Optimistic Outlook

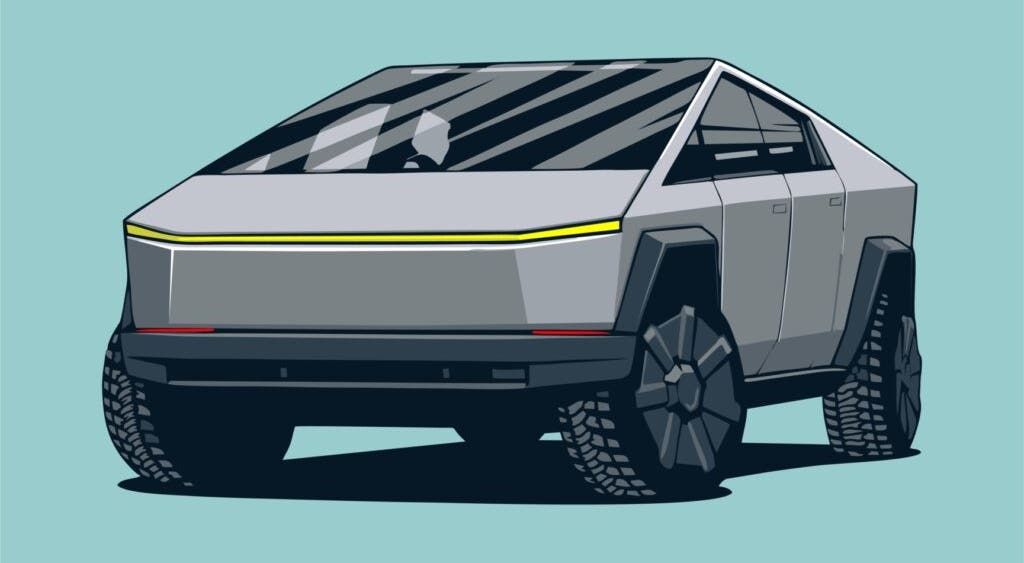

Future Fund Managing Partner Gary Black remains bullish on Tesla Inc‘s TSLA Cybertruck, believing it could be a significant driver of the company’s earnings come 2025, an outlook contingent on Tesla’s ability to ramp up production.

Production Potential

What Happened: Black estimates Tesla is currently producing 400 Cybertrucks per week, with plans to scale this up to 1000 per week by the fourth quarter. This scaling could result in approximately 30,000 Cybertruck deliveries for the year.

Earnings Projection

With a projected profit of $15,000 per unit for initial Cybertruck deliveries, Black suggests this could potentially translate to $0.1/share in earnings for the year. Looking ahead to 2025, he envisions Tesla delivering 100,000 Cybertrucks with a profit of $20,000 per vehicle, equating to $0.5/share in additional earnings.

Growth Potential

Black’s delivery estimates for 2025, while optimistic, still fall short of Elon Musk’s target of 250,000 Cybertruck deliveries for the same year, indicating room for growth beyond current projections.

Upside Momentum

Maintaining a price target of $250 for Tesla, Black’s optimism remains steadfast even as the stock closed at $175.66 on Wednesday, signaling a considerable upside potential from current levels.

Market Impact

Black anticipates that the Cybertruck could have a positive “halo” effect on Tesla’s entire product line, similar to the boost seen following the Model Y launch in 2020, which led to a substantial surge in delivery volumes and a seven-fold increase in Tesla’s stock value.

Consumer Interest and Celebrity Endorsements

Post the initial Cybertruck deliveries, Black highlighted the overwhelming consumer interest in the vehicle. He also pointed out the potential positive impact of celebrity endorsements, such as those from stars like Beyonce and Kim Kardashian, who have embraced the unique stainless steel design of the Cybertruck.

Price Performance

Price Action: Despite closing up 2.5% to $175.66 on Wednesday, Tesla’s stock has seen a decline of nearly 29.3% year-to-date, reflecting the market’s cautious sentiment towards the company amidst recent challenges.

For more insights into the future of mobility, check out Benzinga’s coverage by following this link.

Read More: ‘We Need To Bring This Back!’ Ford CEO Jim Farley Wants To Revive Psychedelic 1970s Bronco