U.S.-China Trade Tensions Could Impact Amazon’s Future Sales

Trade tensions between the U.S. and China are endangering American consumer spending. Retailers depend heavily on imports from China, and prices may increase sharply if tariffs remain unchanged and negotiations stall.

Research by The Motley Fool indicates that tariffs could raise prices on a variety of goods, such as electronics, textiles, leather items, and apparel. Amazon (NASDAQ: AMZN), the leading e-commerce firm in the U.S., stands to be significantly affected.

Amazon Faces Imminent Tariff Impact

With a commanding 40% market share in U.S. e-commerce, Amazon is known for its competitive pricing, largely due to inexpensive Chinese goods. Statista reports that approximately 71% of items sold on Amazon are sourced from China.

Though tariffs have been discussed for weeks, their direct effect on consumers is approaching. Suppliers are expected to raise prices on tariffed goods as they replenish stock. Some may even choose to delay or cancel orders until uncertainty clears. Reports show a notable decline in container traffic for imported goods.

This could result in product shortages, further driving up prices. If items are out of stock or priced higher, Amazon may see a decrease in e-commerce sales.

Will Investors Be Concerned? Amazon’s Adaptability

Despite hopes for a resolution between the U.S. and China, both countries remain at a standstill. Amazon will inevitably face some short-term effects from tariffs; however, investors need to differentiate between minor setbacks and catastrophic damage.

As a marketplace, Amazon connects buyers with sellers effectively. There are likely no significant shifts in consumer behavior away from the platform. Moreover, Amazon Prime’s various benefits are expected to retain subscribers despite tariff pressures.

If tariffs become permanent, suppliers will adapt. While it may take time, new supply chains will emerge, and sellers unable to compete will lose sales to those with lower prices. Tariffs may influence consumer spending, but Amazon’s status as the primary e-commerce platform for most Americans will remain unchanged.

Evaluating Amazon’s Resilience

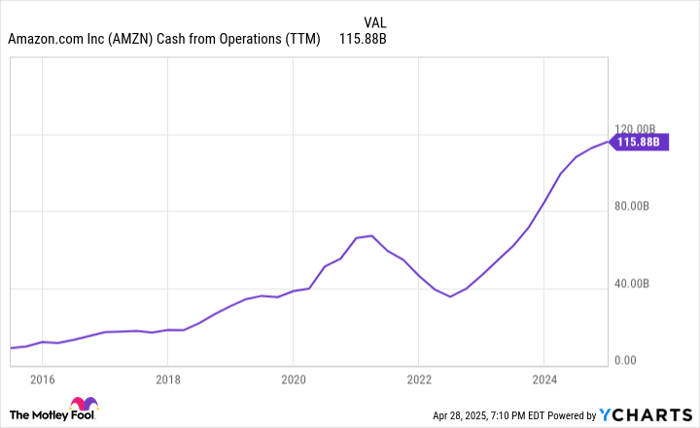

Amazon has the capacity to handle short-term challenges posed by e-commerce slowdowns. During the COVID-19 pandemic, the company saw its cash flow from operations drop by more than 40%, but it never faced losses or significant financial threats.

AMZN Cash from Operations (TTM) data by YCharts. TTM = trailing 12 months.

In the event tariffs exert a more severe impact on Amazon’s operations, the company is well-prepared. With $101 billion in cash and minimal debt, represented by a leverage ratio of just 0.45 times its EBITDA, Amazon is in a solid financial position. Additionally, its cloud computing division, which generates significant profit and is expected to grow due to advancements in artificial intelligence, is likely to remain unaffected by tariffs.

While the business environment becomes trickier, it’s hard to envision Amazon encountering significant trouble. The company may experience setbacks, but it is unlikely to suffer serious damage.

Why Current Market Conditions May Present a Buying Opportunity

The prospect of tariffs has contributed to market fluctuations, causing Amazon’s stock price to decline 25% from its peak earlier this year. Analysts have also revised their long-term growth forecast, lowering it from 24% annually in the fall to approximately 19% now. Yet, this reduced projection has not diminished the stock’s appeal. Presently, shares trade at 28 times estimated 2025 earnings, offering a reasonable price-to-earnings ratio considering its long-term growth potential.

As long as Amazon maintains Prime memberships and its cloud services continue to thrive, the company should be well-equipped to weather any temporary challenges from tariffs. Investors might find it prudent to acquire shares and hold onto them, as prospects for the business and stock look promising in the longer term.

Consider This Second Chance for Potential Gains

For those who feel they missed opportunities with top-performing stocks, now might be an auspicious time to act.

On rare occasions, our expert team recommends a “Double Down” stock for companies poised for significant growth. If you’re concerned that you’ve missed your chance to invest, acting now could be beneficial:

- Nvidia: Investing $1,000 when we doubled down in 2009 would yield $282,717!*

- Apple: Investing $1,000 when we doubled down in 2008 would yield $40,044!*

- Netflix: Investing $1,000 when we doubled down in 2004 would yield $607,048!*

At present, we are issuing “Double Down” alerts for three promising companies, available when you join Stock Advisor, while the opportunity lasts.

See the 3 stocks »

*Stock Advisor returns as of April 28, 2025

John Mackey, former CEO of Whole Foods Market, which is an Amazon subsidiary, serves on The Motley Fool’s board. Justin Pope has no financial interests in the stocks mentioned. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.