Teleflex Keeps Dividend Steady Amid Market Fluctuations

Teleflex, on February 22, 2024, proudly declared a regular quarterly dividend of $0.34 per share ($1.36 annualized). This steady payout remains unchanged from the previous period, showcasing the company’s commitment to its shareholders. Investors holding shares as of March 1, 2024, can anticipate receiving the dividend on March 15, 2024.

At the existing share price of $226.04, the stock boasts a dividend yield of 0.60%. The historical perspective extends over five years, with dividends fluctuating from a low of 0.31% to a high of 0.76%. The standard deviation of yields stands at 0.11 (n=233), reflecting a potentially lucrative proposition for eager investors. Notably, the current dividend yield stands at a remarkable 1.37 standard deviations above the historical average.

Understanding Dividend Payout Ratios

Delving deeper into the financials, Teleflex’s dividend payout ratio rests at 0.18, a figure that sheds light on the company’s financial strategy. As a pivotal metric, the payout ratio illustrates the proportion of income disbursed as dividends. For Teleflex, a ratio above 1.0 would indicate a precarious situation where the company is depleting its reserves to maintain dividends. However, a ratio between 0.5 and 1.0 suggests a steady balance between dividend payouts and retained earnings for further investments.

Over the past three years, Teleflex has maintained its dividend at a constant level, showcasing a prudent approach to shareholder returns amidst a fluctuating market landscape.

Evaluating Market Sentiments and Analyst Forecasts

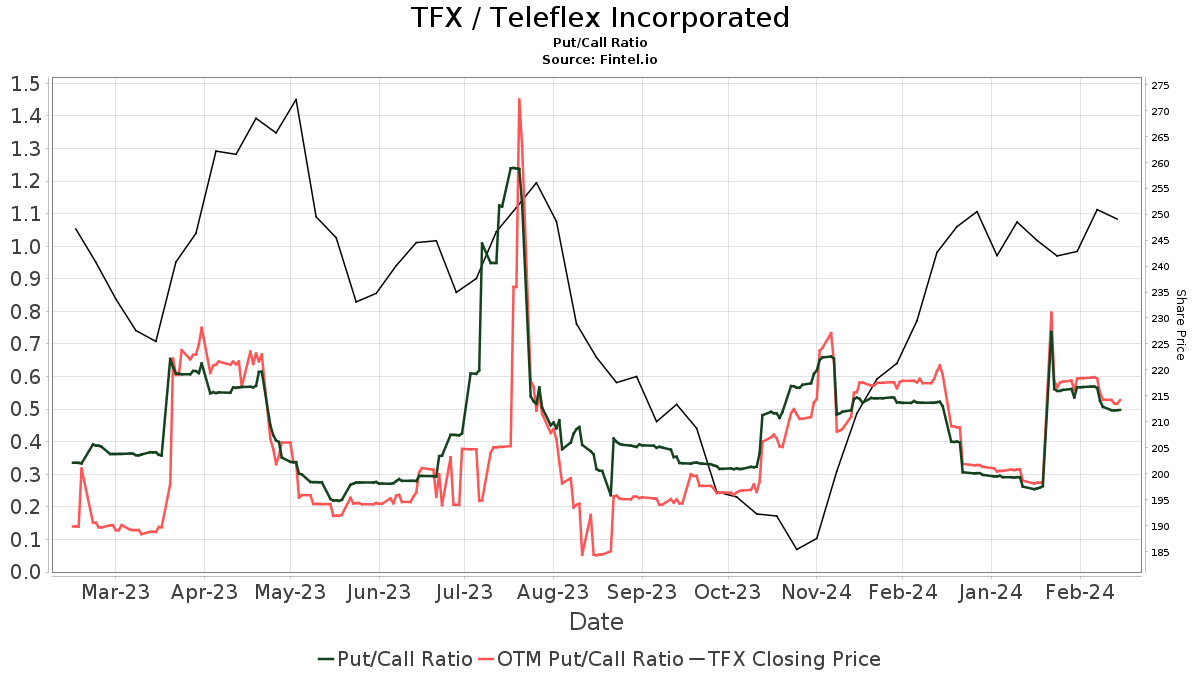

Teleflex continues to capture the attention of the market, with 1114 funds or institutions holding positions in the company. Despite a slight decrease of 0.45% in ownership in the last quarter, the average portfolio weight dedicated to TFX hovers at 0.19%. Meanwhile, the bearish put/call ratio of 1.05 indicates a cautious outlook prevailing among investors.

Analyst price forecasts paint an optimistic picture, with a consensus one-year price target of 271.91, suggesting a 20.30% upside potential from the current valuation. This upbeat sentiment is reinforced by projected annual revenue growth of 4.15% and a non-GAAP EPS of 15.30 for the company.

Insights into Shareholder Activities

Noteworthy institutional shareholders like T. Rowe Price Investment Management and Janus Henderson Group have made strategic portfolio adjustments in Teleflex. T. Rowe Price Investment Management reduced its ownership by 0.82% in the last quarter but increased its portfolio allocation by a substantial 15.82%. In contrast, Janus Henderson Group augmented its ownership by 12.74% while downsizing its portfolio allocation by 56.62% over the same period.

Additionally, RPMGX – T. Rowe Price Mid-Cap Growth Fund, Wellington Management Group Llp, and JAENX – Janus Henderson Enterprise Fund Class T have also demonstrated varying degrees of changes in their portfolio allocations towards Teleflex, underlying the dynamic landscape of institutional investments.

Teleflex: Enriching Lives with Innovative Medical Technologies

Teleflex stands out as a global leader in medical technologies, catering to a diverse range of healthcare needs. With a dedicated focus on purpose-driven innovation, the company prioritizes identifying unmet clinical needs to benefit patients and healthcare providers worldwide. From vascular access to surgical solutions, Teleflex’s extensive portfolio exemplifies a commitment to making a meaningful difference in people’s lives.

As investors navigate the intricate world of financial markets, Teleflex remains a beacon of stability and innovation, poised to deliver consistent returns and technological advancements in the ever-evolving healthcare sector.

Credit: This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.