Embark on a journey to understand the flourishing demand for California carbon allowances (CCAs) that beckons investors to dip their toes into this diverse asset pool. The latest CCA auction outcomes manifest a sturdy demand within a market proffering robust underpinnings.

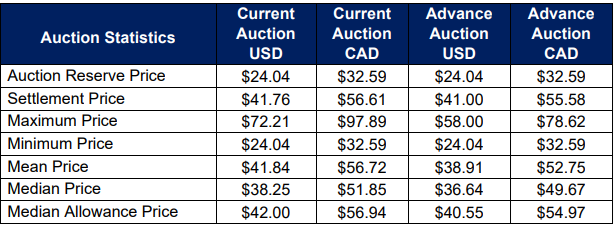

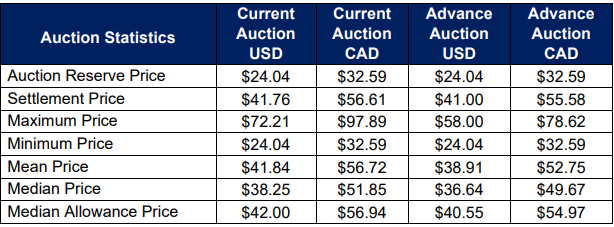

Recently, California conducted its quarterly carbon allowances auction, witnessing a sell-out at soaring record values. The California Air Resources Board disclosed a settlement price of $41.76 per allowance, with each permit representing a metric ton of carbon dioxide.

Image source: California Air Resources Board

Marking the third consecutive auction where carbon allowances commanded record prices, a staggering 50% increase year over year has been observed. Of the 2024 allowances sold, a significant 86.50% found their way to compliance entities, marking a 5% surge from the preceding quarter’s auction.

California’s carbon allowances market retains its allure for investors due to various factors. CCA prices exhibit an upward trajectory over time, escalating by a minimum of 5% annually alongside inflation costs. Furthermore, anticipated legislation might lead to a more aggressive reduction in allowance numbers in the years to come, fostering a robust foundation for potential positive price evolution.

Adding to the optimism is Washington state’s proposed integration into the linked California and Quebec markets. Washington’s recent endorsement to merge its carbon market with the established California and Quebec system could spur greater market participation by alleviating cost constraints on firms while reinforcing stability. The next phase involves California delving into the feasibility and long-term repercussions of this integration.

Seizing Opportunities in the California Carbon Allowance Market with KCCA

For investors seeking to capitalize on the long-term prospects of CCAs, exploring the KraneShares California Carbon Allowance ETF (KCCA) might prove fruitful. This fund extends targeted exposure to the combined California and Quebec carbon allowance markets, poised to benefit from California’s proactive emissions reduction efforts and the escalating demand for allowances. Carbon allowance investments merit consideration for their diversification advantages and upbeat long-term outlook.

KCCA currently boasts a 2.77% year-to-date increase and a robust 37.37% surge in the last 12 months on a price return basis. Furthermore, the fund transcends both its 50-day simple moving average (SMA) and 200-day SMA, signifying strong buy signals for trend followers.

KCCA stands as a fund providing exposure to the California cap-and-trade carbon allowance program, recognized as one of the globe’s fastest-growing carbon allowance initiatives. Anchored by the IHS Markit Carbon CCA Index, the CCA includes up to 15% of Quebec’s cap-and-trade credits.

Employing a wholly owned subsidiary in the Cayman Islands eliminates the necessity for investors to grapple with K-1 tax burdens, enhancing investor ease.

KCCA bears an expense ratio of 0.78%.

For a deeper dive into news, insights, and analysis, explore the Climate Insights Channel.

The opinions and viewpoints articulated in this piece are the author’s own and do not necessarily align with those of Nasdaq, Inc.