Technology

Investor’s Delight: Top Picks Unveiled for March 18th

In a market landscape rife with uncertainty, the unveiling of five new strong buy stocks on the Zacks Rank #1 (Strong Buy) List comes ...

Unveiling Top Momentum Stocks for Investors

As we approach March 15th, investors are presented with a trio of intriguing stocks boasting a buy rank and robust momentum characteristics to consider: ...

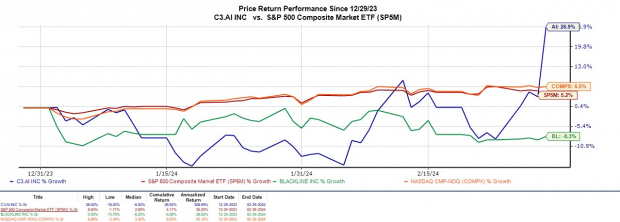

Deciphering C3.ai’s (AI) Phenomenal Stock Surge Post-Earnings: A Deep Dive

As the race heats up among enterprise AI software providers, C3.ai, is emerging as a key player with its stock skyrocketing over +20% in ...

Uncover Promising Momentum Stocks for the Leap Year Day

Discover three stocks displaying promising momentum attributes and a buy rank for investors to mull over on this unique day, February 29: Ultrapar Participações ...

Investing in the Future: New Elite Stocks to Watch

Unveiling the crème de la crème, the Zacks Rank #1 (Strong Buy) List flashes five formidable contenders. Let’s dive into this battlefield of excellence: ...

The Golden Picks: Top Stocks for Income Investors on February 29th

In the frenzied world of stocks, two shining gems beckon investors looking for income opportunities this February 29th. Let’s delve into the allure of ...

The Wisest Value Stocks to Explore Today

For investors seeking promising opportunities to unearth rich returns, three stocks merit discerning attention on this exceptional February 29: Discovering Ultrapar Participações S.A. UGP: ...

Unveiling the Hidden Gems: Top Stocks with Strong Growth Potential for Investors

Venturing into the stock market waters can sometimes feel like navigating a vast sea of uncertainty. Amidst the ebb and flow of economic tides, ...

The Evolution of Ethereum’s Canun-Deneb Upgrade

The Ethereum network has been undergoing a series of upgrades to address the blockchain trilemma, balancing security, decentralization, and scalability. The upcoming Ethereum Cancun-Deneb ...