Apple Moves Towards Domestic Chip Production with TSMC’s Arizona Facility

Apple Inc AAPL is in the final stages of certifying its “made in America” processor chips produced at Taiwan Semiconductor Manufacturing Co’s TSM Arizona plant.

Upcoming Chip Production Timelines

According to a report by Nikkei Asia, the initial batch of commercial chips from this facility is expected to be ready this quarter.

A Shift in Global Semiconductor Dependencies

The COVID-19 pandemic in 2020 pushed countries such as the U.S., Europe, and Japan to strengthen their semiconductor supply chains by turning to companies like Taiwan Semiconductor, Intel Corp INTC, and Samsung Electronics Co SSNLF. This move aimed to reduce reliance on China for chip manufacturing.

Regulatory Measures Amid Rising Tensions

The U.S. government has also begun to restrict China’s access to advanced semiconductor technologies, alleging that they were being used to enhance military capabilities. This includes limits on technologies from companies such as Nvidia Corp NVDA and Taiwan Semiconductor.

Additionally, Washington is collaborating with allies, including Taiwan and the Netherlands, which is home to chip equipment maker ASML Holding ASML, to further restrict semiconductor trade with China.

Market Share Insights and Competitive Landscape

In the third quarter of 2024, Taiwan Semiconductor claimed a 64% share of the global foundry market, up from 62% in Q2, as reported by Taipei Times citing Counterpoint Research. This advantage stems from high utilization rates in its 5nm and 3nm process technologies, alongside demand for artificial intelligence (AI) chips and smartphone sales.

Samsung followed with a 12% market share, driven by its 4nm and 5nm technology. In third place was China’s Semiconductor Manufacturing International, which secured 6% with its 28nm process. Meanwhile, United Microelectronics Corp UMC and GlobalFoundries Inc GFS both held 5% of the market, focusing on the Internet of Things and communications sectors.

Future Innovations and Market Expectations

The 3nm process captured a 13% market share in Q3, while the 5nm and 4nm nodes dominated with 24% of the market, spurred by demand for Nvidia’s Blackwell graphics processing units. Taiwan Semiconductor is set to commence production of its 2nm technology at its Hsinchu County facility in 2025.

Goldman Sachs has expressed positive outlooks on Taiwan Semiconductor’s future, particularly due to rising AI demand and growth in advanced nodes. Anticipated price increases for the 3nm and 5nm nodes in 2025 could enhance margins to over 59% for the company.

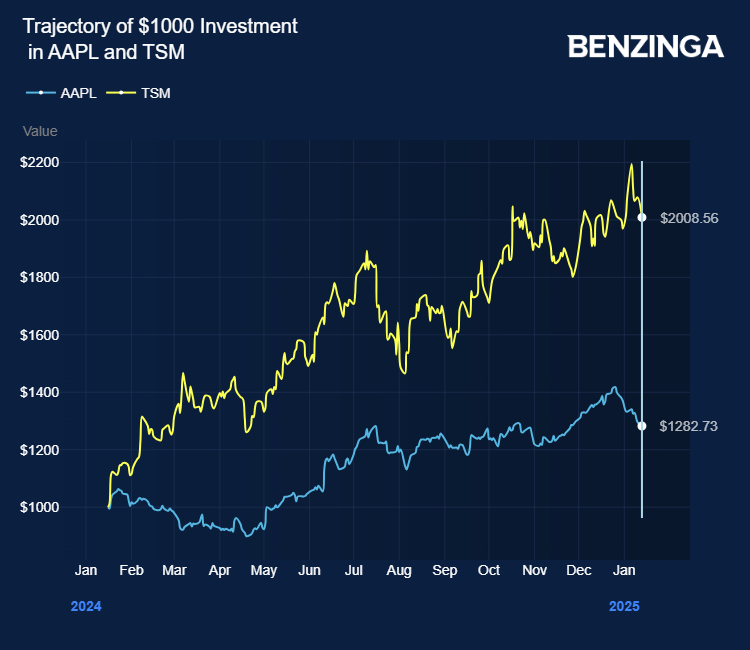

Over the past year, Taiwan Semiconductor’s stock has surged more than 98%. Investors can access semiconductor stocks through the VanEck Semiconductor ETF SMH and the iShares Semiconductor ETF SOXX.

Current Stock Performance

Price Action: As of the latest report on Tuesday, TSM stock is slightly down by 0.65%, trading at $200.05.

Also Read:

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs