Target Corporation reported a 4.7% year-over-year increase in digitally originated comparable sales during the first quarter of fiscal 2025, despite an overall decline in traffic by 2.4% and a drop in comparable store sales. The growth was driven by a more than 35% increase in same-day delivery, facilitated by its Target Circle 360 membership service, which bundles same-day delivery from over 100 third-party retailers. In the first quarter, Target fulfilled over 70% of digital orders within a day.

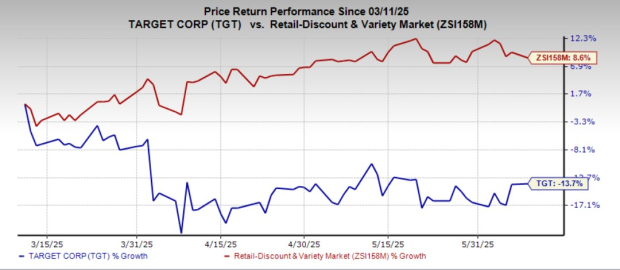

Amid a cautious consumer spending environment, Target Circle 360 has become a pivotal growth driver, achieving nearly a 20% improvement in delivery speed. Target’s stock has declined 13.7% in the past three months, contrasting with an industry growth of 8.6%. The company’s forward 12-month price-to-earnings ratio stands at 12.63, significantly lower than the industry average of 33.21.

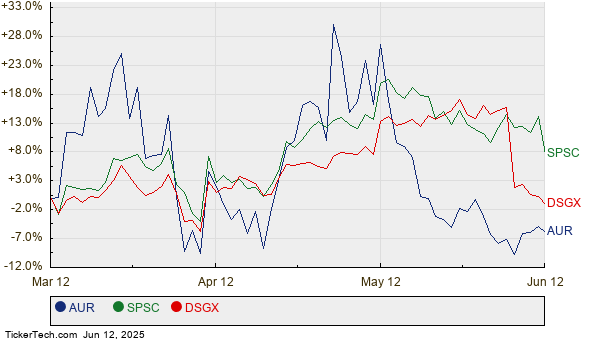

In comparison, Walmart Inc. saw its e-commerce sales grow by 22% in the first quarter of fiscal 2026, while Amazon.com, Inc. continues to offer competitive same-day delivery options through its Prime membership, leveraging its extensive logistics network.