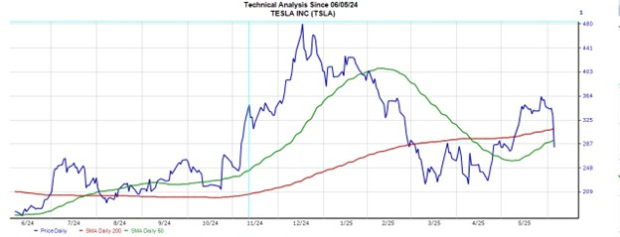

Year-to-date, Apple (NASDAQ: AAPL) and Tesla (NASDAQ: TSLA) have suffered losses of 19% and 15%, making them the worst performers of the “Magnificent Seven” stocks. As of now, Apple’s median target price from 50 analysts is $235, suggesting a potential upside of 16% from its current price of $202. In contrast, Tesla’s median target price from 55 analysts is $307, indicating a 10% downside from its current price of $343.

Analysts project Apple’s earnings to grow at 6% annually through fiscal 2026, while Tesla’s earnings are expected to increase by 14% over the same period. Tesla’s market challenges include a recent decline in market share in Europe and the U.S. and anticipated factors like new autonomous driving ventures, while Apple grapples with potential antitrust issues and manufacturing shifts.