“`html

Telsey Advisory Group maintained an Outperform recommendation for Holley (NYSE:HLLY) on November 7, 2025, with an average one-year price target of $4.00 per share, suggesting a 10.36% upside from its closing price of $3.62 on October 30, 2025. Forecasts range from a low of $3.03 to a high of $6.30.

Holley’s projected annual revenue is $818 million, an increase of 36.74%, with a projected non-GAAP EPS of 0.78. Institutional ownership saw a decrease of 0.16% to 76,266K shares in the last three months, with a total of 242 funds reporting positions in the company, down by 6.92% from the previous quarter.

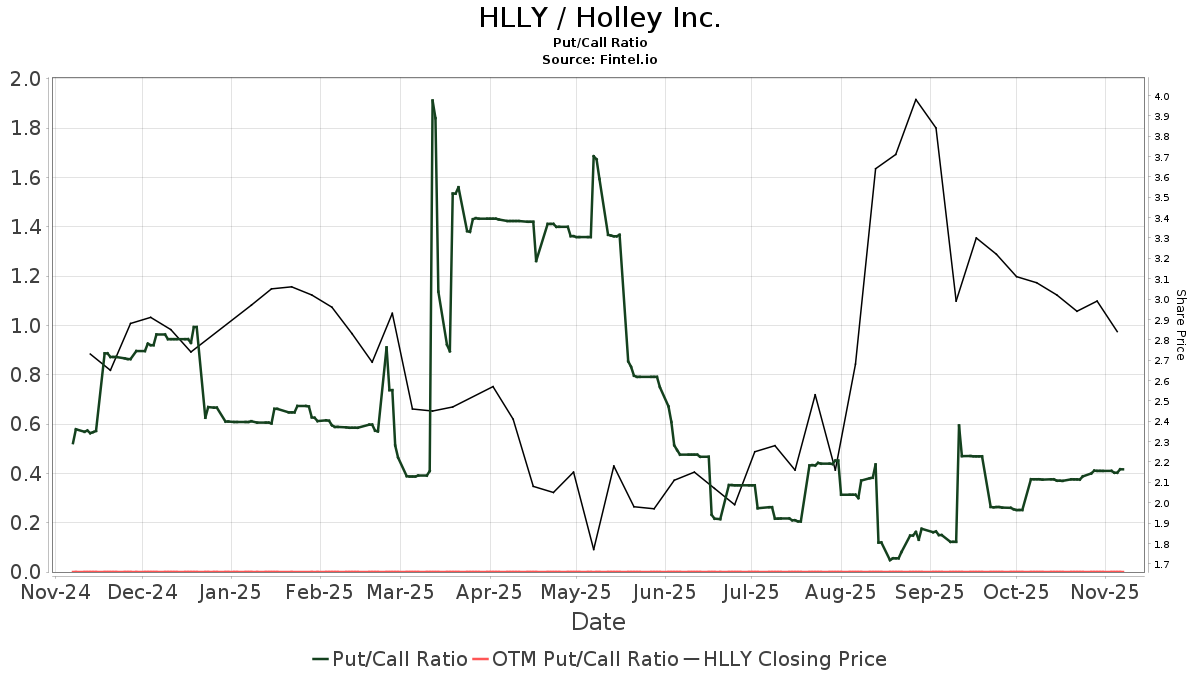

Notable changes in shareholder positions included Allspring Global Investments increasing its stake to 10,590K shares (8.79% ownership), while Kayne Anderson Rudnick Investment Management decreased its holdings by 42.80% to 5,660K shares (4.70% ownership). The put/call ratio for HLLY stands at 0.42, indicating a bullish outlook.

“`