Take-Two Interactive (NASDAQ: TTWO) reported a 27% year-to-date stock price increase as of now, contrasting with the Nasdaq Composite rise of just 0.59%. The company concluded its fiscal 2025 (ending March) with a 6% year-over-year growth in non-GAAP revenue, and a 17% rise in bookings during the recent quarter, highlighting successful strategies in recurrent consumer spending, which accounted for 80% of bookings.

Looking ahead, Take-Two plans to release GTA VI on May 26, 2026, projecting fiscal 2026 bookings at approximately $6 billion—a 6% increase from fiscal 2025. Analysts estimate the game could contribute to bookings reaching $9 billion by fiscal 2027, building on the 215 million copies sold of its predecessor since 2013.

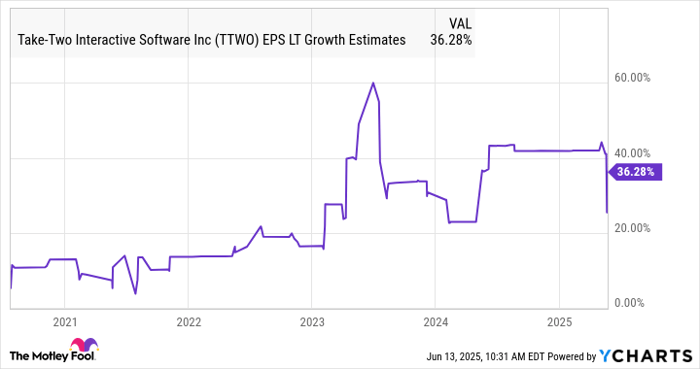

The company maintains a long-term goal to achieve higher margins, aiming for an operating margin of low to mid-20%. Currently, shares trade at a high forward price-to-earnings multiple of 87, inciting debates on potential growth rates necessary to justify current valuations.