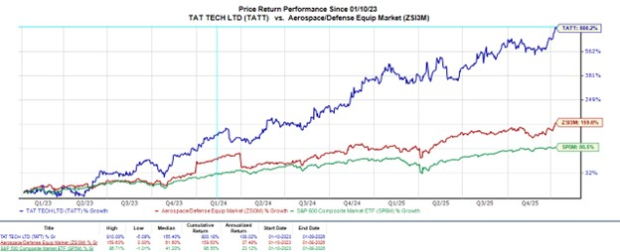

TAT Technologies Ltd. (TATT) is currently trading near an all-time high of $53 per share but has received a Zacks Rank #5 (Strong Sell), indicating a potential time to take profits. The stock’s surge has been fueled by renewed sentiment in aerospace and defense stocks following recent U.S. military operations in Venezuela. Despite the surge, TAT’s trading levels are considered stretched, and it generates less than $300 million in annual sales, having recently missed third-quarter sales estimates of $46.26 million and reporting earnings below expectations.

The company, which has been public since 1987, failed to produce positive free cash flow and has seen downward revisions in EPS forecasts for fiscal years 2025 and 2026 by 4% and 12%, respectively. Additionally, TAT’s current valuation metrics, with a 28X forward earnings multiple and 3X price-to-sales ratio, are approaching overvalued territory, leading analysts to suggest that a sell-off could be imminent.

With increasing competition in the maintenance and repair sector for F-16 aircraft, TAT appears to be a small player within a larger ecosystem dominated by companies like Lockheed Martin and Amentum Holdings. Investors may want to reconsider their positions in TAT Technologies, as the stock’s current price may not be supported by improving business fundamentals.