Market Volatility: Analyzing Earnings Reports from Tesla and Alphabet

Investors have faced significant challenges with recent market volatility. The mixed signals from tariff discussions and President Trump’s remarks about Federal Reserve Chair Jerome Powell have further complicated the landscape.

As many seek stability to alleviate portfolio pressures, it’s important to remember a key insight from economist Ben Graham:

In the short run, the Stock market is a voting machine. But in the long run, it is a weighing machine.

This quote highlights a critical truth: short-term market fluctuations can often resemble popularity contests influenced by sentiment and news, rather than the underlying business fundamentals. Over time, a stock’s true value is revealed through its performance metrics.

This brings us to the current earnings season, which deserves our attention. For investors holding stocks characterized by strong fundamentals, this season could provide a boost to their portfolios following positive earnings announcements.

Tesla, Inc.

This past Tuesday, Tesla announced earnings that elicited mixed reactions. Despite reporting disappointing figures, shares surged by 5% on Wednesday, with an increase approaching 18% as of now. What fueled this rise?

Tesla reported first-quarter revenue of $19.34 billion, falling short of the expected $21.43 billion. This figure is also a decline from the $21.3 billion from the same quarter last year. Adjusted earnings were reported at $0.27 per share, significantly lower than the $0.44 per share that analysts anticipated.

This shortfall is noteworthy, especially considering Tesla’s decision to pause its 2025 guidance amid dwindling demand and trade uncertainties, which management cited as key reasons for slowing sales.

Despite the earnings miss, the stock price increased. CEO Elon Musk assured investors during the earnings call that he would focus more on Tesla moving forward, reducing his time on other ventures. Additionally, a recent announcement from the National Highway Traffic Safety Administration regarding eased self-driving regulations bolstered investor confidence, particularly regarding Tesla’s robotaxi initiatives.

Moreover, Musk stated that Tesla aims to offer fully autonomous rides in Austin, Texas, beginning in June, with additional cities to follow throughout the year. While his timelines have historically been ambitious, this outlook encouraged market optimism, outweighing the disappointing earnings report.

Alphabet, Inc.

In contrast, Alphabet’s recently announced results surpassed expectations. In its first quarter, the company reported earnings of $2.81 per share on revenue of $90.2 billion, exceeding analyst estimates of $2.01 per share and $89.1 billion in revenue. This marks an improvement from last year’s earnings of $1.89 per share on $80.5 billion in revenue.

Alphabet’s advertising revenue reached $66.8 billion, also beating estimates of $66.4 billion. However, Google Cloud Platform revenue of $12.2 billion fell just short of predictions of $12.3 billion.

Despite these successes, Alphabet has dealt with ongoing scrutiny from antitrust regulators. A recent federal ruling concluded that Google holds an illegal monopoly in the online advertising space, which may necessitate restructuring its advertising or search operations.

Still, investor sentiment improved following Alphabet’s announcement of a 5% dividend increase and a $70 billion stock buyback program. CEO Sundar Pichai emphasized the company’s commitment to AI innovation, noting continuous growth across the business, particularly in AI’s integration into its services.

We continue to see healthy growth and momentum across the business, including AI powering new features…

Should You Buy?

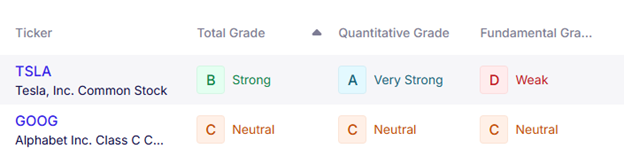

With both Tesla and Alphabet’s earnings examined, the question arises: Are these stocks buys? Utilizing my Stock Grader tool, we can assess their current investment potential.

Alphabet and Tesla Stock Ratings: A Comprehensive Overview

Alphabet currently holds a Total Grade of “C,” with a Fundamental Grade of “C” and a Quantitative Grade of “C.” This rating suggests that existing shareholders should consider it a “Hold” for now. New investors, however, might want to wait and monitor the stock closely before making a decision.

In contrast, Tesla has earned a Total Grade of “B,” indicating a “Buy” recommendation. Although it boasts a strong Quantitative Grade of “A” due to notable institutional buying activity, Tesla’s Fundamental Grade is less favorable at “D.” This discrepancy raises questions about the sustainability of Tesla’s performance.

Investors should prioritize strong fundamentals for long-term success when evaluating stocks. Given Tesla’s lackluster fundamental rating, I would personally advise against purchasing it at this time.

Finding Strong Stocks This Earnings Season

As earnings season approaches, the question arises: where can you find stocks with robust fundamentals? It’s essential to stay informed and focused amid the market’s fluctuations.

My current portfolio, Growth Investor, features stocks that demonstrate impressive metrics, including an average annual sales growth of 24% and an average annual earnings growth of 81.1%. For comparison, the S&P 500 is projected to achieve a mere 4.6% revenue growth and a 7.2% earnings growth rate in the first quarter.

Recently, I released my latest monthly issue to Growth Investor subscribers, highlighting a new stock expected to see sales growth of 32.4% and earnings growth of 49.7%. This snapshot indicates the potential for higher-performing investments.

For more insights on these growth opportunities, feel free to reach out via email. I’m always eager to assist subscribers with any queries they may have.

Sincerely,

Louis Navellier

Editor, Market 360