Analysts Predict Significant Upside for TCW Transform 500 ETF

At ETF Channel, we analyzed the underlying holdings of various ETFs in our coverage area. After comparing the trading prices of each holding to the average analyst’s 12-month forward target price, we calculated the weighted average implied analyst target price for the TCW Transform 500 ETF (Symbol: VOTE). The implied target price for this ETF stands at $79.65 per unit.

Currently, VOTE is trading at approximately $59.21 per unit. This indicates that analysts project a 34.52% upside based on their average target prices for the underlying holdings. Among these holdings, three stocks show particularly notable upside potential relative to their target prices: Nutanix Inc (Symbol: NTNX), Dynatrace Inc (Symbol: DT), and Interactive Brokers Group Inc (Symbol: IBKR).

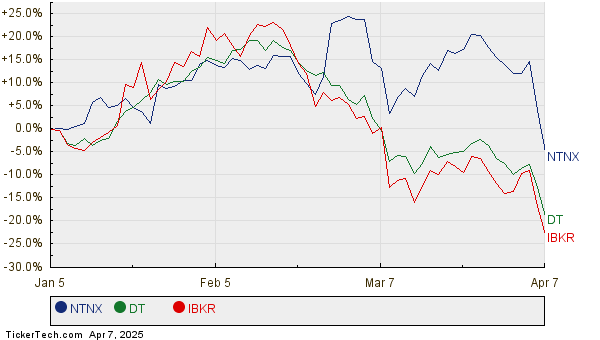

Nutanix Inc is trading at $58.50 per share, while its average analyst target is $91.15, suggesting an upside of 55.82%. Similarly, Dynatrace Inc is priced at $42.01, with a target of $64.18, representing a potential increase of 52.77%. Interactive Brokers Group Inc has a recent price of $146.08, with an expected target price of $218.00, corresponding to a 49.23% upside. Below is a twelve-month price history chart comparing the stock performance of NTNX, DT, and IBKR:

Below is a summary table detailing the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| TCW Transform 500 ETF | VOTE | $59.21 | $79.65 | 34.52% |

| Nutanix Inc | NTNX | $58.50 | $91.15 | 55.82% |

| Dynatrace Inc | DT | $42.01 | $64.18 | 52.77% |

| Interactive Brokers Group Inc | IBKR | $146.08 | $218.00 | 49.23% |

This leads to an important question: Are analysts justified in their targets, or are they overly optimistic regarding where these stocks will trade in 12 months? Investors must consider whether the analysts have valid reasoning for their targets or if they are lagging behind on recent developments within the companies and the industry. High target prices relative to current stock prices may signal optimism about future performance, but can also indicate potential downgrades if they reflect outdated projections. These considerations necessitate further research by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

• DUK Options Chain

• CEG RSI

• LNKB Insider Buying

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.