U.S. Chipmakers Secure Major Government Funding Amid Political Uncertainty

Companies Take Steps to Boost Domestic Semiconductor Production

Leading chipmakers such as Taiwan Semiconductor Manufacturing Co TSM and GlobalFoundries Inc GFS have concluded agreements for significant U.S. government support in the form of grants and loans, according to sources cited by Bloomberg.

This development is a key part of the Biden administration’s efforts to implement the 2022 bipartisan CHIPS Act, which aims to enhance domestic semiconductor manufacturing capabilities.

Taiwan Semiconductor earlier received $6.6 billion in April for its project in Phoenix, Arizona, while GlobalFoundries was granted $1.5 billion for its operations in Malta, New York, and Burlington, Vermont. Collectively, these companies are part of a group of 21 recipients awarded a total of $37 billion in preliminary funds from the CHIPS Act, as reported by Reuters.

Also Read: Why Is Iron Mountain Stock Plunging On Wednesday?

However, some companies are apprehensive about potential changes following former President Donald Trump’s return to political prominence. Trump recently criticized the CHIPS Act during an appearance on the Joe Rogan podcast, calling it a “bad deal” that benefits wealthy corporations. He proposed high tariffs as a more effective strategy for promoting domestic chip production.

Additionally, Republican House Speaker Mike Johnson indicated that the GOP might consider repealing the CHIPS Act if they regain majority control. Although he later clarified his comments, uncertainty remains for companies awaiting final agreements.

Experts believe that despite Trump’s campaign statements, he is unlikely to dismantle the CHIPS and Science Act initiated under the Biden administration. Paul Triolo of Albright Stonebridge pointed out that there is bipartisan backing for advanced manufacturing efforts in the U.S.

Adam Posen, an economist at the Peterson Institute for International Economics, noted that even if Trump opts to shift funding priorities, he is expected to largely preserve the act, much like Biden maintained Trump-era tariffs on China. Posen predicts that Trump might focus more on tariffs than on expanding industrial policy if he modifies the act.

In financial updates, Taiwan Semiconductor reported a third-quarter revenue of 759.69 billion New Taiwan dollars ($23.50 billion), marking a 39% increase. This result exceeded the company’s guidance of $22.4 billion to $23.2 billion. Boosted by strong demand for smartphones and AI technology, especially its 3nm and 5nm chips, the company reported a gross margin of 57.8%, up 350 basis points (bps). Looking ahead, it projects revenue between $26.1 billion and $26.9 billion for the fourth quarter, surpassing the Street consensus of $24.86 billion.

GlobalFoundries, on the other hand, reported a year-over-year revenue decline of 6% in its third quarter of 2024, totaling $1.74 billion, yet it beat analysts’ expectations of $1.73 billion. The adjusted gross margin fell by 450 bps to 24.7%. For the upcoming quarter, it forecasts revenue between $1.80 billion and $1.85 billion, compared to the $1.73 billion estimate.

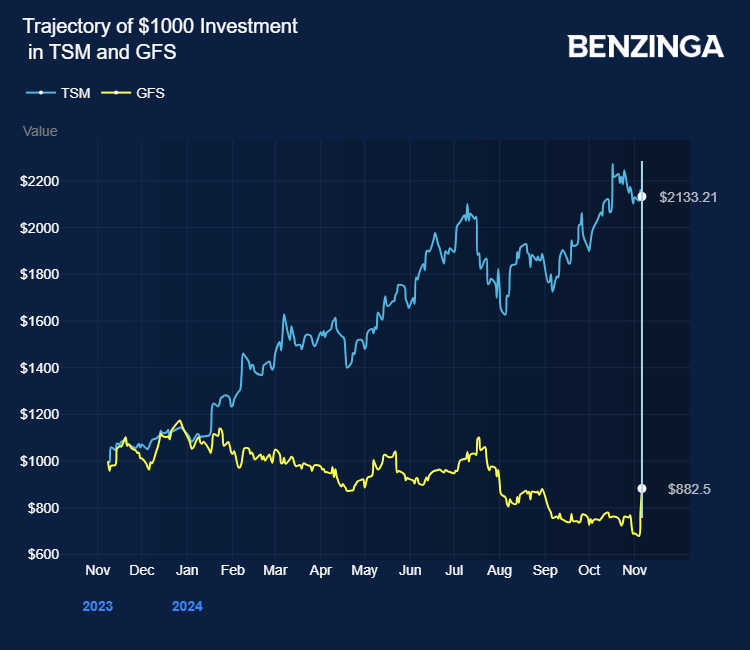

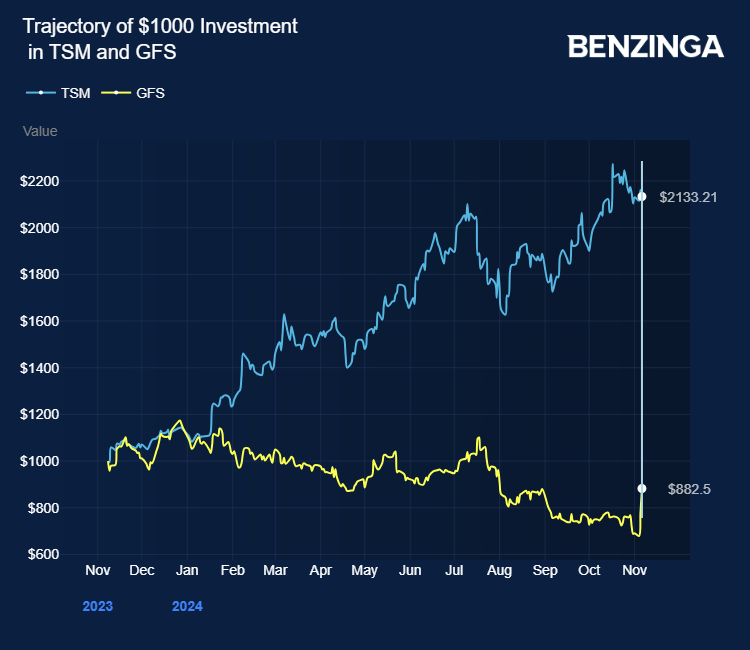

Year-to-date, Taiwan Semiconductor’s stock has jumped over 90%, while GlobalFoundries has seen a decrease of more than 19%.

Price Actions: TSM shares were up 3.97% at $200.90 during the latest market check, while GFS shares fell by 2.30%.

Also Read:

Image via Shutterstock

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs