TechnipFMC Outperforms Oceaneering International and Core Labs

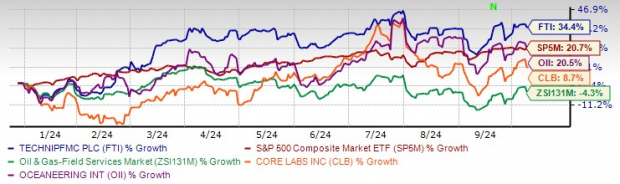

UK-based company TechnipFMC plc (FTI) has shown remarkable growth this year, with a 34.4% increase in its stock value, surpassing both the Oils and Energy sector and the S&P 500. It has also outperformed competitors like Oceaneering International (OII) and Core Labs (CLB).

TechnipFMC: A Brief Overview

TechnipFMC was formed in January 2017 through the merger of Technip and FMC Technologies. The company provides products, services, and technology solutions for the energy industry, specializing in subsea, onshore/offshore, and surface projects.

Strong Fundamentals Drive FTI Stock Performance

In Q2 of 2024, TechnipFMC’s backlog hit a record $13.9 billion, showcasing a 4.51% increase from the previous year. This robust backlog ensures revenue visibility and supports margin growth. The subsea sector, a consistent top performer, is expected to achieve significant revenue growth, further enhancing the company’s market position.

TechnipFMC’s strategic expansion in Guyana has led to key partnerships, making it a top supplier of subsea systems in the region. With a strong regional presence and innovative technologies like Subsea 2.0, the company is poised for future growth.

Analyst Optimism & Pricey Valuation

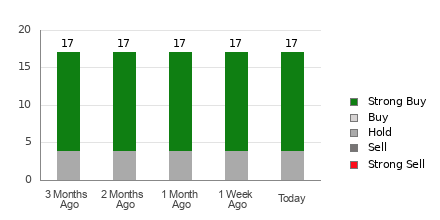

TechnipFMC boasts a strong Value, Growth, and Momentum Score with positive analyst estimates. Despite its positive outlook, the stock appears overvalued based on EV/EBITDA multiples compared to industry peers. Concerns also arise from its low dividend yield and slow transition to green energy solutions.

Caution Advised for Investors

While TechnipFMC shows promise, caution is advised due to its valuation concerns and slow green energy adoption. Investors may consider holding onto their positions rather than investing further.

TechnipFMC currently carries a Zacks Rank #3 (Hold).

Key Takeaway for Investors

Despite its recent success, TechnipFMC’s stock performance may face challenges due to valuation and sustainability concerns. Investors are urged to proceed with caution and assess their positions accordingly.