“`html

Telsey Advisory Group has maintained a Market Perform recommendation for Under Armour (NYSE:UA) as of October 31, 2025. The firm projects an average one-year price target of $5.93/share, indicating a potential 33.52% increase from the latest closing price of $4.44/share.

Key projections for Under Armour include an expected annual revenue of $6.66 billion, reflecting a 30.21% increase, and a non-GAAP EPS of $0.96. Currently, 539 funds report holdings in Under Armour, a decrease of 2.71% from the previous quarter, with total institutional shares down 1.82% to 174.69 million shares.

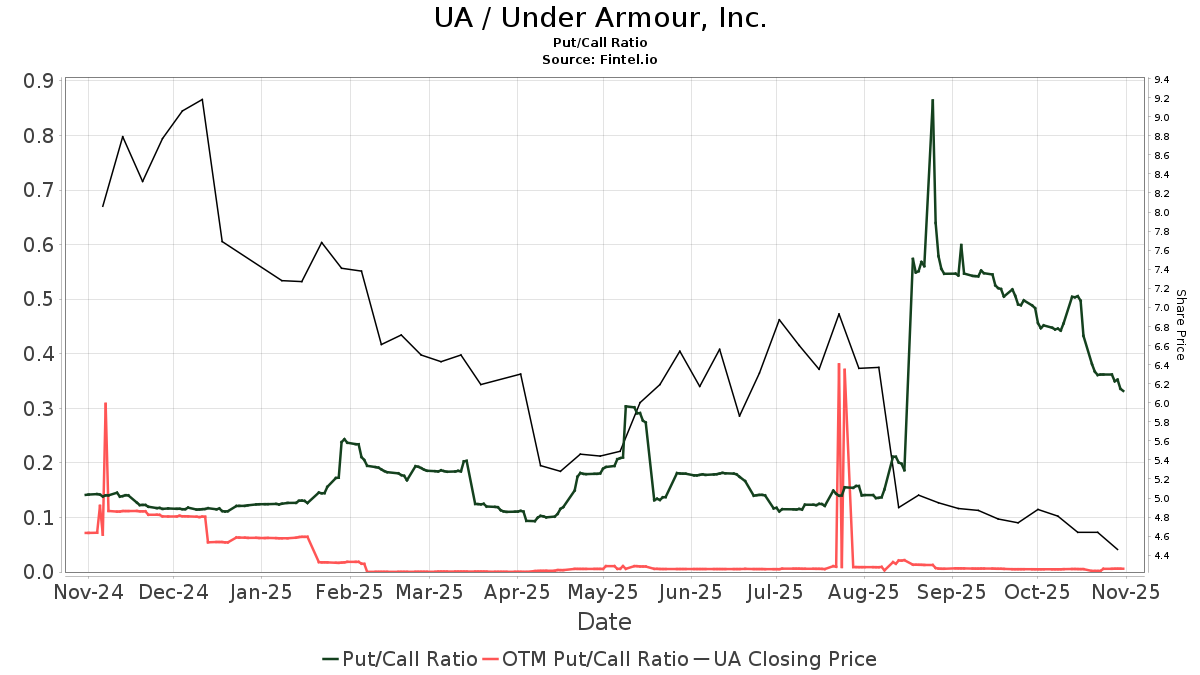

The put/call ratio stands at 0.33, suggesting a bullish market outlook. Major institutional stakeholders include Bdt Capital Partners with 30.39% ownership, while Vanguard Total Stock Market Index Fund reduced its holding by nearly 10% over the last quarter.

“`