The bold strides of Tandem Diabetes TNDM continue to pay dividends thanks to ongoing product innovations. The company’s relentless focus on penetrating global markets shines bright as a beacon of hope. Despite this shining armor, the looming presence of macroeconomic challenges casts a shadow over Tandem Diabetes. The stock currently holds a Zacks Rank #3 (Hold).

In the throes of a transformative journey, Tandem Diabetes is forging a path to unlock the next phase of growth through its innovative product lineup. Throughout 2023, the company unveiled new products to boost pump adoption rates and widen the reach of diabetes technology to a broader audience. As Tandem Diabetes sets its sights on expanding the pump market, it anticipates that fresh waves of customers opting for multiple daily injections will eventually outstrip growth and conversions from competitors.

Tandem Diabetes now stands alone among pump manufacturers in the United States, offering users the liberty to choose CGM integration through its t:slim X2 alongside DexCom’s G7. Leading the way with its latest pump platform, Tandem Mobi is blazing a trail by carving out a niche in the realm of insulin therapy devices. Designed to be entirely controlled via a mobile app on a personal smartphone, Mobi hinges on the foundation of its mobile control functionality encapsulated within the t:connect platform. With the arrival of Mobi in the market, Tandem Diabetes is poised to scale new heights by integrating the current DexCom G6, followed by both DexCom G7 and the FreeStyle Libre 3 technology.

Furthermore, the cutting-edge diabetes management platform, Tandem Source, is now accessible to all Tandem pump users and their healthcare providers in the United States, with plans for global availability by 2024. Bolstered by its top-rated AID system, t:slim X2, coupled with Control-IQ technology, the company delivered around 450,000 insulin pumps in the four years leading up to Dec 31, 2023, with 140,000 units shipped to clients outside the United States.

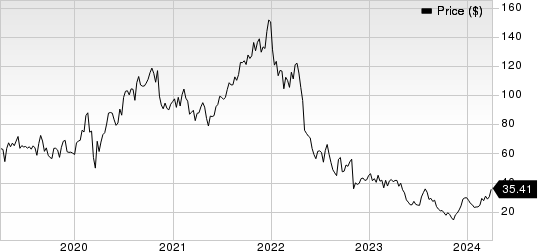

Tandem Diabetes Care, Inc. Price Performance

Track Tandem Diabetes Care, Inc. stock performances | Discover more about Tandem Diabetes Care, Inc.

Driven by an appetite for growth, Tandem Diabetes is actively seeking to fortify its business through strategic acquisitions of products or technologies and investments in related enterprises. The company kicked off the year 2023 with the acquisition of the Switzerland-based private entity, AMF Medical SA, the brains behind the Sigi Patch Pump. Tandem Diabetes has also joined forces with its CGM partners, Dexcom and Abbott, in the integration of their sensors. The newly-minted Tandem Source amalgamates the features of the company’s earlier offerings such as the t:connect, t:connect HCP, and t:connect Portal with new comprehensive data reporting under one roof.

On the downside, Tandem Diabetes grapples with the looming specter of global macroeconomic challenges, including recessionary woes, fluctuations in discretionary spending, and upticks in interest rates, which have cast a murky backdrop over customer purchasing behaviors and distribution patterns.

The ramifications of these macroeconomic forces, coupled with soaring inflation rates, have disrupted Tandem Diabetes’ associations with suppliers, third-party manufacturers, healthcare providers, distributors, and its customer base at large. In the final quarter of 2023, the company witnessed a staggering 498 basis points drop in gross margin, while the adjusted operating loss widened by a whopping 97.5% compared to the previous year.

Furthermore, Tandem Diabetes exists in a fiercely competitive landscape dominated by a spectrum of firms ranging from mighty multinational corporations armed with abundant resources to scrappy startups. The company’s principal rivals include major medical device manufacturers, either publicly listed entities or divisions and subsidiaries of publicly traded corporations, such as Insulet and Medtronic.

Moreover, the competitive and regulatory milieu encapsulating the markets where Tandem Diabetes operates constrains the company’s ability to deploy strategies such as price hikes. Additionally, numerous companies are actively engineering and marketing their insulin delivery systems and associated software applications, spanning from insulin pumps to Bluetooth-enabled insulin pens supporting MDI therapy. These seismic shifts within the industry could impact Tandem Diabetes’ business strategies and operational outcomes.

Top Choices

Among the standout performers in the broad medical spectrum are DaVita DVA, Cardinal Health CAH, and Stryker SYK. While DaVita proudly boasts a Zacks Rank #1 (Strong Buy) presently, Cardinal Health and Stryker both hold a Zacks Rank #2 (Buy). Get a closer look at the full list of Zacks #1 Rank stocks for today.

Estimates for DaVita’s 2024 earnings per share have surged from $8.97 to $9.23 over the past month. The company’s stock has skyrocketed by a remarkable 69% in the past year, dwarfing the industry’s growth rate of 23.4%.

DaVita has consistently outperformed earnings estimates in the last four quarters, with an average surprise factor of 35.6%. In its most recent financial disclosure, the company exceeded analyst expectations by a staggering 22.2%.

Cardinal Health’s stock has experienced a robust surge of 45.8% over the past year. Earnings projections for Cardinal Health have climbed from $7.28 to $7.29 for fiscal 2024, and from $8.03 to $8.04 for fiscal 2025 over the last 30 days.

Cardinal Health has consistently surpassed earnings forecasts in each of the past four quarters, with an average surprise rate of 15.6%. In its most recent financial update, the company posted an earnings surprise of 16.7%.

Earnings projections for Stryker in 2024 remained steady at $11.86 over the past month. Stryker’s shares have surged by an impressive 24.4% in the past year, outpacing the industry’s rise of 5.8%.

Stryker has consistently outperformed earnings expectations in the last four quarters, with an average surprise factor of 5.1%. In its most recent financial disclosure, the company delivered an earnings surprise of 5.8%.

Just $1 to Access All Zacks’ Picks and Trades

No strings attached.

A few years back, we sent shockwaves through our community by extending a 30-day offer granting access to all our insights for a mere $1. There were no hidden agendas, no ulterior motives.

Thousands seized this opportunity, while thousands remained on the fence, suspecting a hidden catch. We assure you, there isn’t one. Our aim is simple – we want you to dip your toe in the water, to experience our plethora of services like Surprise Trader, Stocks Under $10, Technology Innovators,and more. In 2023 alone, a whopping 162 positions were closed with gains in the double and triple digits.

Uncover Stryker Corporation (SYK) : In-Depth Stock Analysis

DaVita Inc. (DVA) : Comprehensive Stock Analysis Report

Cardinal Health, Inc. (CAH) : Detailed Stock Analysis Report

Tandem Diabetes Care, Inc. (TNDM) : Thorough Stock Analysis Report

Read the original article on Zacks.com by clicking here.

For more information, visit Zacks Investment Research

It is important to note that the opinions and viewpoints articulated in this content are those of the author and may not necessarily align with the perspectives held by Nasdaq, Inc.