Telsey Advisory Group Upgrades Home Depot Outlook to Outperform

On November 8, 2024, Telsey Advisory Group made a significant shift in its outlook for Home Depot (SNSE:HDCL), changing it from Market Perform to Outperform.

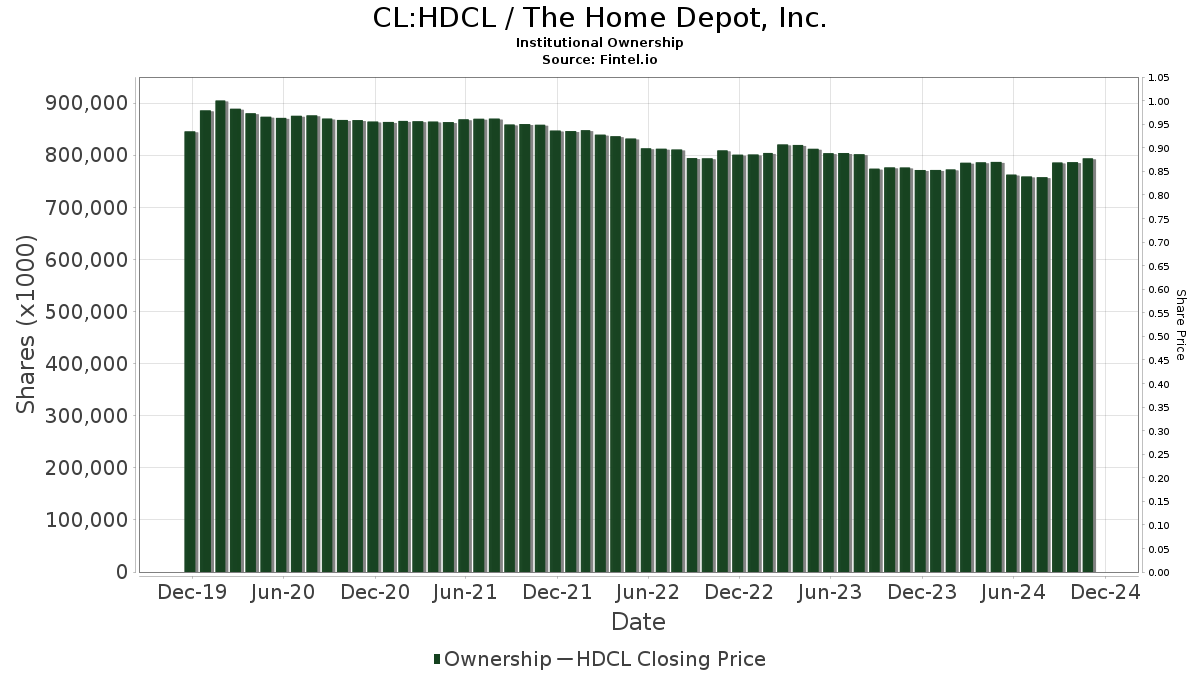

Fund Sentiment Shows Growing Interest

Currently, 5,089 funds or institutions hold positions in Home Depot, marking a rise of 118 owners or 2.37% from the previous quarter. The average portfolio weight of these funds dedicated to HDCL is 0.74%, reflecting an increase of 0.09%. Moreover, total shares owned by institutions grew by 4.94% in the last three months, now totaling 793,753K shares.

Actions by Other Shareholders

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares now holds 31,317K shares, which is 3.15% of the company. This reflects a slight increase of 0.15% since their last filing; however, the firm has reduced its portfolio allocation in HDCL by 12.60% over the last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares has increased its holdings to 25,436K shares, representing 2.56% ownership. This is an increase of 1.39% from their previous report, although they also decreased their portfolio allocation in HDCL by 13.85%.

Capital World Investors shows a notable change, owning 25,102K shares, or 2.53% ownership of the company. They drastically reduced their holdings by 50.05%, decreasing their portfolio allocation in HDCL by 41.08% in the last quarter.

Geode Capital Management has increased its shares to 21,267K, representing 2.14% ownership. Their prior report showed ownership of 20,693K shares, which indicates a 2.70% increase. However, they significantly cut their portfolio allocation in HDCL by 54.30% over the quarter.

Bank Of America currently holds 14,189K shares, or 1.43% of the company, down 3.39% from 14,671K shares reported previously. This firm drastically reduced its portfolio allocation in HDCL by 79.66% over the last quarter.

Fintel serves as a key resource for individual investors, traders, financial advisors, and small hedge funds. Its data encompasses a range of financial metrics, detailed ownership information, and fund sentiment analysis.

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.