“`html

Donald Trump’s Election Victory Sparks Optimism for Tesla’s Future

The wait is finally over. Donald Trump has staged a historic comeback, defeating Kamala Harris to win the 2024 U.S. election. Markets celebrated the news, closing at record highs amid optimism around Trump’s potential tax cuts and pro-domestic trade policies aimed at revving up American manufacturing and boosting economic growth.

One stock riding high on this bullish sentiment and celebrating Trump’s resurgence is the electric vehicle (EV) trailblazer Tesla (TSLA). Yesterday, shares of TSLA surged around 15% following Trump’s win, adding an impressive $20 billion to CEO Elon Musk’s wealth overnight.

Musk has played an influential role in Trump’s campaign, making sizable financial contributions and leveraging his social media presence to galvanize support. Trump reciprocated with high praise for Musk, calling him a “super genius” and a “new star” during his victory speech yesterday. Reports suggest Trump may offer Musk a role in a new government department — the “Department of Government Efficiency.” Clearly, a friendship with the President comes with perks!

With Musk’s close ties to the President-elect, Tesla could gain unique advantages that set it up for a potentially lucrative year ahead. So, should investors consider betting on the stock now? Can Tesla reach the $500 mark next year? Let’s explore how Trump’s return to the White House may impact Tesla’s future.

Trump’s Stance on EVs: Possible Challenges and Opportunities for TSLA

Throughout his campaign, Trump expressed skepticism regarding EVs, promising to end the EV mandate on his first day in office. He frequently claimed that EVs “don’t work” and hinted at reducing subsidies, such as the $7,500 federal tax credit for EV purchases. However, Tesla’s resilience is attributed to its cost efficiency and economies of scale.

Tesla operates as one of the lowest-cost producers in the EV market due to its extensive vertical integration—from battery manufacturing to software development—and its global Gigafactories that lower production costs. Therefore, Tesla might weather subsidy cuts better than competitors like Rivian (RIVN), which are still working toward profitability. Tesla’s production efficiency and strong brand loyalty position it well for continued growth, even without the incentives that support other EV startups and traditional automakers such as General Motors (GM) and Ford (F), who are still incurring losses in their EV sectors.

Trump’s Trade Policies: Boost for Tesla in Domestic Markets

Trump’s trade policies, particularly his tough stance on China, may enhance Tesla’s status in the U.S. market. Presently, the U.S. imposes a 100% tariff on Chinese EVs. Trump has indicated he may raise this to 200% for EVs made in Mexico and imported to the U.S. These tariffs could pose significant barriers for Chinese automakers like BYD Co Ltd. and Nio as they attempt to grow in the U.S. market. With a substantial domestic production capacity and a strong foothold in the EV market, Tesla may capture greater market share as competition weakens.

Growth Potential in TSLA’s Energy Sector Amid Pro-Domestic Policies

Despite Trump’s preference for traditional energy sources, his manufacturing-centric policies could favor Tesla’s energy business. Tesla’s Powerwall and Megapack, primarily produced domestically, could thrive under tax cuts and incentives encouraging U.S. manufacturing. This environment could accelerate growth in Tesla’s energy division, which already boasts the highest profit margins. The upward trajectory in this segment is expected to continue.

Regulatory Changes: Supporting TSLA’s Autonomous Driving Innovations

A deregulatory approach under Trump could simplify the path for Tesla’s Full Self-Driving (FSD) technology. With over 1.3 billion miles logged by FSD users, Tesla holds a significant advantage in autonomous data that could improve long-term prospects. Although safety concerns remain, reduced regulatory scrutiny could facilitate advancements in FSD technology, a key revenue driver for the company.

Positive Momentum for TSLA Stock

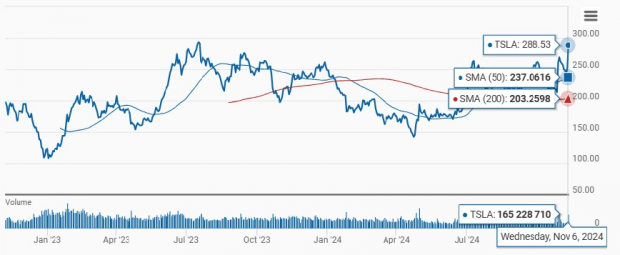

Tesla shares reached a new 52-week high yesterday. Technically, TSLA is trading above its 50-day and 200-day moving averages, signaling bullish market sentiment and confidence in the company’s financial health and growth potential. The stock currently holds a Momentum Score of B.

TSLA Trading Above Key Moving Averages

Image Source: Zacks Investment Research

Solid Growth and EPS Estimates Prompt Investor Interest

Tesla delivered strong earnings in the September quarter, breaking a recent streak of misses in earnings estimates.

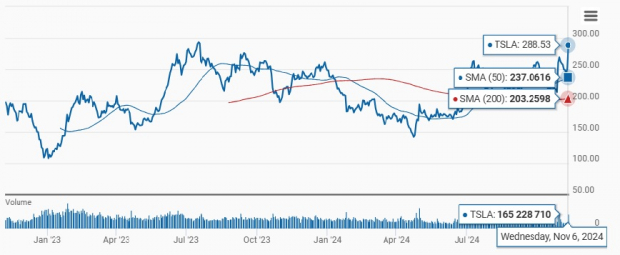

Tesla, Inc. Price, Consensus and EPS Surprise

Tesla, Inc. price-consensus-eps-surprise-chart | Tesla, Inc. Quote

In its recent earnings report, Tesla highlighted positive developments, including rising Cybertruck production and favorable gross margins. The Cybertruck has become the third best-selling EV in the U.S. after Tesla’s Model Y and Model 3, showcasing strong consumer demand. With Musk predicting overall vehicle growth between 20% and 30% for next year, Tesla appears well-positioned, especially as gross margins improve.

Musk has also announced plans for ride-hailing robotaxis in Texas and California by next year, pending regulatory approval. He has promised an “unsupervised” FSD system in the same timeframe. While past predictions from Musk have not fully materialized, the steady advancements in this area should keep investor interest high.

The Zacks Consensus Estimate for Tesla’s 2024 and 2025 EPS has risen over the past 30 days.

Image Source: Zacks Investment Research

TSLA: A Strategic Long-Term Investment Opportunity

Tesla’s growth in 2025 largely depends on…

“`

Tesla’s Bright Future: Key Factors Driving Growth and Stock Potential

Understanding Tesla’s Unique Advantage

Three important factors are helping Tesla rise: vehicle delivery growth, margin improvement, and advancements in autonomous vehicles and artificial intelligence. Although the overall electric vehicle (EV) industry might face challenges under Trump’s administration, Tesla appears strategically positioned to come out on top during this period.

The company’s strong market position and ability to thrive without heavy subsidies provide it with a significant competitive edge. Additionally, potential tariffs could further shield Tesla from Chinese competition. Favorable domestic manufacturing incentives may also assist in capitalizing on these changes.

Is Now the Right Time to Invest in Tesla?

The question arises: Should investors buy Tesla stock at its current price? For those looking towards the long term, the answer seems affirmative. Although short-term trading fluctuations, like yesterday’s 15% price jump, may create volatility, they shouldn’t overshadow Tesla’s expansive growth potential. In fact, any price dip might represent a chance to increase investment in a company well-positioned to benefit from Trump’s pro-manufacturing and pro-deregulation policies.

Could Tesla Reach $500 by 2025?

While it might seem overly ambitious for Tesla to hit $500 by 2025—especially with TSLA shares closing at $288.53 recently—historical performance suggests it’s not impossible. Tesla is on the brink of a significant growth phase, aided by an expanding market presence and technological advancements. Regardless of whether it reaches this price point in the specified time frame, Tesla is set for substantial long-term growth under Trump’s policies, making it a commendable addition to your investment portfolio now.

Currently, TSLA stock holds a Zacks Rank #1 (Strong Buy). You can view the complete list of today’s Zacks #1 Rank stocks here.

Discovering Profits in Nuclear Energy

Electricity demand is rising rapidly, alongside efforts to reduce reliance on fossil fuels like oil and natural gas. Nuclear energy stands out as a viable alternative.

Governments from the US and 21 other nations have pledged to TRIPLE the world’s nuclear energy capacities. This shift could lead to significant profits for companies in the nuclear sector, especially for investors who get in early.

Our vital report, Atomic Opportunity: Nuclear Energy’s Comeback, details the key players and technologies that are driving this change, highlighting three standout stocks poised to reap the greatest benefits. Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

Want the latest stock insights from Zacks Investment Research? Download 5 Stocks Set to Double today for free.

Ford Motor Company (F): Free Stock Analysis Report

General Motors Company (GM): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Rivian Automotive, Inc. (RIVN): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.