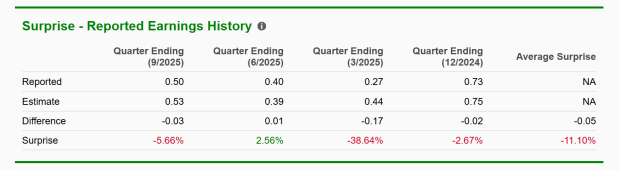

Tesla’s Upcoming Q4 Earnings Report

Tesla Inc. (TSLA) is set to report its Q4 earnings on Wednesday, January 28, after the market close. Analysts forecast earnings per share (EPS) of $0.45, reflecting a 40% decline year-over-year, with revenues expected to reach approximately $24.75 billion. The options market indicates a potential post-market price move of +/- $29.56, or 6.58%, following the report.

Key Business Challenges and Future Prospects

Tesla’s legacy electric vehicle business, which constitutes about 75% of its revenue, faces challenges amid a slowing EV market and increased competition. Despite these hurdles, the company has seen a stock price increase from a low of $100 in late 2023 to near all-time highs. Analysts note Tesla’s growth in its energy segment, rising 84% year-over-year, and the testing of its full self-driving service, which is reported to be twice as safe as human drivers according to recent third-party data.

Market Position and Future Innovations

As Tesla approaches this earnings report, investor focus will likely shift to its diversification beyond EVs, including advancements in Tesla Energy, robotic technologies, and the anticipated semi-truck production. The company’s long-term viability will depend on these strategic expansions offsetting current challenges in its traditional EV sales.