Tesla Faces Challenges as Deliveries and Margins Decline

Tesla (NASDAQ: TSLA) continues to be the center of attention in the electric vehicle (EV) market. Recently, shareholders experienced a surge in optimism, primarily following the 2024 election, but the company’s stock has since dropped by about 50% from its peak. This downturn has erased recent gains, as Tesla grapples with shrinking profit margins and increasing competition globally.

Delivery Slumps and Revenue Declines

After releasing its first-quarter results, Tesla’s stock initially rose during after-hours trading. However, market reactions were influenced more by external factors, including remarks from President Donald Trump regarding U.S. tariffs on China. A closer look at Tesla’s financial report reveals troubling signs.

The company reported a 13% decrease in EV deliveries year-over-year. Revenue fell by 9%, only partially offset by growth in its energy generation and storage segment. The gross margin has dropped to 16.3%, while the operating margin for Q1 stood at a mere 2.1%. These figures indicate Tesla’s vulnerability to rising costs and intensified competition, as it has failed to gain market share across critical regions such as China, North America, and Europe.

Looking ahead, Tesla’s management is not projecting optimism for the rest of 2025. They chose to withhold guidance numbers until the next quarter and did not provide insights into growth expectations for the upcoming months. This uncertainty highlights a significant shift for a company once viewed as a beacon of rapid technological advancement.

New Products on the Horizon?

Optimistic investors may argue that future product launches could revitalize Tesla. The company plans to produce a new, affordable vehicle model by 2025 and aims to increase its annual production capacity to 3 million vehicles. In 2024, Tesla produced just under 2 million vehicles. However, skeptics question whether there is sufficient demand for these new vehicles, as sales have been supported mainly by extensive price cuts that have further diminished profit margins. In contrast, companies like BYD are capitalizing on Tesla’s decline in market share in China.

Tesla is also working on ambitious projects outside consumer EVs, such as the Cybercab, an autonomous vehicle expected to enter volume production in 2026. The Optimus Robot is currently undergoing testing, but a public release date remains uncertain. While these projects may have technological promise, they are unlikely to provide financial relief for the company in the near future. Investors who bank on Tesla’s stock due to the Cybercab or Optimus may be overestimating a management team known for unmet promises.

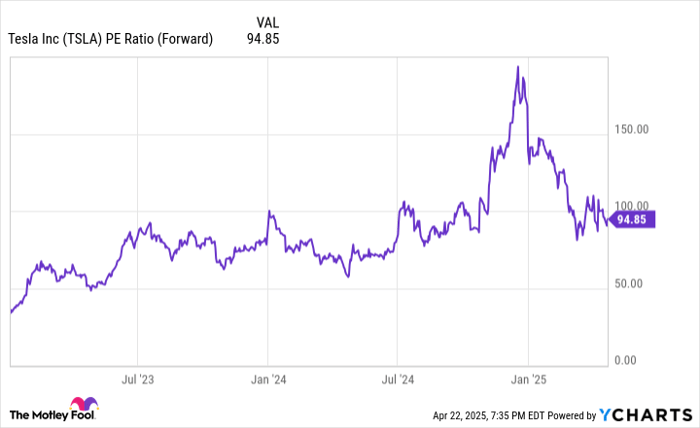

TSLA PE Ratio (Forward) data by YCharts.

Crucial Earnings Metrics

Typically, a company’s stock price increases with the growth of its earnings potential over time. However, Tesla is not in a position to demonstrate this. Its earnings are on a downward trend; for the first quarter, Tesla reported adjusted earnings per share (EPS) of $0.27, substantially below the analyst expectation of $0.39. Following the end of 2022, operating income has been declining, and given the current profit margins, further decreases in 2025 seem likely.

In addition, Tesla’s shares are not priced reasonably at the moment. The stock currently trades at a forward price-to-earnings (P/E) ratio of 95, a number that does not reflect the anticipated adjustments analysts may make following the disappointing first-quarter earnings. A forward P/E of this magnitude indicates potential struggles ahead for shareholders, as market averages typically range between 20 and 25.

Considering the high forward P/E ratio, Tesla’s shareholders may face more challenges in the coming years. Investors should refrain from purchasing this stock for now.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.