“`html

The Royal Swedish Academy of Sciences has awarded two prestigious prizes this week for contributions to artificial intelligence (AI).

In related news, Bitcoin continues to show volatility influenced by broader economic trends, while Tesla (NASDAQ:TSLA) unveiled its highly anticipated autonomous vehicle—a move that left many investors disappointed.

Furthermore, projections from OpenAI indicate that profitability remains a future goal for the organization.

For the latest updates in the technology sector, follow the Investing News Network’s comprehensive overview.

1. AI Scholars Awarded Nobel Prizes

This week, the Royal Swedish Academy of Sciences awarded two Nobel Prizes in science to leaders in artificial intelligence (AI).

The Nobel Prize in Physics was granted to Geoffrey Hinton from Canada and John Hopfield from the US on Tuesday. Their foundational research on neural networks has significantly shaped the field of machine learning, reflecting how the human brain processes information.

Hopfield developed a computer model mimicking brain function, enabling it to retain and retrieve patterns even with incomplete data. Meanwhile, Hinton’s innovations facilitated self-learning in computers, allowing them to identify patterns autonomously, without requiring extensive programming.

On Wednesday, Sir Demis Hassabis and John Jumper from Google DeepMind received the Nobel Prize in Chemistry for creating AlphaFold 2 in 2020, an AI system capable of predicting the 3D structures of proteins.

Understanding a protein’s structure is crucial, as it directly impacts its functionality and is typically a complex and costly endeavor for scientists. Notably, in July 2021, AlphaFold 2 successfully predicted the structures of nearly all known 200 million proteins, using only their amino acid sequences. This advancement could revolutionize scientific research and accelerate medical breakthroughs.

However, not all news was positive for Alphabet’s companies. A court ruling on Monday mandated Google to revamp its mobile app store, allowing Android users to access apps from other sources. In a follow-up, the US Department of Justice suggested it may pursue a split between Google’s Chrome and Android divisions, building on earlier actions in an ongoing antitrust case. Following these developments, Google shares declined by 2.65 percent this week.

2. Tesla’s Cybercab Launch Disappoints Investors

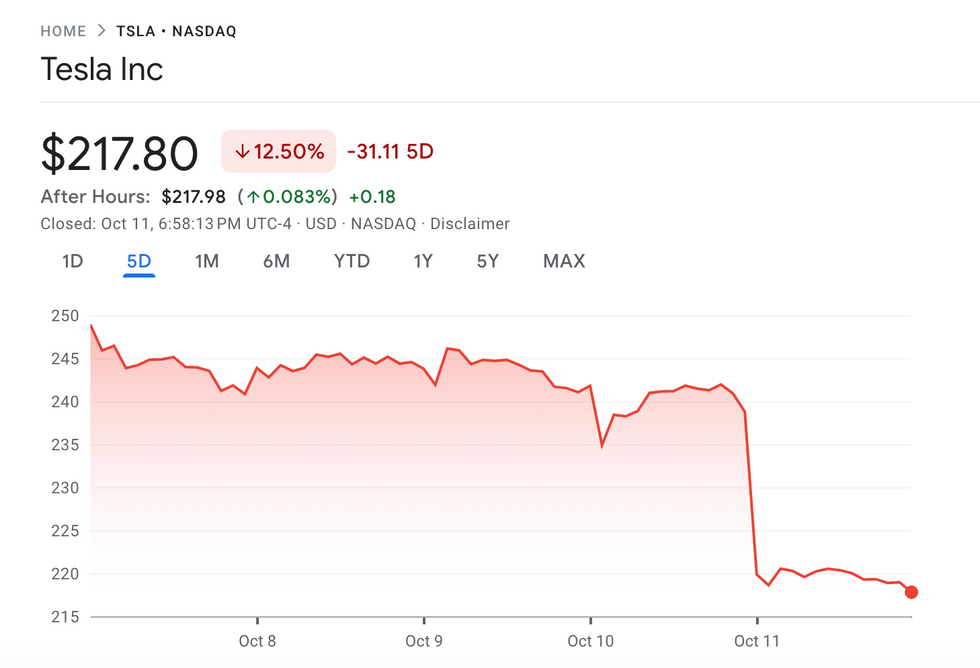

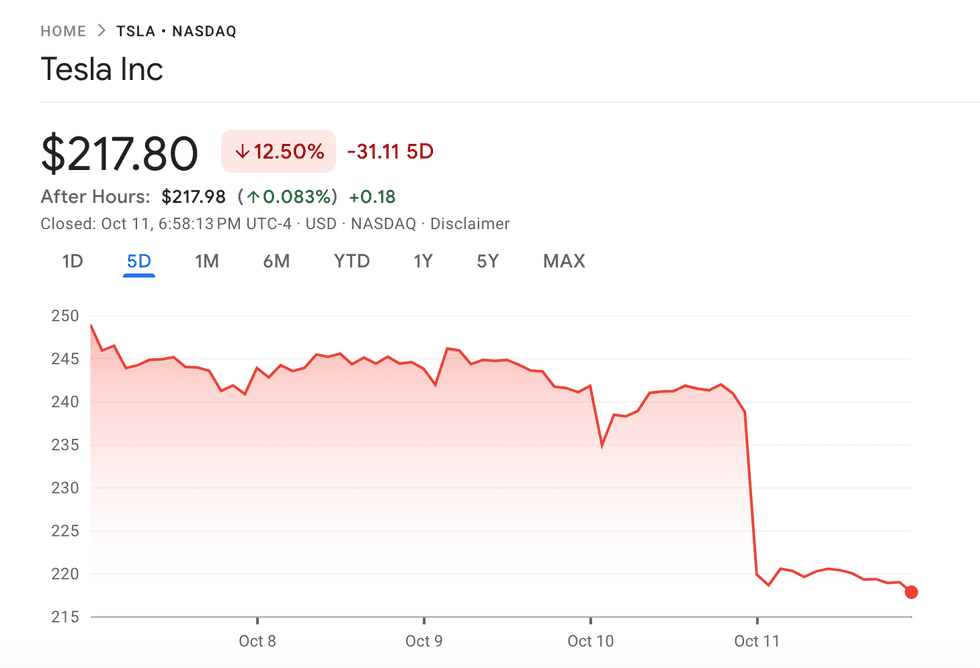

On Friday, Tesla’s stock dropped by 8.78 percent after the company revealed its long-anticipated fully autonomous vehicle, the Cybercab, during an event on Thursday evening. The unveiling, which had generated significant hype, ultimately did not meet investors’ expectations.

“““html

Tesla Launches New Models Amid Financial Challenges

Innovative Designs Unveiled, But CEO Provides Few Details

A two-seater vehicle lacking a steering wheel or foot pedals was showcased at Tesla’s “We Robot” event in Burbank, an hour behind schedule.

During the event, Tesla CEO Elon Musk announced that the new model will be priced below US$30,000, with production potentially starting before 2027. However, he did not elaborate on when or where this would occur. He also mentioned plans for a fully autonomous 20-passenger Robovan but again offered no further specifics beyond the fact that both vehicles would feature wireless charging.

Musk provided an update on Tesla’s full self-driving (FSD) technology, expected to launch in China in 2025. Despite facing regulatory hurdles in the US, Musk anticipates FSD will be available in Model 3 and Model Y vehicles in Texas and California “next year,” though he did not provide a clear release date.

Currently, Tesla’s stock has decreased by 12.5 percent this week and 12.33 percent year-to-date.

Chart via Google Finance.

Tesla’s price movements for the week ending October 11.

Samsung Apologizes For Missed Expectations

South Korean technology giant Samsung (KRX:005930) released its Q3 profit guidance on Tuesday, projecting a remarkable 274 percent increase in operating profits, amounting to approximately 9.1 trillion Korean won, or about US$6.74 billion. This marks significant growth from the 2.43 trillion won earned in Q3 2023; however, it fell short of LSEG’s expectations of 11.45 trillion won, leading to a 1.47 percent drop in the company’s share prices on Tuesday morning.

Following the announcement, Samsung’s vice chairman, Jun Young-hyun, expressed regret for the shortfall, attributing it to “one-time costs and negative impacts” within the memory division. He cited inventory adjustments by mobile customers and increased supply from Chinese suppliers as key factors.

Young-hyun vowed that Samsung’s leadership will “prepare for the future more thoroughly,” stating, “Samsung … has always turned crises into opportunities, having a history of challenge, innovation, and overcoming.” He closed with a commitment to transform the current difficulties into a stepping stone for future success.

As a result of these developments, Samsung’s shares are down 3.26 percent this week.

OpenAI Sees Future Losses Amid Rapid Growth

The Information reported on Wednesday that OpenAI, despite its fast expansion, anticipates losses reaching up to US$14 billion in 2026, totaling US$44 billion in losses from 2023 through 2028. According to documents reviewed by The Information, OpenAI plans to invest up to US$200 billion in training new AI models by the end of the decade.

As part of OpenAI’s recent funding round, which raised US$6.6 billion with backing from firms like Andreessen-Horowitz, Microsoft (NASDAQ:MSFT), and Nvidia (NASDAQ:NVDA), the company has restructured to focus on a for-profit model. Despite being valued at US$157 billion, OpenAI does not expect to turn a profit until 2029, aiming for US$100 billion in revenue primarily through ChatGPT.

“`

Bitcoin Sees Volatile Week, Yet Shows Signs of Recovery

Market Movements Driven by Economic Signals

At the beginning of the week, Bitcoin’s price hovered around US$63,000. This fluctuation was largely due to the lack of a clear stimulus plan from China, while meme coins enjoyed a boost. On Monday, Ether ETFs noted no flows in or out for the second time since their launch. In contrast, Bitcoin ETFs recorded their highest inflows since September 27.

Bitcoin Dips Below $60,000 Amid CPI Release

By Wednesday, Bitcoin’s price had dipped as anticipation built for the Thursday consumer price index (CPI) data release. After the figures were published, Bitcoin’s value plummeted below US$60,000 for the first time this month, a notable trend considering October is traditionally seen as a bullish month.

CPI Data Shows Slowdown in Inflation Growth

The CPI data revealed a modest increase of 0.2 percent from the previous month and a year-over-year rise of just 2.4 percent, marking the smallest annual increase since inflation began to surge in February 2021.

Recovery Efforts Seen on Friday

Following the initial downturn, Bitcoin prices began to recover, briefly climbing back above US$63,000 by Friday afternoon.

Stay updated on market trends by following us on @INN_Technology for real-time news!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.