The Company’s Risky Temptation

I can’t help but think that TC Energy (NYSE:TRP) (TSX:TRP:CA) may be a value trap, all things considered:

- Valuations are near their 10-yr troughs

- TC Energy’s negative FCF generation record is expected to continue

- TC Energy’s debt portfolio does not directly benefit from rate cuts

- Unclear reasons for the spinoff of the liquids business

- Asset sales can lead to deleveraging but value destruction risks are there

Valuations: A Deceptive Mirage?

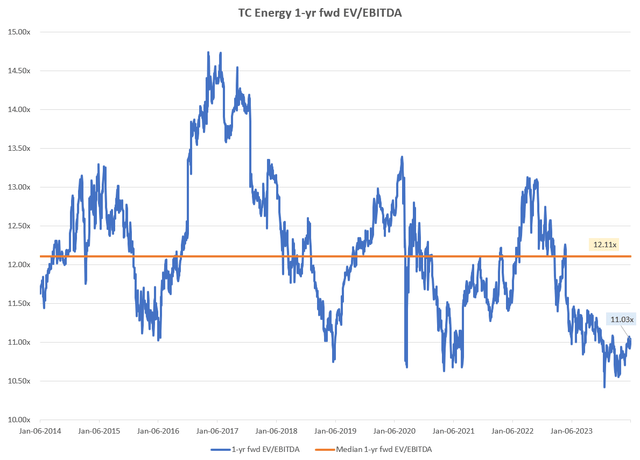

TC Energy is trading near its 10-yr 1-yr fwd EV/EBITDA lows at 11.03x. This corresponds to a ~9% discount of the median multiple over 10 years of 12.11x. This may attract value and dividend investors, especially considering the 1-yr fwd 7.00% dividend yield. However, I will make my case for why I believe this is a value trap:

The Sinking Ship of Negative FCF Generation

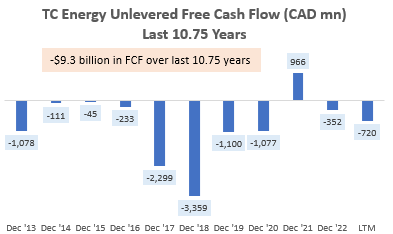

Firstly, TC Energy has had a horrendous FCF generation record over the last decade. It has generated negative CAD 9.3 billion in FCF over the last 10.75 years:

The cash flow from operations has been CAD 62 billion in the same time period. However, most of that has been eaten away by capex spending, which totaled CAD 59 billion. This leads to a cumulative Capex/CFO ratio of 95% over the last 10.75 years. Going forward, this is not expected to decrease as management still expects to generate CAD 32 billion in operational cash flow and spend all the CAD 32 billion in future capex till 2026.

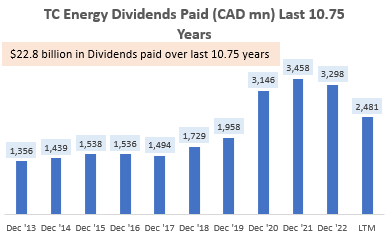

It has forked out CAD 22.8 billion in dividends in this time with a ~150% average payout ratio, with total dividends paid growing at 6.4% CAGR annually.

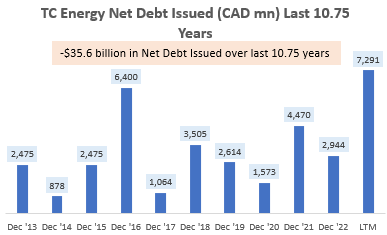

However, I contend that this high dividend payment record is not relevant as it is unsustainable; the dividends are funded largely by CAD 35.6 billion in net debt issuances:

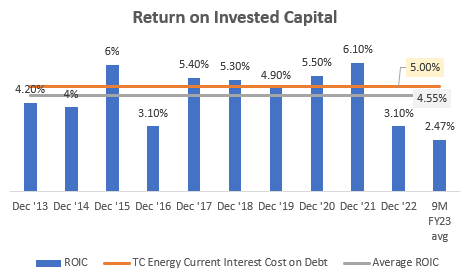

The company is not using debt advantageously to make more than what even conservative estimates of the cost of capital would be (taking cost of capital to only equal the cost of debt of 5%. In practice, the cost of capital would be higher than that as cost of equity is higher than cost of debt, and the debt/assets ratio for TC Energy is 50%) either:

I don’t think funding dividend payments via debt issuance for such an extended period of time without adding value on the additional capital is a characteristic of a good dividend-paying stock.

On the 2023 Investor Day, Wells Fargo Analyst Praneeth Satish noted that the company can get close to FCF-positive if capex is limited to CAD 5 billion and asked if management is vying for this goal:

So I guess when I look at the slide for committed projects in 2026, it’s in the $5 billion range. If you add no new projects at this point, at least on our math, you’d be pretty close to being free cash flow positive. So I guess, how do you think about the desire to be free cash flow positive, fully self-funding at a philosophical level? And is this something that you would consider down the road in the ’26 time frame?

– Author’s bolded highlights

However, CEO Francois Poirier indicated that it is not their priority right now:

We have to balance some competing objectives. And so our approach — and all of the work that went into devising a $6 billion to $7 billion range, with a bias to the downside to the bottom of that range at $6 billion, is to make sure that we can balance growth, a stable payout ratio as well as the strong balance sheet.

– Author’s bolded highlights

Hence, I believe the negative FCF generation is likely to continue for a while longer.

Debt Profile: A Weighty Burden

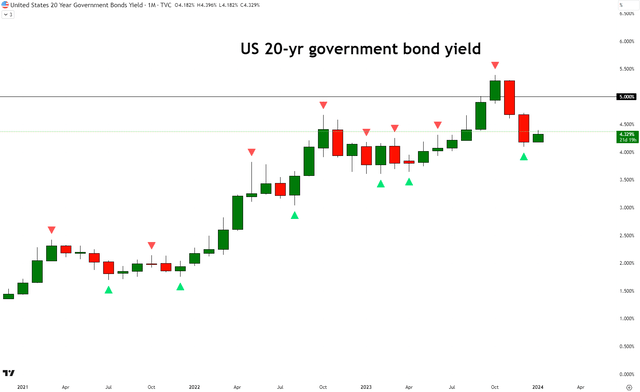

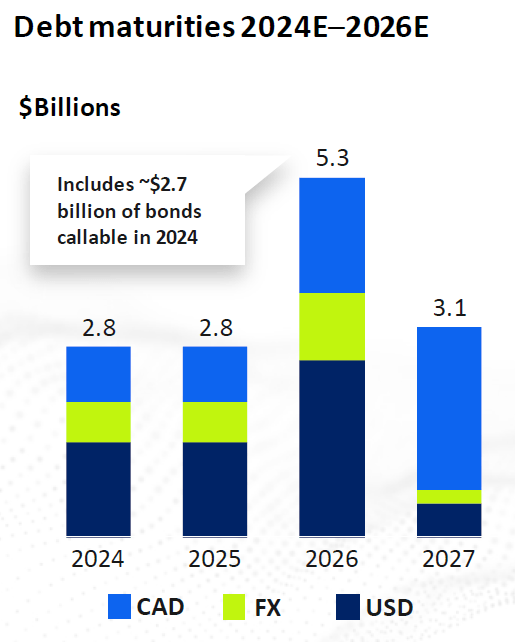

TC Energy is a CAD 55.7 billion market capitalization company with CAD 62.5 billion in net debt, denominated in mostly USD and CAD. 89% is fixed-rate debt at a weighted average rate of 5%. This debt profile does not directly benefit from the rate cuts expected sometime in 2024. Also, the average term of their debt is 18 years. Looking at the US 20-yr government bond yields, 5.00% means they have incurred a near-peak cost of debt funding:

Canadian bond yields also have peaked at 4.22%. So overall, the company has unfortunately locked in high interest costs, just when the rates situation seems to be getting a bit easier.

TC Energy’s long-term debt is rated BBB+ (lower-medium grade). Previously, it used to be A-, but it was downgraded in March 2023. Its preferred share class is rated BBB-, which is another downgrade from the earlier BBB. Debt maturities are spread over the next 3-4 years, but weighted toward the latter half, which means the company is locked into higher interest rates for longer, even though some $2.7 billion is callable (can be repaid earlier):

TC Energy – A Turbulent Pipeline of Financial Decisions

TC Energy has seen its net interest expense rise rapidly, eating away at its earnings before interest and taxes (EBIT). This has left many investors concerned about the company’s financial position. Even in prior years, debt costs have taken a significant portion of the company’s EBIT.

To make matters worse, TC Energy has made the decision to undergo accelerated deleveraging through asset sales to alleviate this pressure. However, the direction of these financial decisions has come under scrutiny, leaving the company’s debt profile and free cash flow (FCF) in desperate need of repair.

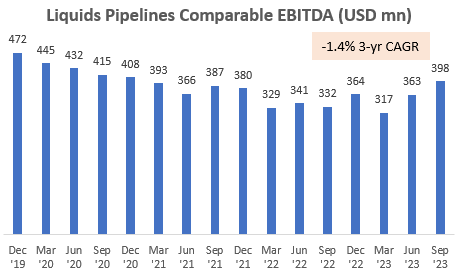

A Cloudy Move: The Unclear Rationale for the Liquids Business Spinoff

TC Energy’s Liquids Pipelines business, which involves the transport of Canadian crude oil from Alberta to US refining and export markets, has been struggling. Over the past three years, its earnings before interest, taxes, depreciation, and amortization (EBITDA) have experienced negative growth. Despite this, the company has decided to spin off this business into a separate entity. This decision has not been met without skepticism, as the rationale behind it remains ambiguous. The lack of clarity is raising doubts about the company’s strategic direction, leading many to question whether fixing their FCF and debt profile should be the priority.

The Risks of Desperation: Asset Sales and Possible Value Destruction

To tackle its debt burden, TC Energy has already divested CAD 5.3 billion of assets and plans to sell a further CAD 3 billion. Management is aggressively striving to achieve their deleveraging goal; however, their tone suggests a sense of urgency that has not gone unnoticed. The risk of value destruction in these asset sales is looming large, particularly as recent sales may have occurred at lower prices than expected. This has raised concerns about the possible adverse effects of the company’s financial decisions.

Final Verdict: A Neutral/Hold Rating

While TC Energy may appear attractive with its high dividend yield and relatively cheaper valuations, the underlying challenges cannot be overlooked. The company’s persistent negative FCF profile, weak returns on capital, and rush to sell assets have cast a shadow over its prospects. Given these circumstances, TC Energy receives a “Neutral/Hold” rating, despite its low 10-year valuation.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher-than-usual confidence

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher-than-usual confidence

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.