Target Corporation Prepares for Q1 Fiscal 2025 Earnings Release

The countdown is on for Target Corporation’s TGT first-quarter fiscal 2025 earnings, which are set to be announced on May 21, before the market opens.

The Zacks Consensus Estimate forecasts first-quarter revenues at $24.45 billion, a slight decline of 0.3% from the same period last year. Earnings are projected at $1.68 per share, indicating a drop of 17.2% compared to the year-ago quarter. Over the past week, the consensus estimate for earnings has been revised downward by six cents.

Image Source: Zacks Investment Research

Target has a trailing four-quarter average earnings surprise of 1.5%. In the last reported quarter, the company’s earnings exceeded the Zacks Consensus Estimate by 7.1%.

Target Corporation Price, Consensus and EPS Surprise

Target Corporation price-consensus-eps-surprise-chart | Target Corporation Quote

Forecast Insights for Target Corporation

As the earnings announcement approaches, investors are left wondering whether Target will hit or miss its earnings expectations. The analysis reveals that the current outlook does not suggest a definitive earnings beat for this quarter. A combination of a positive Earnings ESP and a Zacks Rank of 1 (Strong Buy), 2 (Buy), or 3 (Hold) typically indicates a higher likelihood of an earnings beat; however, that’s not the case here.

Currently, Target holds a Zacks Rank of 5 (Strong Sell) along with an Earnings ESP of -9.91%. Investors can use the Earnings ESP Filter to uncover top stock opportunities.

Factors Influencing Target’s Q1 Earnings

During its last earnings call, Target provided a cautious outlook for Q1 fiscal 2025, forecasting significant year-over-year profit pressure. This outlook stems from ongoing consumer uncertainty, slight declines in net sales for February, tariff concerns, and varied timing for certain expenses throughout the fiscal year.

While the company recorded strong Valentine’s Day sales in February, overall performance was subdued. Unseasonably cold weather affected apparel sales, while decreasing consumer confidence led to weaker demand in discretionary categories. A persistent area of concern for Target is its reliance on discretionary segments like home goods and apparel, which are more volatile and vulnerable to external shocks.

Factors such as U.S.-China tariff dynamics compound the uncertainties, leading to an expected 1% decrease in comparable sales. The average transaction amount is anticipated to decline by 1.6%.

Despite these challenges, Target’s commitment to innovation and digital growth may bolster first-quarter performance. By enhancing its physical store presence along with e-commerce capabilities, the company has improved convenience for customers. Initiatives like same-day services and curbside pickup, alongside a rising Target Circle membership, are likely to enhance customer traffic. Successful private label brands and a well-balanced product mix also serve as positive growth factors. Additionally, platforms like Target Plus and Roundel have contributed to higher-margin revenue streams.

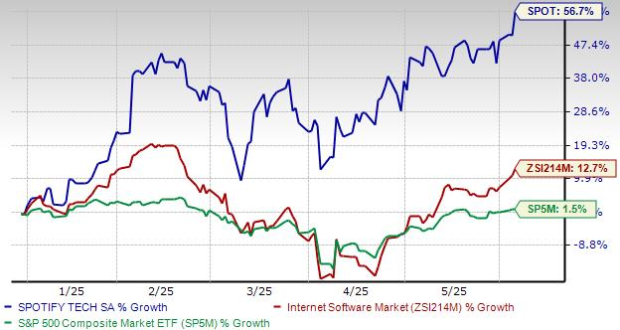

Target Stock Price Performance

Target’s stock has increased by 4.3% over the past month, outpacing the Zacks Retail-Discount Stores industry, which rose by 1.5%. In contrast, the broader Zacks Retail-Wholesale sector grew by 12.3%, and the S&P 500 Index climbed 11.4% during this period.

In comparison to competitors, Target has performed better than Costco Wholesale Corporation and Dollar General Corporation, but has lagged behind Dollar Tree, Inc. over the last month. Shares of Costco and Dollar Tree increased by 1.6% and 9.4%, respectively, while Dollar General fell by 0.1%.

Image Source: Zacks Investment Research

Target’s Value Investing Proposition

Currently, Target is trading at a forward 12-month price-to-earnings (P/E) ratio of 10.67X, which is a discount compared to the industry average of 32.49X. The stock is also below its historical median P/E level of 14.65 over the past year. In comparison, Dollar General has a forward P/E ratio of 16.24, Dollar Tree stands at 16.03, and Costco is at 52.53.

Image Source: Zacks Investment Research

Strategic Insights for Investors in Target Stock

In a challenging retail landscape marked by declining discretionary spending and margin pressure, Target is facing hurdles that may dampen investor sentiment. Despite ongoing investments in digital initiatives and operational enhancements, immediate benefits might not surface quickly. Investors may wish to wait for more evident recovery signals, while current holders might consider lowering their positions if short-term instability continues.

Conclusion on Target’s Q1 Earnings Outlook

Considering the balance of immediate challenges and long-term strategic strengths, investors may exercise caution ahead of Target’s Q1 earnings announcement. External factors, including fragile discretionary demand and macroeconomic uncertainties, may pressure results. Nevertheless, the company’s commitment to digital growth, private label expansion, and customer experience provides a potential platform for future improvement. It may be prudent for investors to watch for clearer indicators of stabilization in sales and margin performance prior to making a significant investment decision.

# Promising Chip Stock Set to Outpace NVIDIA Amid AI Boom

In recent months, a new top chip stock has emerged that offers significant growth potential, outpacing NVIDIA’s substantial gains of over 800% since our initial recommendation.

## Strong Market Position and Growth Potential

This newly highlighted stock benefits from robust earnings growth and an expanding customer base, making it well-positioned to meet soaring demand in fields such as Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor industry is projected to grow remarkably, expanding from $452 billion in 2021 to $803 billion by 2028.

While NVIDIA continues to show strength, market analysts suggest that this emerging competitor has much more room for growth, particularly given the ongoing trend towards increased technology adoption across various sectors.

Investors looking to capitalize on this trend should closely monitor developments in both companies as they navigate a rapidly evolving landscape.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.