The recent Tesla TSLA earnings report has left many investors in the aftermath of a collision, with the stock plummeting more than 12% at one stage of mid-day trading after missing both sales and earnings expectations.

The company’s EPS of $0.71 fell short of the anticipated $0.74, and its revenue of $25.17 billion missed the expected $25.76 billion. Furthermore, with sales results showing only a 1% YoY increase and concerning guidance threatening notably lower volume growth, Tesla’s previously heady valuation may be a house of cards.

The automaker’s struggle has been compounded by price cuts, which have exerted further pressure on margins. The expectation of major secular growth in the electric vehicle (EV) market, on which Tesla’s premium valuation is grounded, has now come under severe doubt.

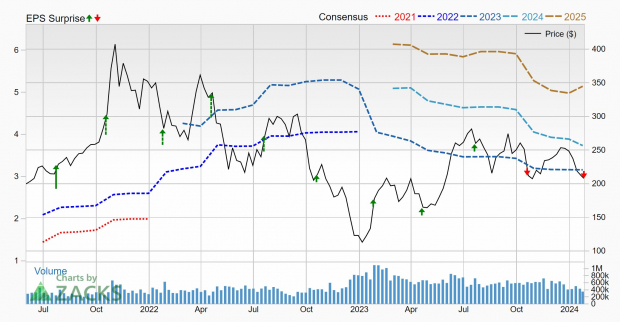

The Earnings Picture and Valuation

Image Source: Zacks Investment Research

A deeper look at Tesla’s earnings revisions trend reveals that the stock began to struggle as estimates for 2024 and 2025 started to decline. With a current Zacks Rank #3 (Hold) rating, Tesla is facing mixed earnings estimates. Furthermore, its one-year forward earnings multiple of 64.4x, while below its three-year median of 89x, still looms large over its competitors.

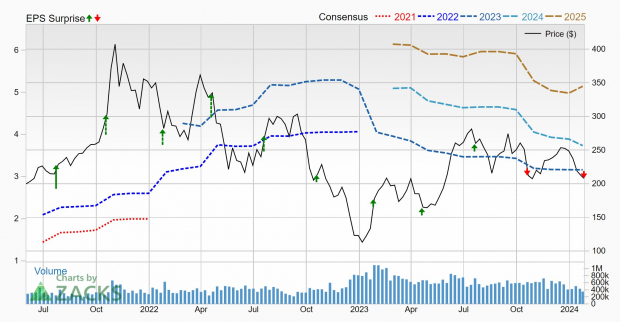

Automaker Alternatives

Image Source: Zacks Investment Research

Amidst Tesla’s turbulence, the stocks of Toyota Motors TM and Honda Motor Co. HMC present a more stable outlook. Both companies, with their Zacks Rank #3 (Hold) ratings, offer mixed earnings revisions, but also promising catalysts.

Over the next 3-5 years, Honda Motor Co. is projected to achieve an annual EPS growth of 21.2%, while Toyota Motors is expected to realize a 24.6% annual growth over the same period. In contrast to Tesla’s forecasted 3–5-year EPS growth of 18.8% annually, both Toyota and Honda boast much better earnings growth expectations.

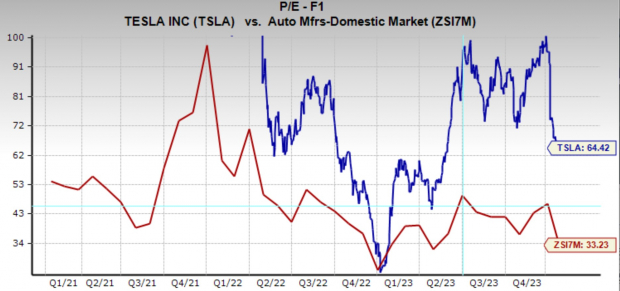

Image Source: Zacks Investment Research

Bottom Line

Although Tesla’s long-term potential under the visionary leadership of Elon Musk remains promising, its current struggle with growth has cast a shadow over its near-term outlook. As a result, investors might want to divert their attention towards more appealing options such as Honda Motor Co. and Toyota Motors, which are currently trading at more reasonable levels.

Toyota Motor Corporation (TM) : Free Stock Analysis Report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.