US Markets

Top Stocks to Consider During the Market Dip: Is HOOD a Smart Buy After a 50% Drop Ahead of Earnings?

Robinhood Markets, Inc. (HOOD) saw its stock price reach all-time highs in October, reflecting its evolution from a stock-trading app to a significant player ...

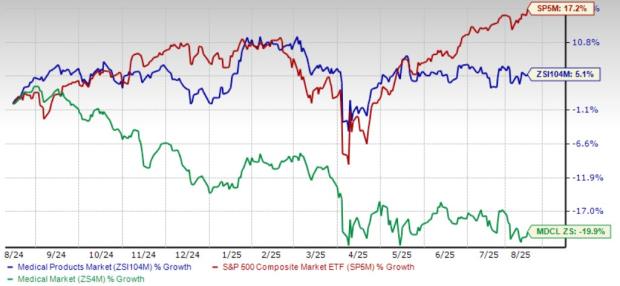

Four Medical Stocks to Monitor Amid Industry Challenges

The Zacks Medical Products industry is projected to face ongoing challenges through 2025, as procedural volumes stabilize amidst slowing growth and funding hurdles for ...

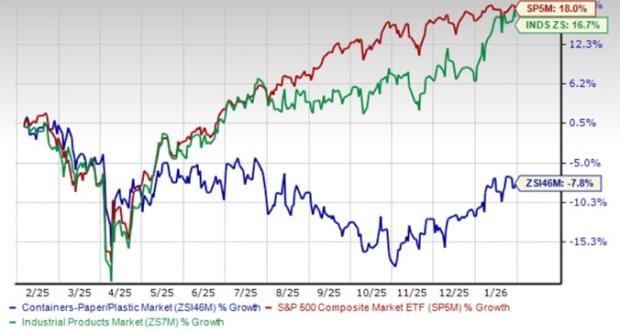

Top 3 Packaging Stocks to Monitor During Market Turbulence

The Containers – Paper and Packaging industry is currently facing weak demand, attributed to declining consumer spending amid inflationary pressures. As of now, the ...

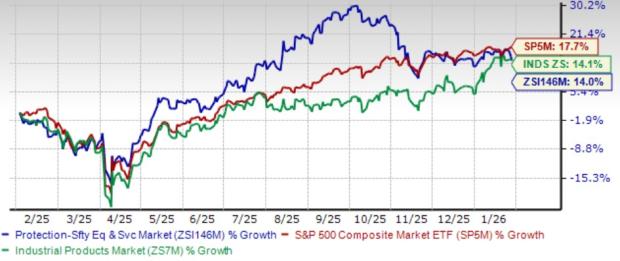

Top 4 Security and Safety Stocks Benefiting from Emerging Industry Trends

The Zacks Security and Safety Services industry, ranked 97th among 244 industries, is poised for growth due to rising demand for cybersecurity and safety ...

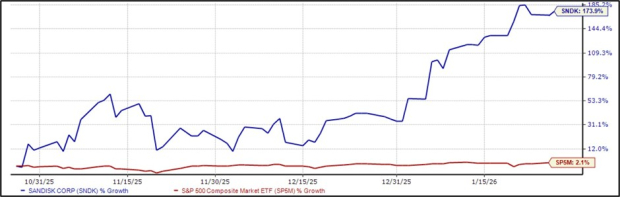

Current Trends in SanDisk Stock Performance

SanDisk (SNDK) shares have surged more than 170% in the past three months as demand for storage solutions driven by AI escalates. The company’s ...

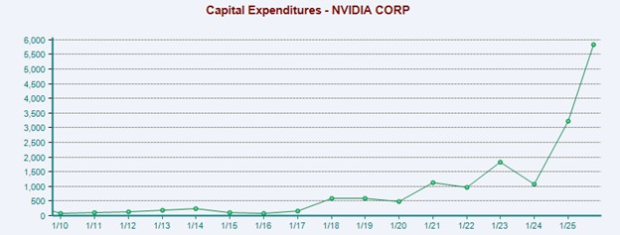

Assessing Nvidia’s Capital Efficiency as an Investment Opportunity

Nvidia’s capital expenditures have surged over 500% in the last five years, nearing $6 billion on a trailing twelve-month basis, as the company expands ...

Top 3 Media Stocks to Invest in for Growth Potential

Industry Growth and Challenges: The Zacks Media Conglomerates industry is experiencing growth driven by a shift to over-the-top (OTT) content, with major players such ...

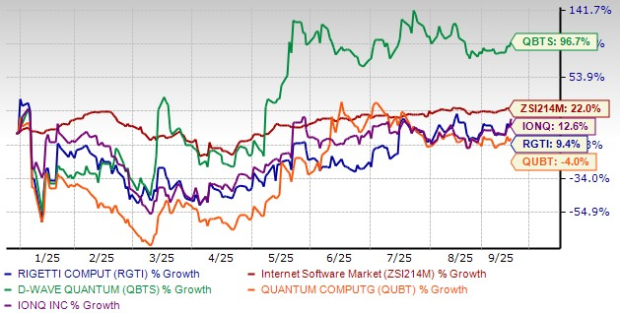

RGTI Expands Global Partnerships in Quantum Initiatives: Should You Invest Now or Wait?

“`html Rigetti Computing (RGTI) is expanding its global reach by entering new collaborations in the U.S. and India, aiming to bolster its positioning in ...

MET Enhances Critical Illness Plan with New Cancer Support Benefit

“`html MetLife, Inc. (MET) has launched a Cancer Support benefit as part of its Critical Illness Insurance offering, effective January 1, 2026. This new ...

Factors That Could Lead to a Surge in Rio Tinto Stock Value

“`html Rio Tinto’s stock has gained only 1% over the past year, significantly lagging behind the S&P 500’s 14% increase. The company, valued at ...