“`html

Tempus AI (TEM) stock price surged nearly 13% following the release of its second-quarter 2025 earnings. The company reported an 89.6% year-over-year revenue increase, driven by a 115% rise in Genomics revenues from oncology and hereditary testing, as well as a 35.7% increase in its Data and Services segment. Adjusted EBITDA losses narrowed to $5.6 million from $31.2 million a year prior.

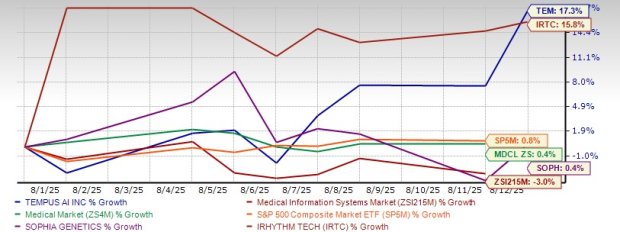

In August, Tempus AI shares increased by 17.3%, significantly outperforming the Medical Info Systems industry, which saw a 3% decline. The company has restructured its financials with a $750 million convertible note offering and reported a strong cash position of $293 million by the end of the quarter, positioning itself for future growth and profitability.

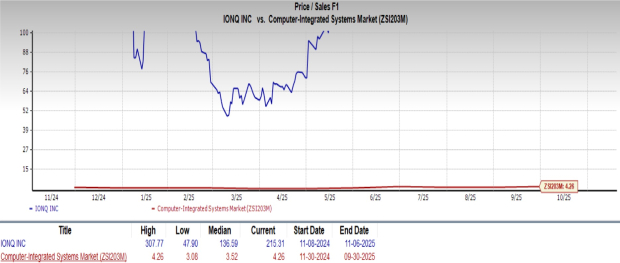

The stock is currently trading at a forward 12-month price-to-sales (P/S) ratio of 7.98, above the broader industry’s average of 5.57, indicating that its recent performance may already be priced into its current valuation. Tempus AI remains focused on maintaining revenue growth and cost control as it aims for sustainable profitability.

“`