## Analysts Recommend Holding Aflac Stock

On October 9, 2024, TD Cowen began covering Aflac (XTRA:AFL) with a “Hold” recommendation, as reported by Fintel.

### Price Forecast Anticipates 12.14% Decrease

The average one-year price target for Aflac as of September 25, 2024, stands at 90.27 €/share. Analysts predict a range from 75.97 € to 108.13 €. This places the average forecast at a 12.14% drop from the recent closing price of 102.75 €/ share.

### Company Revenue and Earnings Outlook

Aflac is projected to earn annual revenue of 18,906MM, reflecting a 2.06% decrease. Furthermore, the estimated non-GAAP EPS is 6.10.

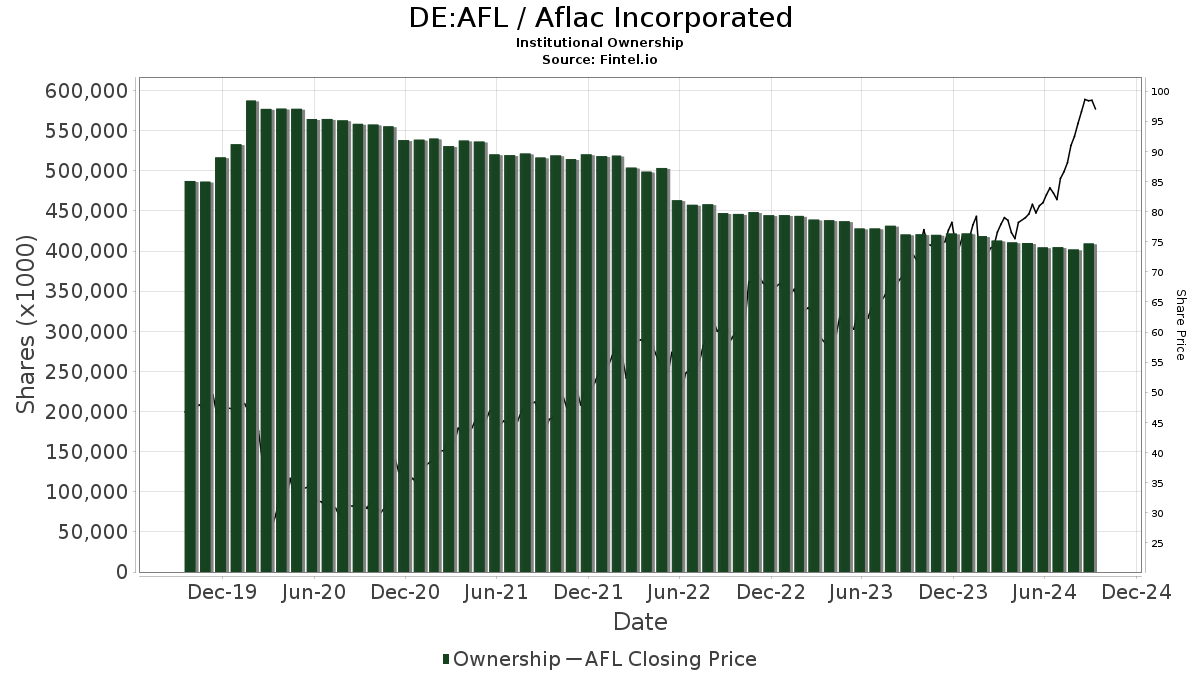

### Institutional Holdings in Aflac

A total of 2,161 funds or institutions hold positions in Aflac, marking a 1.46% increase in the last quarter. The average portfolio weight for Aflac across all funds is 0.27%, a rise of 0.50%. Institutional shares in Aflac have surged by 3.71% over the last three months to 409,399K shares.

### Significant Shareholders’ Actions

– Japan Post Holdings Co. remains steady with 52,300K shares, representing 9.34% ownership.

– VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 17,973K shares, equivalent to 3.21% ownership, showing a slight decrease.

– Wells Fargo retains 16,054K shares, equating to 2.87% ownership, with a slight reduction.

– VFINX – Vanguard 500 Index Fund Investor Shares possesses 13,271K shares, representing 2.37% ownership, showing a minimal increase.

– Geode Capital Management holds 12,356K shares, signifying 2.21% ownership, experiencing a slight increase over the last quarter.

Fintel offers a comprehensive platform for investing research, catering to individual investors, traders, financial advisors, and small hedge funds. Their diverse data includes fundamentals, analyst reports, ownership data, and more, aiding in informed investment decisions.

[Click to Learn More](#)

_This article was initially featured on Fintel._

> The opinions expressed herein belong solely to the author and do not reflect Nasdaq, Inc.’s viewpoints.