US Markets

Top 3 Media Stocks to Invest in for Growth Potential

Industry Growth and Challenges: The Zacks Media Conglomerates industry is experiencing growth driven by a shift to over-the-top (OTT) content, with major players such ...

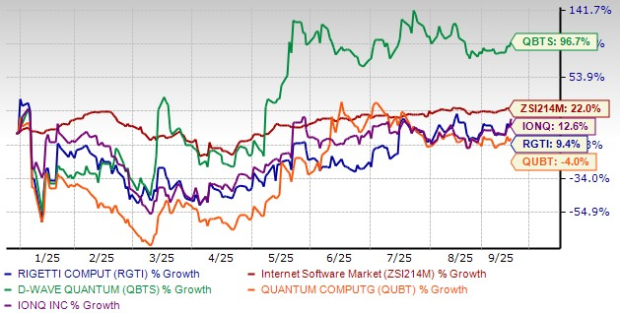

RGTI Expands Global Partnerships in Quantum Initiatives: Should You Invest Now or Wait?

“`html Rigetti Computing (RGTI) is expanding its global reach by entering new collaborations in the U.S. and India, aiming to bolster its positioning in ...

MET Enhances Critical Illness Plan with New Cancer Support Benefit

“`html MetLife, Inc. (MET) has launched a Cancer Support benefit as part of its Critical Illness Insurance offering, effective January 1, 2026. This new ...

Factors That Could Lead to a Surge in Rio Tinto Stock Value

“`html Rio Tinto’s stock has gained only 1% over the past year, significantly lagging behind the S&P 500’s 14% increase. The company, valued at ...

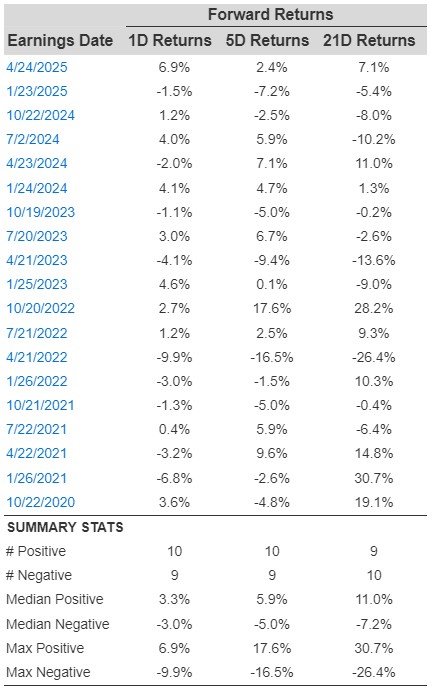

Anticipating the Market Response to Freeport-McMoRan’s Upcoming Earnings Report

“`html Freeport-McMoRan (NYSE: FCX) will report its earnings on July 23, 2025, with consensus estimates indicating earnings of $0.44 per share and a revenue ...

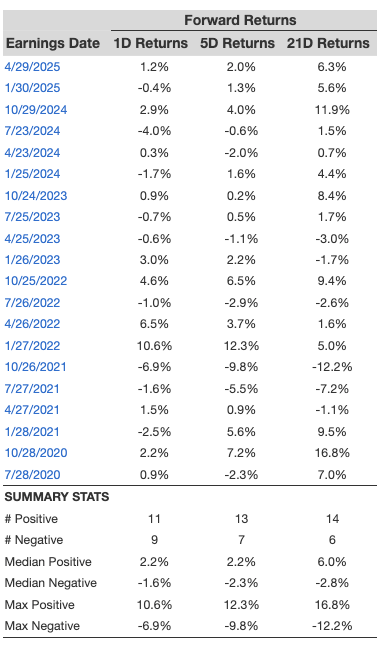

Anticipating Visa Stock’s Performance Ahead of Earnings Report

Visa (NYSE: V) is scheduled to report its Q3 FY’25 earnings on July 29. Analysts project revenues to reach approximately $9.82 billion, marking a ...

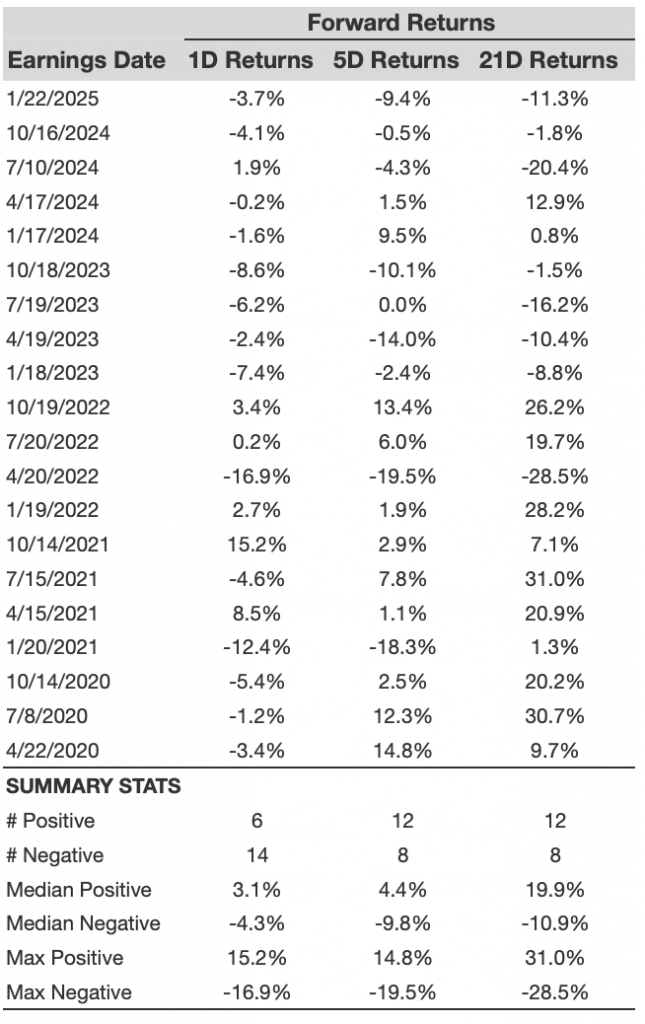

Anticipating Alcoa’s Stock Performance Ahead of Earnings Release

“`html Alcoa (NYSE:AA) is scheduled to report its first quarter earnings on April 16, 2025, with expected revenues of approximately $3.6 billion, marking a ...

Exploring the Long-Term Investment Potential of Jazz Pharmaceuticals

Jazz Pharmaceuticals (NASDAQ: JAZZ) is currently trading at approximately $110, down 11% year-to-date, following the European Commission’s conditional Marketing Authorization for Ziihera (zanidatamab) for ...

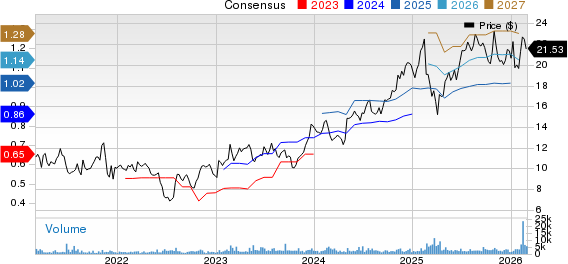

Is There Potential for Soundhound AI Stock to Increase Significantly?

SoundHound AI (NASDAQ: SOUN) saw its stock price surge from $2 to $24 in 2024, marking a twelvefold increase. As of early 2025, the ...

Is It Time to Buy Paychex After a 10% Decline?

Paychex (NASDAQ:PAYX) saw its stock drop nearly 10% on Wednesday following the release of its Q4 FY’25 results, where the company reported a 10% ...