top

Rio Tinto’s Strategic Move to Acquire Arcadium Elevates its Lithium Standing

A Game-Changing Acquisition Rio Tinto, the second-largest miner globally, has announced its acquisition of United States-based lithium company Arcadium for $5.85 per share—a substantial ...

Utah ranked top jurisdiction for mining investment by Fraser Institute

To arrive at the ranking, the Fraser Institute surveyed approximately 2,045 mining-related firms globally between August 16, 2023, and January 9, 2024, tallying their ...

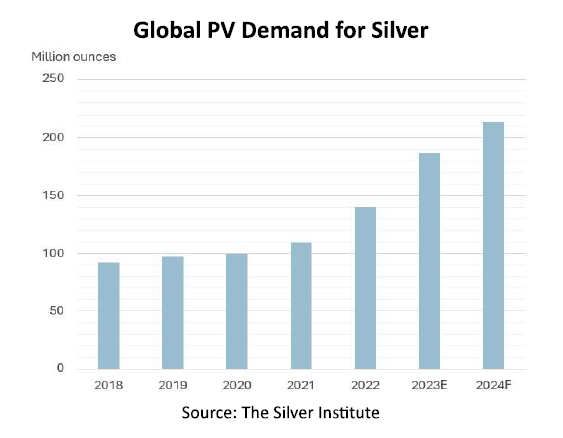

Silver’s Emergence as a Critical Mineral in North America

Silver’s Emergence as a Critical Mineral in North America

The case for silver In December 2023, Natural Resources Canada embarked on a journey to review Canada’s Critical Minerals list and methodology, inviting public ...

The Remorseless Collapse of First Quantum Minerals

Metal and mineral markets are notoriously erratic and prone to abrupt downturns. The 2023 plunge in nickel, cobalt, and lithium prices, while extreme, is ...

The Golden Touch: BMO and Canaccord Genuity Lead 2023 Mining M&A Advisory Board, Says Report

Atop the mountain of mining mergers and acquisitions, a report has hailed BMO Capital Markets and Canaccord Genuity Group as the paragons of advisory ...

Chilean Government’s Lithium Partnership

Chilean Government Forges New Path with Lithium Partnership

President Gabriel Boric’s bold plan mandates that any company seeking to mine lithium in Chile must form a partnership with the government, with the ...