Delight swept investors as the previous week concluded, unveiling significant gains across prominent indices. The S&P 500, the Nasdaq Composite, and the Dow Jones Industrial Average flourished with 1.7%, 1.4%, and 1.3% increases, respectively.

Throughout the week, market movements were largely shaped by the ripples of anticipation and eventual elation triggered by NVIDIA Corporation’s (NVDA) robust fourth-quarter earnings report. This propelled tech giants to soaring heights, cementing the narrative that Nvidia’s rapid ascent in the AI realm was firmly grounded in robust fundamentals rather than inflated valuations. The week managed to overcome looming concerns about extended high rates from the Fed and a persistent inflationary backdrop.

As we brace for the upcoming week, all eyes are on the imminent release of the PCE report, the Federal Reserve’s preferred inflation gauge, to glean deeper insights.

Irrespective of market dynamics, Zacks stands as a steadfast guide for investors, offering impartial counsel on outperforming the market. Zacks Research has once again illuminated the path over the last quarter with their time-proven methodologies. In the face of prevailing market uncertainties, a review of our triumphs could arm you effectively for your next investment move.

Here’s a glimpse of our notable victories:

Driving Carrols Restaurant and WisdomTree to New Heights Post Zacks Rank Boost

Following its elevation to a Zacks Rank #1 (Strong Buy) on December 25, Carrols Restaurant Group, Inc. TAST has surged by 27.4% compared to the S&P 500’s 6.7% uptick.

Likewise, WisdomTree, Inc. WT, after being bestowed with a Zacks Rank #2 (Buy) on December 29, has yielded a solid 7.2% increase, outshining the S&P 500’s 6.2% growth.

The Zacks Rank, our short-term rating mechanism, revolves around earnings estimate revisions. Studies confirm a robust correlation between these revisions and immediate stock price actions.

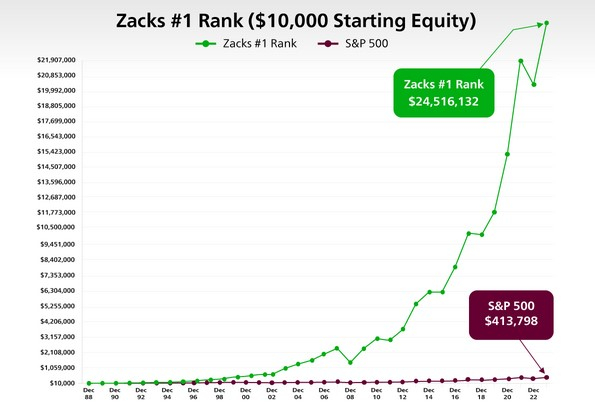

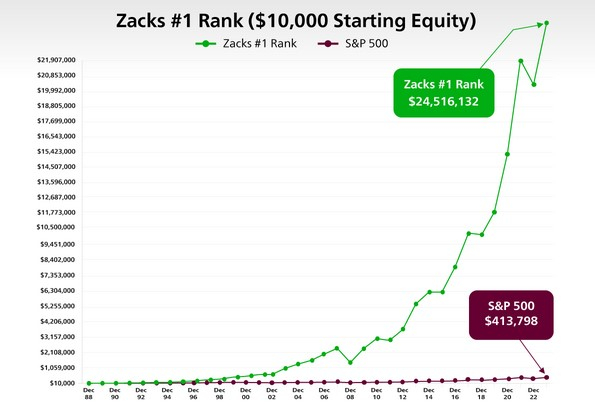

In 2023, a hypothetical portfolio sporting Zacks Rank #1 (Strong Buy) equities delivered a return of +20.63%, surpassing the S&P 500 index’s +24.83% and the equal-weight S&P 500 index’s +15%. Noteworthy indeed, considering the S&P 500 index’s distortion by the stellar performance of mega-cap stocks last year.

Avoiding cherry-picking, it is worth highlighting that the equal-weight S&P 500 index serves as a fitting benchmark for the Zacks Model portfolio of Zacks Rank #1 stocks. Appreciating this perspective, the portfolio has consistently outperformed the index.

Since 1988, the Zacks Model Portfolio, featuring Zacks Rank #1 stocks, has outshined the S&P index by a remarkable 13 percentage points. Up to January 1st, 2024, these Zacks #1 Rank stocks have ardently delivered an annualized return of +24.18% since 1988, contrasting starkly with the S&P 500 index’s +10.88%.

Keen to explore more? Check out today’s Zacks Rank #1 stocks entire list here >>>

Review Carrols’ historical EPS and Sales here>>>

Examine WisdomTree’s historical EPS and Sales here>>>

Image Source: Zacks Investment Research

Elevating Nextracker and H World Group with Zacks Recommendation Enhanced Guidance

Since their Zacks Recommendation upgrade to Outperform on December 18 and December 21, respectively, Nextracker Inc. NXT and H World Group Limited HTHT have flourished by 21% and 18%, eclipsing the S&P 500’s 7.8% and 8% ascents.

Whilst the Zacks Rank excels within the short-term investment horizon of one to three months, the Zacks Recommendation delves into performance forecasts spanning 6 to 12 months. Anchored in earnings estimate revision trends akin to the Zacks Rank, this prognostication tool categorizes stocks as Outperform, Neutral, and Underperform.

Quantitative in nature, the Zacks Recommendation affords our analysts the discretion to override recommendations for the 1100+ stocks under their keen surveillance. Such deviations are driven by nuanced factors like valuation, industry climate, and managerial proficiency surpassing mere quantitative models.

For comprehensive access to our research reports brimming with Zacks Recommendations for our vast coverage of 1100+ stocks, simply click here>>>

Zacks Focus List Stars: Lam Research and GE HealthCare on a Winning Streak

Lam Research Corporation LRCX, a proud member of the exclusive Zacks Focus List, has clinched a commendable 28.6% appreciation over the past 12 weeks. Earning its spot on the Focus List on December 5, 2016, the stock has stood tall. Also, GE HealthCare Technologies Inc. GEHC, honored with inclusion into the portfolio on January 4, 2023, has showcased a stellar 28.3% surge across the same duration, while the S&P 500 recorded a modest 10.6% growth.

In 2023, the 50-stock Zacks Focus List model portfolio dazzled with a +21.72% return through November 30, outpacing the S&P 500 index’s +20.79% and the equal-weight S&P 500 index’s +6.32%. Noteworthy is the model portfolio’s -15.2% return versus the S&P 500 index’s -17.96% in 2022.

Since 2004, the Focus List portfolio has delivered an annualized return of +11.07% through November 30, 2023, contrasting with the S&P 500 index’s +9.49% for the same period.

Reviewing one-, three-, and five-year annualized performance, the Zacks Focus List has boasted +13.49%, +9.21%, and +14.05% gains, respectively, against the S&P 500 index’s +13.82%, +9.74%, and +12.51% performances.

Unlock the treasury trove of our potent research, tools, and analysis inclusive of the Focus List, Zacks #1 Rank List, Equity Research Reports, Zacks Earnings ESP Filter, Premium Screener, and more with Zacks Premium. Embark on a journey of full access now >>

Zacks ECAP Marvels: Costco Wholesale and Novo Nordisk on an Upward Trajectory

Costco Wholesale Corporation COST, a distinguished member of our Earnings Certain Admiral Portfolio (ECAP), has surged by 23.8% over the past 12 weeks. Demonstrating remarkable growth, Novo Nordisk NJORD displayed a similar upward trend, spreading optimism.

Zacks Portfolio Performance Shines Amidst Market Volatility

Zacks ECDP Stocks Intercontinental Exchange and Home Depot Outperform

Intercontinental Exchange, Inc. (ICE) and The Home Depot, Inc. (HD) have proven to be shining stars within the Earnings Certain Dividend Portfolio (ECDP). ICE has boasted a remarkable 21.1% return over the past 12 weeks, closely followed by HD, which has soared by 16.4% during the same period. Investors are flocking towards quality dividend stocks to secure a reliable income stream, especially in times of heightened market volatility.

Zacks Top 10 Stocks — Sprouts Farmers Market Showcases Strong Growth

Sprouts Farmers Market, Inc. (SFM), a part of the Zacks Top 10 Stocks for 2024, has impressively surged by 23.9% year to date, significantly outperforming the S&P 500 Index’s modest 6.9% increase. The Top 10 portfolio has demonstrated solid performance, boasting a cumulative return of +1060.9% since 2012, compared to +360.1% for the S&P 500 index. The success of SFM highlights the potential for robust returns within well-curated investment portfolios.