Intel Faces Challenges as Taiwan Semiconductor Expands Investment

During President Biden’s time in office, his administration prioritized domestic manufacturing investments. A significant achievement was the signing of the CHIPS and Science Act in 2022, which allocated $280 billion for research, development, and semiconductor manufacturing in the United States here.

In recent years, Intel has been one of the primary beneficiaries of CHIPS Act funding. With growing investments in artificial intelligence (AI) infrastructure—especially in data centers and semiconductor technology—there have been predictions that Intel could thrive under the new Trump administration, which similarly emphasizes domestic manufacturing.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

However, concerns arise from a recent announcement by Taiwan Semiconductor Manufacturing (NYSE: TSM). This new development prompts a reassessment of Intel’s position in a competitive market.

Intel Struggles to Gain Ground

In 2022, Intel reported $53.1 billion in total revenue, reflecting a modest 2% decline year-over-year. However, the situation within Intel’s foundry business raises alarm. In 2024, Intel Foundry earned $17.5 billion—7% lower than the previous year. This decline contrasts sharply with Taiwan Semi, which controls nearly 60% of the global foundry market. Intel’s foundry sector is falling behind faster than its overall business, casting doubt on its ability to close the gap with established competition.

Adding to Intel’s challenges, the company announced a delay in opening a new plant in Ohio, now scheduled for 2030 instead of between 2024 and 2026. This setback underscores ongoing struggles within the organization.

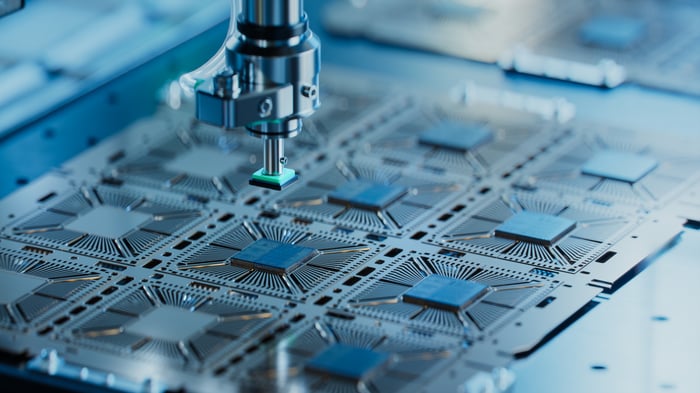

Image source: Getty Images.

Taiwan Semiconductor’s $100 Billion Investment

On March 4, Taiwan Semi announced a significant $100 billion investment in the U.S., which will fund the construction of three new fabrication plants, two packaging factories, and a research and development center. This announcement follows a prior $65 billion initiative in Arizona to expand manufacturing capabilities.

The investment aims to enhance operational partnerships with major clients, including Nvidia, AMD, Broadcom, and Qualcomm.

Implications for Intel

Several leading players in the tech industry have recently detailed ambitions to invest in AI infrastructure over the coming years. While one might assume that Intel could benefit from increased capital expenditures from key AI contributors, TSMC has recognized Intel’s challenges. The $100 billion investment by TSMC could further solidify its dominance in the foundry market.

Despite its strong ties with the U.S. government, Intel has yet to show progress from CHIPS Act funding. This lack of advancement complicates any optimistic perspective regarding Intel’s future. Rumors of a partnership with TSMC have circulated, but no concrete plans have materialized. A collaboration with Taiwan Semi—or even an acquisition—could provide a possible lifeline for Intel.

In the face of substantial competition, Intel appears to be losing ground during a pivotal period for the semiconductor industry. TSMC’s strategic investments may pose a significant hurdle for Intel’s recovery.

Should You Invest $1,000 in Taiwan Semiconductor Manufacturing Now?

Before purchasing stock in Taiwan Semiconductor Manufacturing, consider the following:

The Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks to buy, and Taiwan Semiconductor Manufacturing did not make the list. The companies included could yield substantial returns in the years ahead.

Consider when Nvidia earned a spot on this list on April 15, 2005… if you invested $1,000 at that time, you’d have $690,624!*

Stock Advisor delivers an accessible strategy for investors, providing guidance on portfolio building, regular analyst updates, and two fresh Stock picks each month. The Stock Advisor service has more than quadrupled the returns of the S&P 500 since 2002*. Don’t miss the latest top 10 list, available upon joining the Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of March 3, 2025

Adam Spatacco owns shares in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Intel, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool also recommends Broadcom and has disclosed the following options: short May 2025 $30 calls on Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.