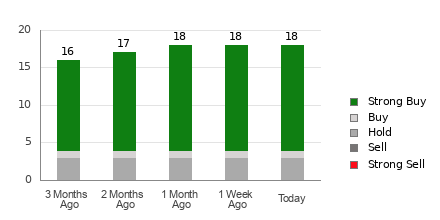

Brokers Suggest Investing in Royal Caribbean (RCL): Read This Before Placing a Bet

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports ...

Best Growth Stocks to Buy for May 16th

Here are three stocks with buy ranks and strong growth characteristics for investors to consider today May 16th: Powell Industries POWL: This metal-working shop ...

Best Income Stocks to Buy for May 16th

Here are three stocks with buy rank and strong income characteristics for investors to consider today, May 16th: Costamare CMRE: This company which operates ...

Best Value Stocks to Buy for May 16th

Here are three stocks with buy rank and strong value characteristics for investors to consider today, May 16th: Navios Maritime Partners NMM: This ...

New Strong Buy Stocks for May 16th

Here are five stocks added to the Zacks Rank #1 (Strong Buy) List today: Diversified Energy Company PLC DEC: This energy company which is ...

Should You Invest in Spotify (SPOT) Based on Bullish Wall Street Views?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports ...

Excelerate Energy (EE) Is Considered a Good Investment by Brokers: Is That True?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports ...

Is It Worth Investing in Nu (NU) Based on Wall Street’s Bullish Views?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed ...

Is Zscaler (ZS) a Buy as Wall Street Analysts Look Optimistic?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed ...