Technology

Two Compelling Healthcare Stocks to Monitor Ahead of Q4 Earnings: EXEL, GILD

Exelixis Inc. (EXEL) and Gilead Sciences Inc. (GILD) are set to release their Q4 financial results after market hours on February 10. Exelixis has ...

United Bancorp Reports Year-over-Year Increase in Q4 Earnings Driven by Strong Loan Demand

United Bancorp, Inc. (UBCP) reported a year-over-year net income increase of 10% to $2 million for the fourth quarter ended December 31, 2025. The ...

Key Tronic Sees Positive Momentum Amid Year-Over-Year Q2 Loss Following Restructuring Efforts

**Key Tronic Corporation Reports Q2 Fiscal 2026 Results Amid Revenue Decline** Key Tronic Corporation (KTCC) announced a 15% decrease in revenues for the second ...

Star Group Reports Year-over-Year Earnings Growth in Q1 Fueled by Cold Weather and Strategic Acquisitions

Star Group, L.P. (SGU) reported a 10.5% year-over-year increase in total revenues for Q1 fiscal 2026, reaching $539.3 million, compared to $488.1 million in ...

Taylor Devices Surges 74% in 6 Months: Is It Time to Invest?

**Taylor Devices, Inc. (TAYD)** has experienced a remarkable 74.4% surge in share price over the past six months, significantly outperforming the 17% growth observed ...

Top Strong Buy Stocks to Consider for February 6th

Five stocks have been added to the Zacks Rank #1 (Strong Buy) List as of February 6, 2023. Notable companies include Atlantic Union Bankshares ...

Top Momentum Stocks to Consider for February 5th

On February 5, three stocks received a “buy” rank and demonstrated strong momentum: Centerra Gold Inc. (CGAU), WisdomTree, Inc. (WT), and UMB Financial Corporation ...

Top Stock Picks to Consider for February 5th

Five stocks have been added to the Zacks Rank #1 (Strong Buy) List as of today, February 5, 2024. Hancock Whitney Corporation (HWC) has ...

Utah Medical Reports Q4 Earnings Drop Due to Decline in OEM Sales Year Over Year

Utah Medical Products, Inc. (UTMD) reported its fourth-quarter earnings for 2025 on December 31, revealing a 6.3% drop in earnings per share (EPS) to ...

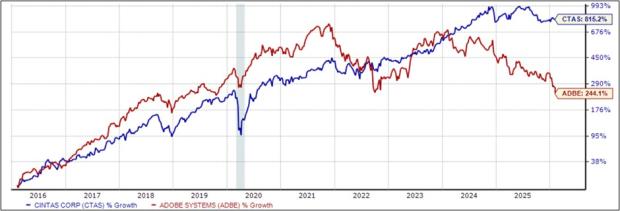

Exploring Alternative Investment Opportunities Beyond Tech Stocks

Cintas Corporation (CTAS), a company specializing in workplace supplies and uniforms, has seen its stock surge by 815% over the past decade, significantly outperforming ...