Tesla Sees Surge in Insurance Registrations in China

Strong Demand Evident in Key Market: Tesla Inc. TSLA reported 18,600 insurance registrations in China for the week ending December 1. This figure suggests strong demand in one of the company’s most important markets, according to industry analysts.

Quarterly Growth Highlights: Gary Black, Managing Partner at The Future Fund LLC, emphasized that Tesla China’s performance in the fourth quarter shows impressive growth. Insurance registrations are up by 14.2% compared to last year and 5.8% from the previous quarter. Current trends indicate that this might be Tesla China’s best quarter yet.

Throughout November, weekly registrations consistently remained above 16,700 units. The latest number of 18,600 represents a substantial increase from earlier weeks, which recorded 17,300, 17,100, and 16,700 registrations.

Historically, Tesla’s presence in China has expanded significantly. Insurance registrations rose from 440,793 units in 2022 to 610,074 units in 2023. Projections for 2024 suggest that this upward trend will continue, with weekly registrations consistently exceeding those of prior years.

Related News: Charles Schwab and Goldman Sachs Increase MARA Stake as Stock Rallies 30% Over Last 6 Months

Challenges and Future Plans: While Tesla enjoys strong numbers in China, the company faces obstacles elsewhere. It was recently confirmed that Tesla has no immediate plans to sell its new Cybertruck in China, as noted by Chinese media outlet Jiemian. CEO Elon Musk previously mentioned that regulatory challenges may affect the stainless steel vehicle’s introduction into the market.

The Shanghai gigafactory, which produces the affordable Model 3 and Model Y vehicles, has played a vital role in Tesla’s success in China. Unlike the high-end Model S and Model X that are imported, local production of these models has enabled Tesla to capture a larger share of China’s expanding electric vehicle market.

The impressive insurance registration figures suggest that Tesla maintains strong demand in China despite rising competition from domestic manufacturers and global economic challenges.

Stock Performance Overview: On Monday, Tesla’s stock closed at $357.09, up 3.46% for the day. However, it dipped 1.23% in after-hours trading. Year-to-date, Tesla’s stock has increased by 43.74%, based on data from Benzinga Pro.

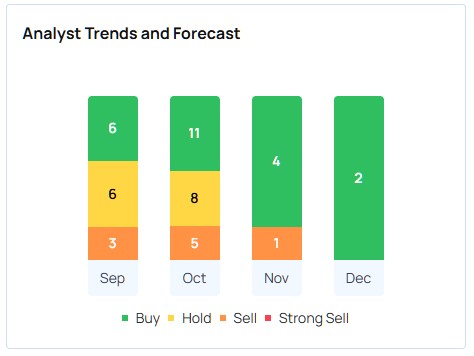

According to analysts, Tesla has a consensus price target of $246.16, based on insights from 34 analysts. The highest target stands at $411, while the lowest is $24.86. Recent evaluations from Roth MKM, Stifel, and UBS suggest an average target of $339, indicating a potential 5% downside, as per data from Benzinga Pro.

What’s Next:

Image via Tesla

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs