Institutional Funds Reveal First Quarter Positions Amid Market Volatility

As the second quarter of 2025 progresses, investment funds are preparing to disclose their first quarter stock holdings, offering investors insight into their trading strategies during a turbulent period. This disclosure is particularly significant given the market’s volatility and the institutional investors’ responses to economic conditions.

While these filings won’t capture market movements from April, following President Donald Trump’s “Liberation Day” announcement on April 2, they provide important context regarding how investors engaged with tariffs and high valuations in sectors like artificial intelligence (AI).

TRS Reduces Stakes in Major Tech Stocks

In the first quarter, the Teacher Retirement System of Texas (TRS), the sixth-largest teacher pension fund in the U.S., notably cut its positions in Nvidia (NASDAQ: NVDA), Tesla (NASDAQ: TSLA), and Apple (NASDAQ: AAPL). During the same time, the fund acquired a significant pharmaceutical stock that has appreciated 419% over the past five years.

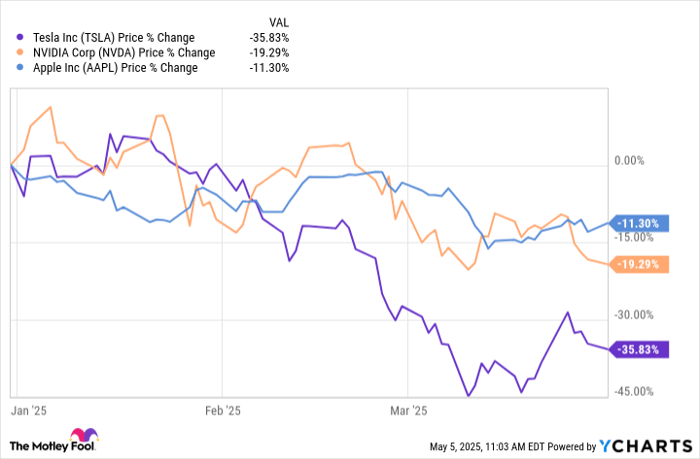

While the exact timing of these reductions is unclear, TRS decreased its holdings in these popular stocks as follows:

- Apple: reduced by 12%

- Nvidia: reduced by 9%

- Tesla: reduced by 8%

These actions appear to be well-timed, given the performance of these stocks in the first quarter. Nvidia and other AI-focused stocks faced challenges when Chinese company DeepSeek revealed a chatbot competitor to OpenAI’s ChatGPT, reportedly using fewer resources. This raised questions about AI market demand and the capital investments by major players in the sector.

Tesla’s performance declined as CEO Elon Musk engaged more in political initiatives, which, combined with reports of falling global demand, raised concerns about the company’s brand image. Analysts noted Tesla’s high valuation necessitates successful future initiatives in autonomous driving and robotics.

Apple’s shares experienced less decline than the others in the first quarter. However, investors may need to remain cautious due to the company’s extensive manufacturing operations in China and Vietnam. After an initial drop following April 2, the stock gained ground thanks to a temporary reprieve from increased tariffs on consumer electronics.

Boost in Eli Lilly Stake

In contrast to its reductions in tech holdings, TRS increased its position in Eli Lilly (NYSE: LLY) by 11% during the quarter. Eli Lilly, a major player in the pharmaceutical sector since going public in 1951, has seen a 395% rise in stock value over five years, competing well with many tech firms.

The company’s recent success is largely attributed to its GLP-1 drugs aimed at managing type 2 diabetes and weight loss. Notably, Eli Lilly’s Mounjaro reported a 113% year-over-year revenue increase in the first quarter, while Zepbound’s sales surged 347% year-over-year.

Moreover, Eli Lilly is actively developing new drugs, with CEO David Ricks mentioning several regulatory approvals in oncology and immunology. The company anticipates full-year revenues between $58 billion and $61 billion, with a target performance margin of 40.5% to 42.5%.

Although technology stocks have been the focus for investors in recent years, diversifying across sectors remains a wise strategy. Eli Lilly exemplifies a stable pharmaceutical investment that rivals notable tech innovations.

Investment Considerations for Eli Lilly

Before considering an investment in Eli Lilly, it’s important to note the recent advice from analysts. Eli Lilly did not make the list of the top 10 recommended stocks, highlighting the volatile nature of stock recommendations.

It’s essential to evaluate various investment options and remain informed about market trends. Purchasing stocks in different sectors can help balance risk and foster long-term growth potential.

Bram Berkowitz has no positions in the stocks mentioned. The Motley Fool has positions in and recommends Apple, Nvidia, and Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.