Trump’s 25% Tariff Sparks Dismay in the Auto Industry

Analysts are expressing strong concerns regarding US President Donald Trump’s recently announced 25% tariff on all imported cars and car parts.

Market reactions reflect this apprehension. Major indices including the S&P 500, Nasdaq, and Dow have experienced consecutive weekly declines. The emerging global trade landscape is projected to be worse than many expect.

What Happened: Analysts at Wedbush Securities compare these tariffs to an ‘armageddon’ for the automotive sector and its related industries. They emphasized that there will be ‘No Winners’ with such tariffs, which ultimately raise costs and create complications throughout the industry.

The firm predicts that the outcome will be ‘pure chaos.’ Automakers will be forced to reorganize their supply chains, established over decades. Consumers can expect to pay an additional $10,000 to $15,000 for a new car as a direct result of these tariffs.

The financial implications of Trump’s tariffs on the auto industry could exceed $100 billion, affecting all market players. Even Tesla Inc. TSLA is not immune, as no automaker operates with a completely domestic supply chain. CEO Elon Musk previously indicated that these tariffs would have a ‘significant’ impact on Tesla.

Is US Manufacturing Resurgence Realistic?

Despite ongoing market challenges, President Trump remains committed to his vision of revitalizing US manufacturing. However, many experts dismiss this ambition as unrealistic.

According to Wedbush, reviving auto manufacturing in the US could take years to achieve. In the interim, consumers, automakers, parts suppliers, and thousands of workers across ancillary sectors will face significant hardship.

This tariff-centered trade policy fails to consider the intricate global value chains inherent in the automotive sector. Implementing tariffs does not guarantee that complex automotive parts and solutions can be produced domestically, especially considering existing intellectual property laws.

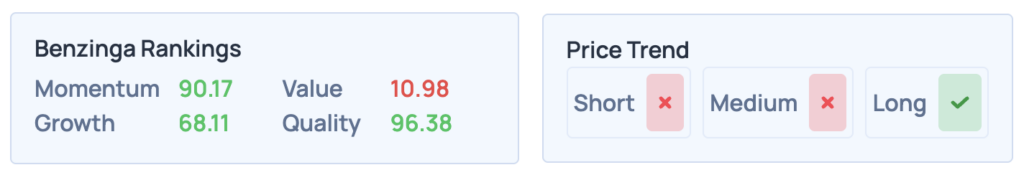

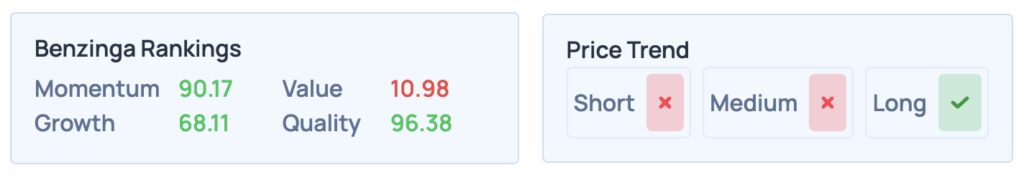

According to Benzinga Edge, Tesla shares currently exhibit strong growth and momentum ratings at 68% and 90%, respectively. However, the stock performs poorly in terms of value, rated at just 10%. What do these ratings indicate for Tesla’s future?

Read Next:

Photo courtesy: Shutterstock

Momentum90.17

Growth68.11

Quality96.38

Value10.98

Market News and Data brought to you by Benzinga APIs