Tesla Faces Financial Hardships Amid Political and Market Turbulence

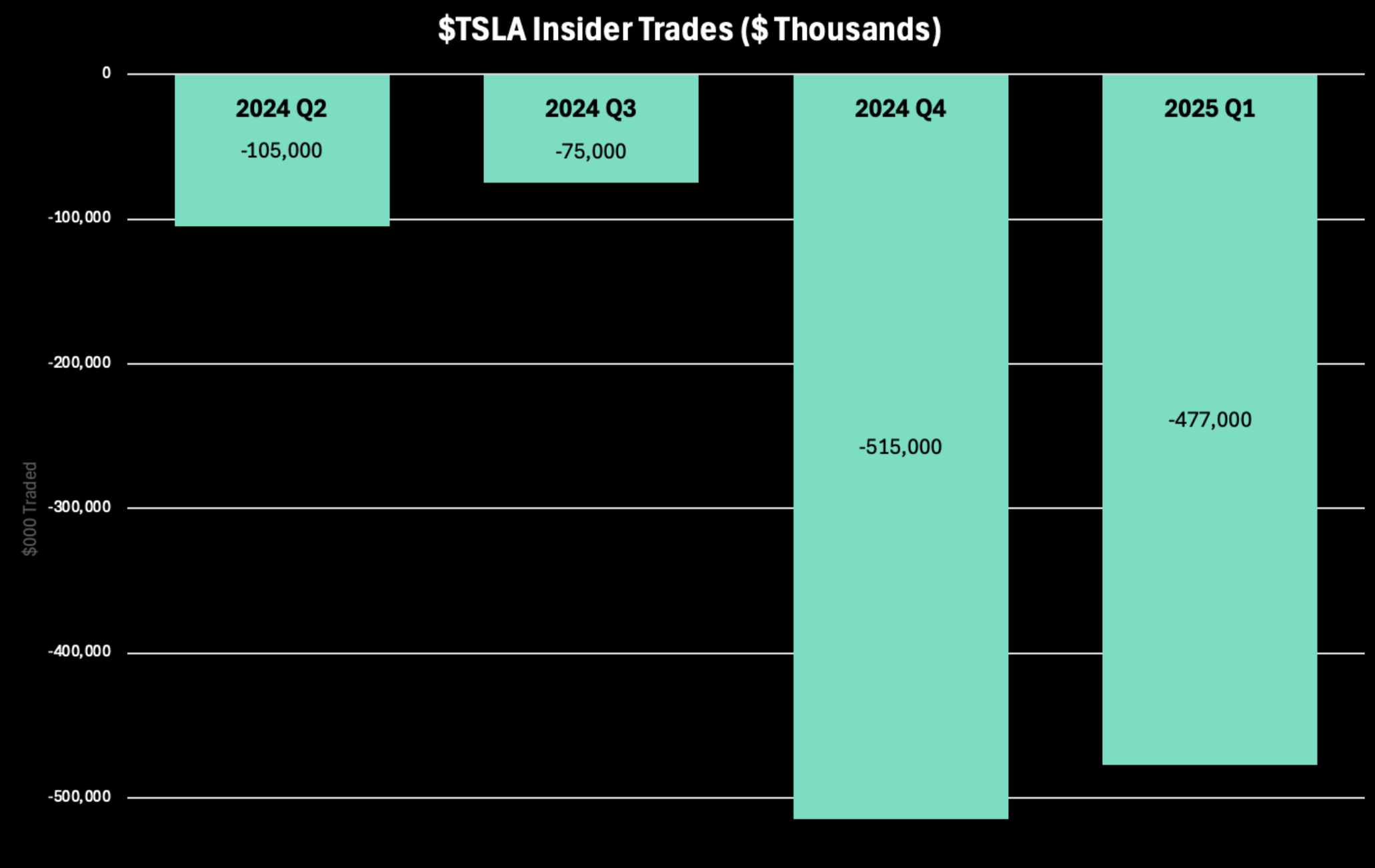

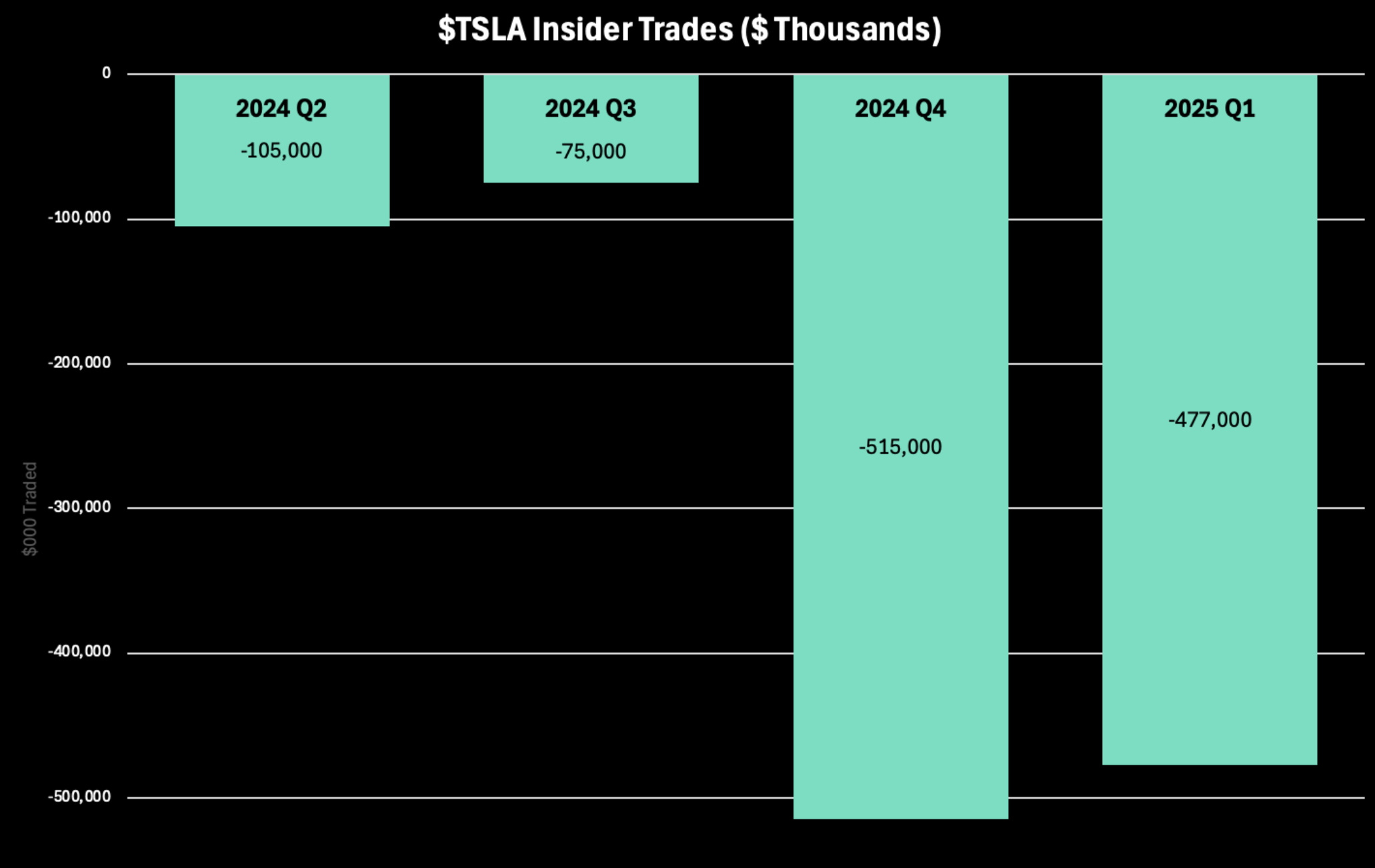

Elon Musk is advising Tesla employees to “hang onto your Stock.” As tariffs and changing electric vehicle (EV) policies pose challenges, Musk’s role as head of the Department of Government Efficiency (DOGE) also raises concerns for investors. As of March, $TSLA shares have decreased by 8% this month alone and plummeted by 40% since the year began. Moreover, insider trading activity has seen nearly $500,000 worth of Stock sold in the first quarter of 2025, with members of Congress disposing of over $100,000 in shares during February and March.

Impact of Tariffs and Supply Chain Issues

Multiple factors contribute to Tesla’s declining fortunes, with new tariffs set by President Trump significantly impacting U.S. manufacturers. To address these tariffs, Tesla is currently lobbying, having disclosed a lobbying expenditure of $190,000 in January. The company has urged U.S. Trade Representative Jamieson Greer to “consider the downstream impacts” that these import restrictions may impose. Additionally, supply chain disruptions are projected to increase production costs, thereby affecting Tesla’s profit margins, as the company depends on parts sourced from Canada, Mexico, and China—all of which face tariffs under current policies.

Decline in Global Sales Amid Heightened Competition

Sales of Tesla vehicles are also waning globally, particularly in Europe and China. Competitors like Ford, GM, and Volkswagen are increasingly encroaching on Tesla’s market share, while local automakers in China are eroding demand in Asia. Notably, in Germany—a significant market for electric vehicles—Tesla sales have nearly halved, dropping by 76% since February 2024.

Political Dynamics Around EV Adoption

Electric vehicles have entered the political arena, with Trump, previously critical of clean energy, now claiming to purchase a “brand new Tesla.” He has also accused left-leaning consumers of staging boycotts against the Stock.

Musk’s outspoken stance against the Biden administration and collaboration with Republican lawmakers have strained relationships with some traditional Tesla customers. His company’s forward-thinking energy goals may not align well with the interests of a conservative Congress. The reversal by President Trump of Biden’s 2021 executive order designed to promote electric vehicle adoption adds to Musk and $TSLA’s current challenges.

Industry-Wide Struggles and Market Dynamics

It is worth noting that Tesla is not alone in its struggles. BMW and other companies in the automotive sector are reporting weak Q1 earnings as consumer hesitance looms in an increasingly unpredictable market. Rising interest rates have made auto loans more expensive, inhibiting the wider adoption of electric vehicles.

Looking Ahead: Uncertainties and Future Directions

As Tesla navigates these turbulent times, its ability to distinguish its Stock valuation from Musk’s political involvement will be crucial for improving investor confidence, sales, and overall Stock prices. The company’s response to new tariffs remains uncertain, as do the tariffs’ potential effects on consumer demand. Although Musk encourages employees to retain their Stock, the recent insider activity indicates lingering skepticism about the company’s future forecasts.

This article was originally published on Quiver News; read the full story.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.