Technology

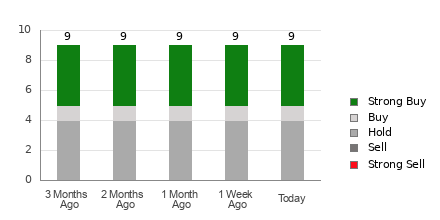

Wall Street Analysts See BRC INC (BRCC) as a Buy: Should You Invest?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports ...

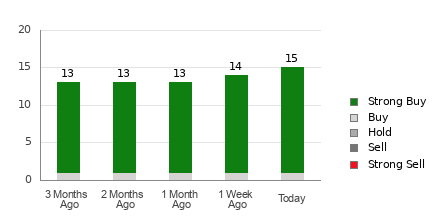

Wall Street Bulls Look Optimistic About Grab (GRAB): Should You Buy?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports ...

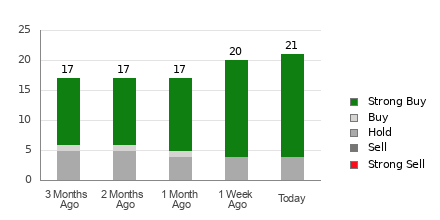

Wall Street Analysts Think Western Digital (WDC) Is a Good Investment: Is It?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports ...

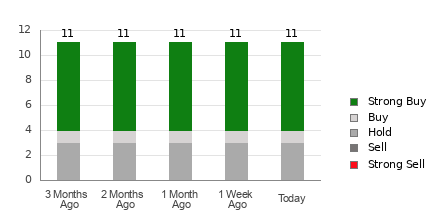

Wall Street Analysts See ResMed (RMD) as a Buy: Should You Invest?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed ...

Brokers Suggest Investing in American Tower (AMT): Read This Before Placing a Bet

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed ...

Is It Worth Investing in Fiverr (FVRR) Based on Wall Street’s Bullish Views?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed ...

Brokers Suggest Investing in Core & Main (CNM): Read This Before Placing a Bet

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed ...

Best Momentum Stocks to Buy for May 21st

Here are three stocks with buy rank and strong momentum characteristics for investors to consider today, May 21st: Onto Innovation Inc. ONTO: This manufacturer ...

Wall Street Analysts See Abbott (ABT) as a Buy: Should You Invest?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed ...

Wall Street Analysts See MongoDB (MDB) as a Buy: Should You Invest?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed ...