TEGNA disclosed on February 21, 2024, that its board of directors has announced a routine quarterly dividend of $0.11 per share ($0.46 annualized), maintaining the previous quarter’s payment. Shareholders need to acquire shares before the ex-dividend date on March 7, 2024, to qualify for the dividend with the payment scheduled for April 1, 2024.

Presently trading at $14.51 per share, the stock’s dividend yield stands at 3.14%. Examining the past five years at a weekly interval, the average dividend yield has been 2.08%, with the lowest at 1.37% and the highest at 3.30%. Notably, the current dividend yield is 2.64 standard deviations above the historical average.

Furthermore, the company’s dividend payout ratio, which reveals the portion of income paid out as dividends, is at 0.14. A ratio exceeding one suggests the company is drawing upon reserves to sustain dividends, a practice with unfavorable implications for financial health. In contrast, a ratio between 0.5 and 1.0 is typical for entities with limited growth opportunities. Companies poised for growth usually maintain a ratio between zero and 0.5.

With a 3-Year dividend growth rate of 0.62%, TEGNA exhibits a trend of increasing dividends over time.

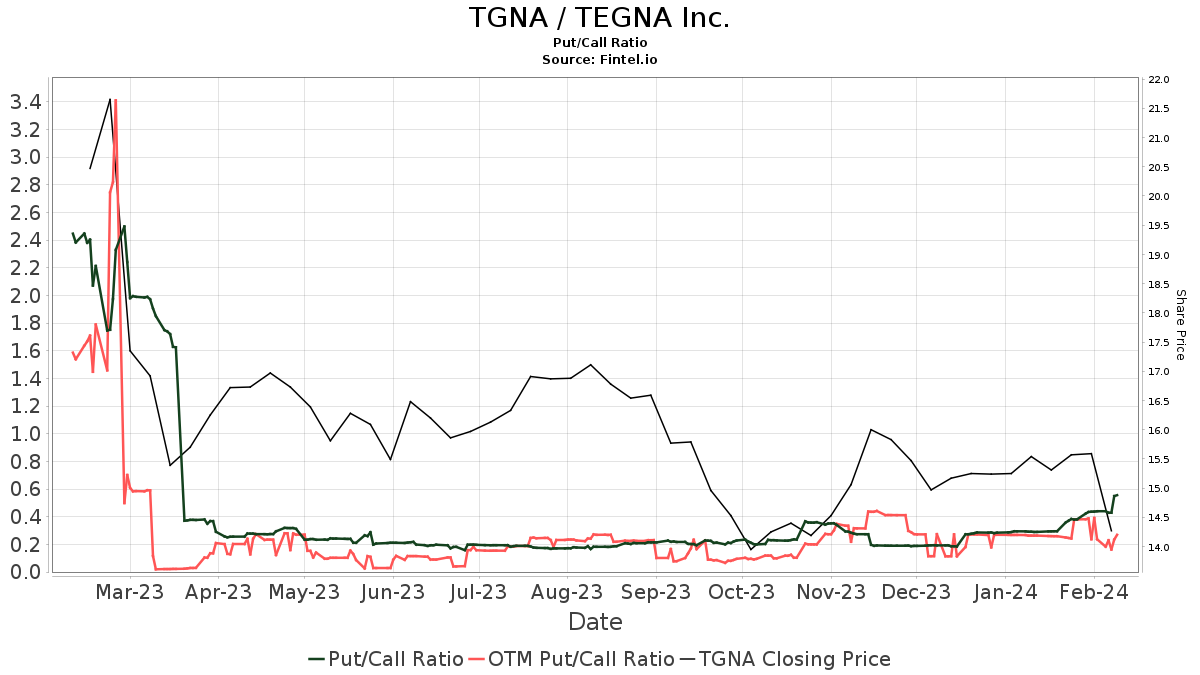

Understanding Market Sentiment

Reportedly, there are 865 funds or institutions holding positions in TEGNA, marking an uptick of 122 owners, a 16.42% rise in the last quarter. The average portfolio weight allocated to TGNA by all funds is 0.25%, showing a 6.62% increase. Despite this, total shares owned by institutions reduced by 3.84% in the past three months to 203,681K shares.

Analyst Price Targets and Projections

Analyzing projections as of January 18, 2024, the average one-year price target for TEGNA is $19.79. Forecasts span from a low of $17.17 to a high of $23.10, indicating a 36.37% potential increase from the latest closing price of $14.51.

The anticipated annual revenue for TEGNA is $3,734MM, with a forecasted 20.37% growth rate. Additionally, the projected annual non-GAAP EPS stands at $4.01.

Shareholder Activity

Looking at institutional holdings, IJH – iShares Core S&P Mid-Cap ETF owns 6,298K shares, constituting 3.20% ownership, reflecting an 8.38% decrease from its prior filing. Meanwhile, Vanguard Total Stock Market Index Fund Investor Shares hold 6,292K shares, owning 3.19% with an 11.45% decrease in their portfolio allocation within TGNA. Geode Capital Management and Lsv Asset Management exhibit contrasting trends of ownership fluctuation, with Boston Partners undergoing a significant 98.49% reduction in portfolio allocation.

Insight into TEGNA Operations

TEGNA Inc. is a dynamic media entity focused on community service, with 64 television stations spread across 51 U.S. markets. Renowned as the largest owner of top network affiliates in major markets among independent station groups, the company reaches approximately 39% of all U.S. television households. Additionally, TEGNA owns popular multicast networks like True Crime Network and Quest, with its marketing arm, TEGNA Marketing Solutions (TMS), offering innovative marketing avenues across television, digital, and OTT platforms.

For individuals seeking detailed investment research, platforms like Fintel provide comprehensive data including fundamentals, analyst reports, and ownership trends, leveraging advanced quantitative models for enhanced profitability.

This narrative was originally featured on Fintel, offering valuable insights into TEGNA’s dividend performance and market dynamics.

The viewpoints expressed are solely those of the author and do not necessarily mirror Nasdaq, Inc.’s perspectives.