U.S. Stock Markets Surge as Earnings Surprise and Labor Data Supports Optimism

The S&P 500 Index ($SPX) (SPY) closed on Thursday with a notable gain of +2.03%, while the Dow Jones Industrials Index ($DOWI) (DIA) rose by +1.23%. The Nasdaq 100 Index ($IUXX) (QQQ) experienced a robust increase of +2.79%. June E-mini S&P futures (ESM25) rose by +2.05%, and June E-mini Nasdaq futures (NQM25) climbed by +2.80%.

Stock indexes experienced a rally on Thursday, marking a three-week high for the S&P 500 and a two-week high for the Nasdaq 100. The surge was fueled by strong performance in megacap technology stocks and semiconductor manufacturers. Notably, Texas Instruments and Lam Research reported earnings that exceeded analyst expectations. Additionally, signs of a stable U.S. labor market enhanced investors’ confidence, as initial weekly unemployment claims increased by 6,000 to 222,000—an expected result—while continuing claims dropped to a 10-week low of 1.841 million.

Further bolstering market sentiment were declines in Treasury note yields, with the 10-year T-note yield falling by 7.6 basis points to 4.305%. This drop followed statements from Cleveland Fed President Hammack, suggesting potential rate cuts could be on the table in June if accompanied by compelling data. Similarly, Fed Governor Waller mentioned that he would support cuts if job losses resulted from tariffs.

Stocks experienced extended gains on Thursday in part due to President Trump’s comments regarding ongoing trade discussions with China. This occurred despite China’s recent denial of any active negotiations. Trump indicated that his administration had met with Chinese officials that morning.

Despite the optimism, concerns regarding the duration of the U.S.-China trade conflict persisted. Treasury Secretary Bessent emphasized that Trump had not proposed unilateral tariff reductions, while China’s Commerce Ministry stated that the U.S. must revoke all unilateral tariffs and demonstrate sincerity for any trade agreements. They further claimed that reports of trade negotiations were unfounded.

In labor market statistics, weekly initial unemployment claims rose by 6,000, aligning with expectations. Conversely, continuing claims decreased by 37,000 to a 10-week low of 1.841 million, indicating stronger labor conditions than the forecast of 1.869 million. Moreover, non-defense capital goods orders for March reported a modest increase of +0.1% month-over-month.

Other economic indicators showed mixed results. The March Chicago Fed national activity index fell by 0.27 to -0.03, falling short of expectations of 0.12. Additionally, existing home sales for March experienced a -5.9% month-over-month decline to a six-month low of 4.02 million, again weaker than the anticipated 4.13 million.

Dovish comments from the Federal Reserve regarding potential rate movements offered additional support for stocks and bonds. Cleveland Fed President Hammack indicated she would rule out rate cuts at the May 6-7 FOMC meeting but suggested that clear and convincing data in June might prompt action. Governor Waller also noted the need to consider rate reductions if tariffs led to significant job losses.

The current market sentiment reflects an 8% probability of a 25 basis point rate cut following the upcoming FOMC meeting. Focus this week is anticipated on Q1 corporate earnings results and developments in U.S. trade policies, with the revised University of Michigan April consumer sentiment index set for release on Friday, expected to hold at 50.8.

As first-quarter earnings reporting season is underway, data from Bloomberg Intelligence indicate that the market anticipates year-over-year earnings growth of +6.7% for S&P 500 companies, a reduction from earlier projections of +11.1%. For 2025, S&P 500 corporate profits are expected to rise by +9.4%, down from prior forecasts of +12.5%.

International markets also experienced upward movement, with the Euro Stoxx 50 closing up by +0.32%. China’s Shanghai Composite rose to a three-week high, ending the day up +0.03%. Japan’s Nikkei 225 also climbed to a three-week high, closing up by +0.49%.

Interest Rates

June 10-year T-notes (ZNM25) closed Thursday up by +18 ticks, with the 10-year T-note yield dropping by 7.6 basis points to 4.305%. Supportive factors for T-notes included strength from European government bonds and reassurances from President Trump regarding the Fed Chair’s position, which alleviated fears of foreign asset sell-offs.

T-notes also gained ground following dovish comments from Fed officials regarding potential interest rate cuts, yet rising inflation expectations capped further advances. The 10-year breakeven inflation rate reached a three-week high of 2.317%. Demand was dampened at the Treasury’s recent auction of 7-year T-notes, which yielded a bid-to-cover ratio of 2.55, underperforming against the average of 2.64.

In Europe, government bond yields fell, with the 10-year German bund yield declining by 4.9 basis points to 2.448% and the 10-year UK gilt yield falling by 5.2 basis points to 4.500%.

Eurozone car registrations saw a -0.2% year-over-year decrease in March, reaching 1.030 million units, marking the third consecutive month of decline. On a more positive note, the German April IFO business confidence index unexpectedly rose by +0.2 to a nine-month high of 86.9, exceeding expectations for a drop to 85.2. ECB Governing Council member Rehn indicated that the ECB may need to lower rates further, possibly exceeding a 25 basis point reduction, with swaps currently reflecting a 98% probability of such a cut at the June 5 meeting.

U.S. Stock Movers

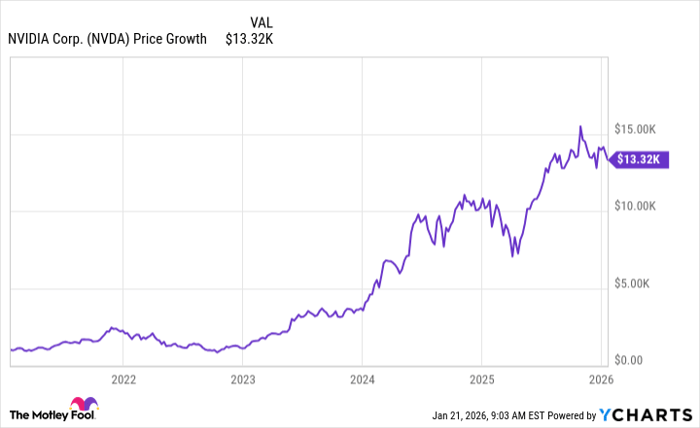

The “Magnificent Seven” stocks fueled Thursday’s market rally, with Nvidia (NVDA), Amazon.com (AMZN), Tesla (TSLA), and Microsoft (MSFT) all closing up more than +3%. Other notable gainers included Meta Platforms (META) and Alphabet (GOOGL), both up over +2%, while Apple (AAPL) rose more than +1%.

Chip stocks saw a significant rally, led by Microchip Technology (MCHP), which surged over +12%, and ON Semiconductor (ON), up more than +8%. Texas Instruments (TXN) advanced by more than +5% following the release of Q1 revenue of $4.07 billion, surpassing the consensus estimate of $3.91 billion, while also forecasting Q2 revenue between $4.17 billion and $4.53 billion, stronger than the estimate of $4.12 billion. Lam Research (LRCX) gained over +6% after reporting a Q3 adjusted EPS of $1.04, which exceeded expectations of $1.00. Other chipmakers also benefited from these results, with significant support seen across the sector.

ServiceNow and Hasbro Post Strong Earnings, Boosting Investor Confidence

Several companies saw significant gains in their stock prices, with Holdings Plc (ARM), Broadcom (AVGO), and NXP Semiconductors NV (NXPI) all closing up more than +6%. Additionally, GlobalFoundries (GFS) closed up more than +5%.

Leading the S&P 500, ServiceNow (NOW) saw an impressive increase of over +15% after reporting Q1 subscription revenue of $3.09 billion, surpassing the consensus expectation of $3.08 billion. The company also forecasted Q2 subscription revenue between $3.03 billion and $3.04 billion, which is stronger than the consensus of $3.02 billion.

In another major development, Hasbro (HAS) closed up more than +14% following a strong Q1 net revenue report of $887.1 million, significantly exceeding the consensus estimate of $769.2 million.

Allegion Plc (ALLE) also posted gains with a +10% increase, reporting a Q1 adjusted EPS of $1.86, higher than the consensus of $1.68. Meanwhile, United Rentals (URI) closed up more than +9% on an adjusted EPS of $8.86, surpassing the consensus of $8.66.

Edwards Lifesciences (EW) increased more than +6% by raising its full-year sales forecast to $5.7 billion to $6.1 billion from an earlier forecast of $5.6 billion to $6.0 billion. This midpoint exceeds the consensus expectation of $5.81 billion.

In contrast, several companies faced sharp declines. Fiserv (FI) led the S&P 500 losses, closing down more than -18% after reporting Q1 organic revenue growth of +7.0%, which fell short of the anticipated +8.48% growth.

LKQ Corp (LKQ) decreased over -11% with Q1 revenue of $3.46 billion, which was below the consensus estimate of $3.59 billion. Alaska Air Group (ALK) also closed down more than -9% after forecasting Q2 adjusted EPS of $1.15 to $1.65, well below the consensus expectation of $2.41.

Despite reporting better-than-expected Q1 earnings, International Business Machines (IBM) closed down more than -6%. The company expressed concern that economic uncertainty and U.S. government cost cuts may impact future earnings.

PepsiCo (PEP) fell more than -4% in the Nasdaq 100 after delivering Q1 core EPS of $1.48, just below the consensus of $1.49. The company also revised its full-year organic revenue outlook downward to a low single-digit increase, compared to the previous estimate of mid-single-digit growth.

Furthermore, Comcast Corp (CMCSA) closed down more than -3% as it reported a loss of 427,000 pay-TV customers in Q1, worse than the expected decline of 409,300. Tractor Supply (TSCO) also fell over -3% after posting Q1 net sales of $3.47 billion, below the consensus of $3.53 billion. Robert Half Inc (RHI) similarly closed down more than -3%, reporting Q1 revenue of $1.35 billion, missing the consensus of $1.41 billion while citing concerns over U.S. trade policy affecting business confidence.

Earnings Reports (4/25/2025)

Upcoming earnings reports include AbbVie Inc (ABBV), Aon PLC (AON), Centene Corp (CNC), Charter Communications Inc (CHTR), Colgate-Palmolive Co (CL), HCA Healthcare Inc (HCA), LyondellBasell Industries NV (LYB), Phillips 66 (PSX), and Schlumberger NV (SLB).

On the date of publication, Rich Asplund did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.