US Markets

Can Broadcom Stock Double in Value?

Broadcom (NASDAQ: AVGO) has seen a 125% surge in stock price from $110 in early 2024, raising questions about its potential to exceed $500 ...

CleanSpark Stock: Could the Recent 13% Jump Signal Further Gains?

On June 24, 2025, CleanSpark (NASDAQ: CLSK) experienced a stock increase of 13% following the achievement of a 50 EH/s hashrate milestone, which enhances ...

Chime’s Potential: Is Strong Growth and Rising Earnings a Buy Signal?

The fintech company Chime Financial (NASDAQ: CHYM) debuted on the market last week, initially surging nearly 40% above its IPO price of $27 to ...

Will Circle Stock Hit $300?

Circle Internet Group Inc (NYSE: CRCL), the issuer of the USDC stablecoin, has seen its stock surge to around $115, a significant increase from ...

Avoid Investing in Semtech Stock at This Time

“`html Semtech Corporation (NASDAQ:SMTC) experienced a stock increase of nearly 9% on Monday, driven by optimism surrounding U.S.-China trade talks which may lead to ...

Reasons Investors Should Avoid FedEx Stock at This Time

“`html FedEx Corporation (FDX) is facing increased operating expenses that are negatively impacting its performance, prompting concerns among investors. The Zacks Consensus Estimate for ...

Is a Decline Below $100 Possible for First Solar Stock?

First Solar’s stock (NASDAQ: FSLR) has declined nearly 50% from approximately $300 to around $150, raising concerns about whether this represents a buying opportunity ...

The Future of Merck: Assessing Keytruda’s Role in Sustained Growth

Merck’s leading drug, Keytruda, experienced a significant sales increase of 72%, rising from $17 billion in 2021 to $29 billion in 2022, now accounting ...

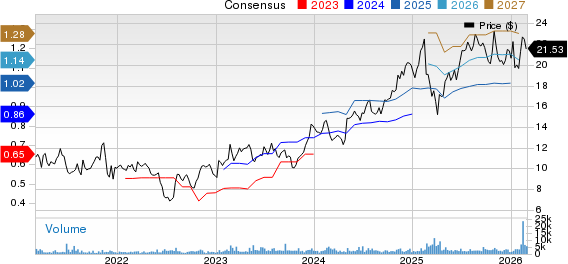

Will Deckers Exceed Expectations in the Upcoming Earnings Report?

Deckers Outdoor Corp Set to Announce Q4 Earnings on May 22 Deckers Outdoor Corp (NYSE: DECK) will report its fiscal fourth-quarter earnings on Thursday, ...

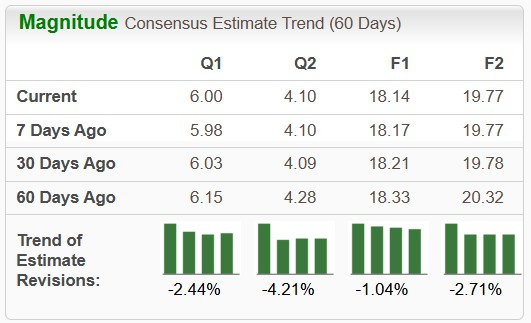

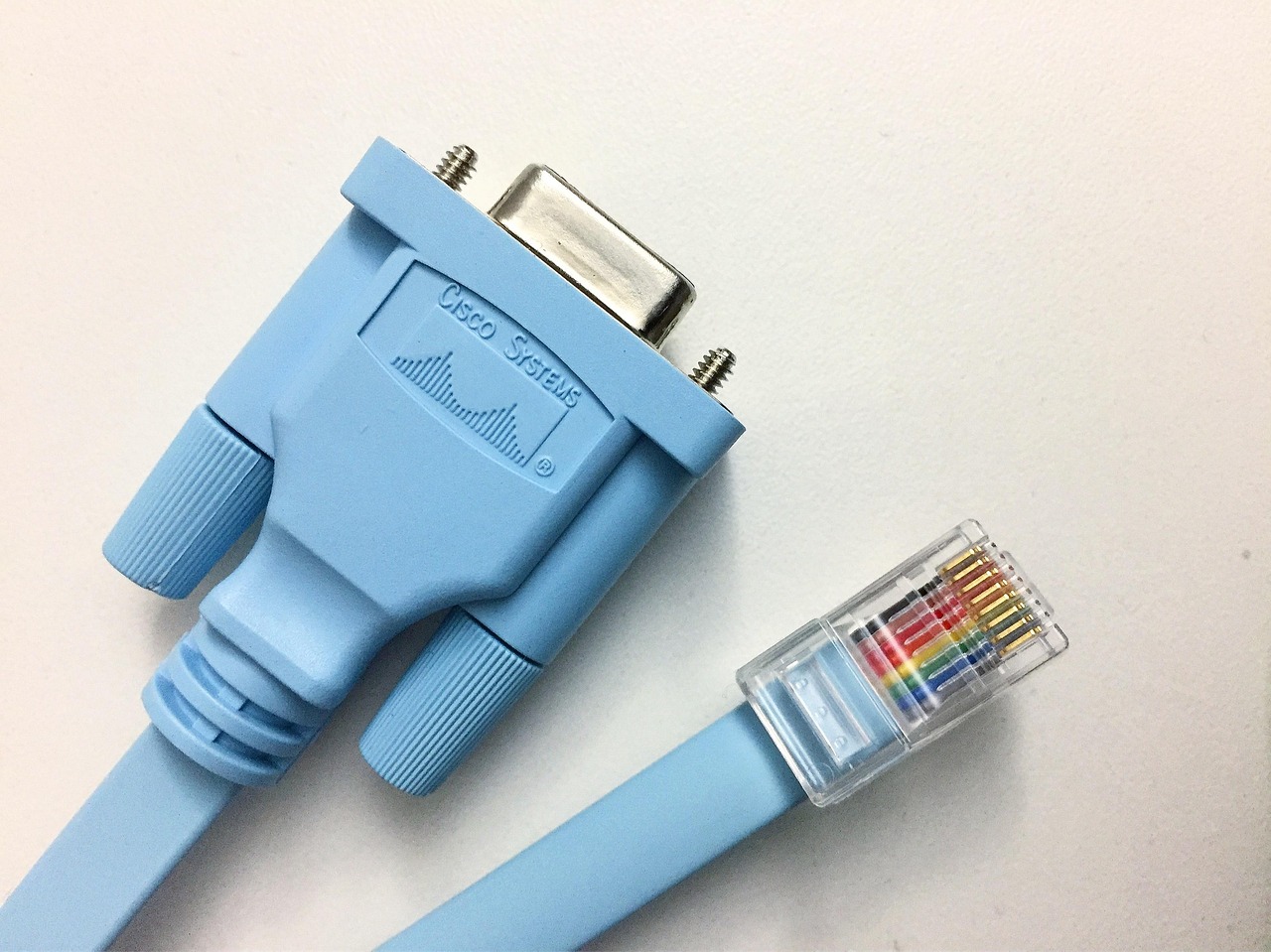

Can Cisco’s Q3 Results Propel Its Stock Upward?

Cisco Earnings Preview: Growth Expected Amid Challenges Note: Cisco’s FY 2024 ended July 27, 2024 Cisco Systems Inc (NASDAQ: CSCO), known for its networking ...