Investor Uncertainty Amidst Market Volatility

As September unfolds, a sense of uncertainty lingers following a tumultuous August that left investors perplexed. Within the tech sector, Bitcoin and Ether prices remained stagnant this week, reflecting decreased investor enthusiasm. Additionally, Broadcom’s recent quarterly report on the NASDAQ sparked cautious sentiments among market participants.

Tesla’s Full Self-driving Revelation

This week, Tesla (NASDAQ:TSLA) made significant waves by hinting at the imminent release of its full self-driving technology in selected markets. This development comes at a crucial time when technology and innovation are at the forefront of the market narrative.

Market Fluctuations and Global Impact

The week began on a rocky note for U.S. markets, with the Nasdaq Composite (INDEXNASDAQ:.IXIC) experiencing its most significant daily decline since August 5. The S&P 500 (INDEXSP:.INX) and the Russell 2000 (INDEXRUSSELL:RUT) also faced losses, marking a challenging start to the month.

These declines were triggered by new U.S. manufacturing data for August, with indices such as the S&P Global US Manufacturing PMI and the ISM Manufacturing PMI painting a grim picture. Concurrently, in Canada, the S&P Global Canada Manufacturing PMI data exerted pressure on the S&P/TSX Composite Index (INDEXTSI:OSPTX).

Economic Decisions and Market Responses

Mid-week, the Bank of Canada implemented its third interest rate cut for the summer, underscoring a challenging economic landscape. Simultaneously, the U.S. Department of Labor’s JOLTS report revealed a significant decline in job openings, further complicating the economic outlook.

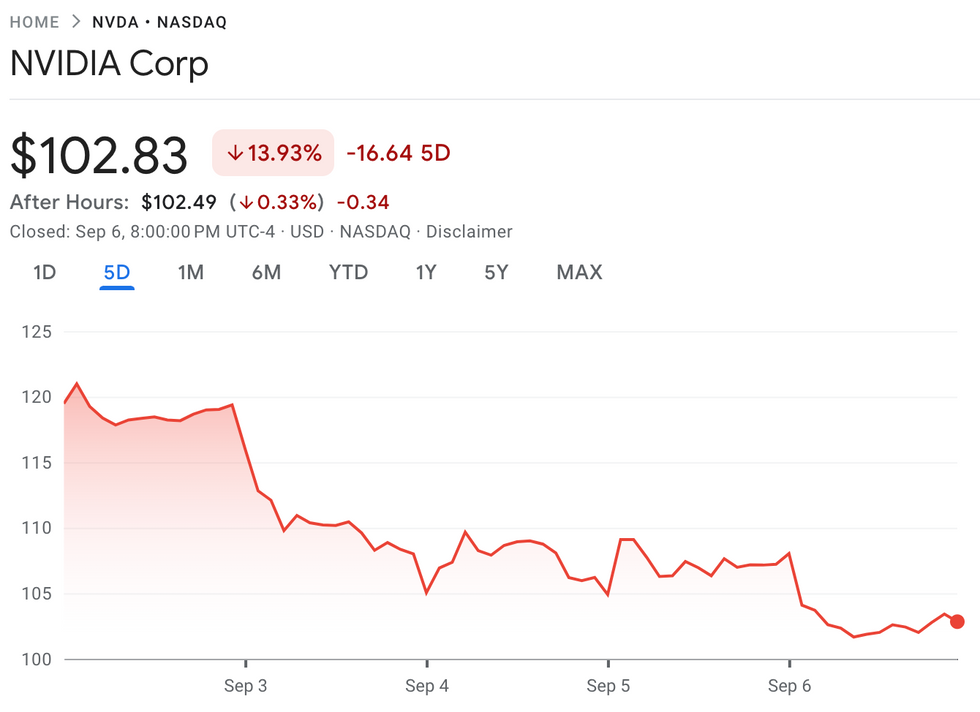

Amidst these events, major indexes remained relatively stable, despite the Nasdaq Composite facing downward pressure due to NVIDIA’s selloff. This sell-off occurred following reports of a Department of Justice subpoena in the context of an antitrust investigation, a claim later refuted by NVIDIA.

The Economic Landscape: Assessing Market Trends and Company Performance

A Mixed Bag: Economic Data Fluctuations in the US and Canada

Thursday’s economic data readings out of the US and Canada presented a contrasting view of the economic landscape. While the US services sector exhibited resilience, the ADP National Employment report hinted at a cooling labor market, with a lower-than-expected job addition rate. In Canada, the S&P Global Canada Services PMI indicated a continued albeit slowed contraction in the sector. With traders awaiting the non-farm payrolls report, volatility in major indexes was evident, reflecting uncertainty about the future.

The Crypto Conundrum: Price Plummets in September

Post the August 5 crypto market downturn, Bitcoin and Ether have been grappling with challenges like regulatory uncertainties, wavering investor sentiment, and macroeconomic nuances. Both currencies experienced declines over the past week, with Bitcoin down by 4.2 percent and Ether by 6.5 percent. Struggling to regain momentum, Bitcoin’s price descended sharply since its peak in August. Ether, plagued by lower Ethereum mainnet activity and subpar Ether ETF performance, mirrored Bitcoin’s downward trajectory.

Broadcom’s Quarter: A Disappointing Financial Report

On Thursday, Broadcom disclosed its third fiscal quarter results, revealing a remarkable 47 percent surge in revenue to US$13.07 billion. Despite surpassing analysts’ expectations marginally, the figures fell short, highlighting potential challenges faced by the tech giant in a competitive market environment.

The Evolving Landscape of Semiconductor Giants

Quarterly Earnings Revelations at Broadcom

Analyst anticipations were left befuddled by Broadcom, as the tech giant’s earnings trumped predictions with a swiftness unseen before. Bystanders watched in awe as adjusted earnings per share soared above expectations. A delightful dividend of US$0.53 per share was duly approved by the company’s board, sending shareholders into a frenzy of delight.

Brimming with excitement, Broadcom unveiled its future trajectory, setting a revenue guidance bar at a towering US$14 billion. Admittedly, this splendid prospect is 51% above the year-ago period, though falling just shy of the lofty US$14.13 billion pedestal envisioned by industry pundits.

In a peculiar twist of fate, Broadcom’s revenue streams from broadband and non-AI networking took a sharp nosedive in Q3, plummeting by 49% and 41% respectively despite a commendable 47% revenue upsurge overall.

Tesla’s Expansion into Full Self-Driving Technology

Musk’s Tesla embarked on an exhilarating journey this week, resuscitating dwindling market value figures with a remarkable bounce. Despite struggles in the US full self-driving domain, Tesla tantalized enthusiasts with promises of full self-driving technology taking flight in Europe and China come Q1 2025. The mystical announcement unfolded in an ethereal post on X, drawing curious glances towards Tesla’s imminent AI upgrades.

Excitement rippled through the stock market as Tesla saw a spirited 6.52% surge in share price, reaching exhilarating heights not seen since July, only to dwindle slightly and close the week at a respectable US$210.73.

Qualcomm’s Alleged Interest in Intel’s Design Business

Rumors abound as Qualcomm, an Apple mainstay, supposedly eyes a piece of Intel’s illustrious design business. Intel, a recipient of generous federal funding and tireless AI investments, faces a precipitous decline, tainted by recent setbacks. Noteworthy among them is Intel’s 18A system, which floundered in tests, causing the company’s value to plummet by over 60% since the year’s inception.

Intel’s precarious situation in the Dow Jones Industrial Average mirrors its tumultuous financial performance, as the company strategizes amidst an avalanche of challenges. Intel’s share prices, faltering at US$18.89 by week’s end, serve as a stark reminder of the treacherous waters navigated by tech giants in today’s cutthroat market.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.