Tesla’s Market Cap Falls Below $1 Trillion as Sales Decline

U.S. electric vehicle and tech powerhouse Tesla saw its TSLA market capitalization dip below $1 trillion yesterday. The company’s shares dropped more than 8%, closing at $302.80. This decline marks the fourth consecutive day of losses, culminating in a 16% slump in just four sessions and erasing $186 billion in market value. Tesla’s valuation currently stands at approximately $974 billion, largely undoing its gains following the recent presidential election. In late 2024, the stock benefited from Trump’s election victory and CEO Elon Musk’s favorable connections to the new administration. However, the year 2025 has been challenging for Tesla, with shares down 25% year to date.

What is causing this significant decline? Investors are now questioning whether this is a “buy-the-dip” opportunity or if Tesla’s inherent challenges render it a risky prospect at this time. Let’s explore the situation.

January Sales Decline and Seasonal Impacts

Tesla experienced a sales downturn last month, with notable reductions in major markets. In Europe, the company sold 9,945 vehicles, representing a 45% decrease year over year, while overall battery electric vehicle (BEV) sales in the region surged by 37%, according to the European Automobile Manufacturers’ Association. In Germany, Tesla sold just 1,277 units, the lowest figure since July 2021, and in France, sales fell by 63%, reaching their weakest point since August 2022. In a historic shift, Tesla sold fewer vehicles than China’s BYD Co Ltd BYDDY for the first time in the UK.

Sales in China also reflected a slowdown, with figures for January down around 15% year over year, based on the China Passenger Car Association’s data. In the U.S., Tesla reported approximately 42,000 vehicle sales, a 13% decline year over year, as tracked by Freedom Capital Markets. Notably, Tesla’s U.S. BEV market share dropped from 59% in January 2024 to 45% in January 2025, as reported by Wards Auto.

This decline underscores Tesla’s increasing struggles, particularly following its first-ever annual decline in global vehicle deliveries in 2024. Increased pressure is mounting on Musk to expedite the launch of more affordable models and advance the company’s push for autonomous driving, a critical element of Tesla’s long-term strategy.

Nevertheless, January is traditionally the slowest month for car sales, meaning a weak start may not indicate a poor quarter or year. Thus, this drop should not be viewed as wholly alarming. Some industry observers also note inventory shortages in specific regions after Tesla’s aggressive year-end delivery efforts. Furthermore, ongoing updates to the Model Y may have interrupted sales, as potential buyers might be waiting for the refreshed model.

Despite these explanations, investor sentiment is growing uneasy, with many choosing to sell rather than wait for potential recovery from new models and forthcoming autonomous features. The question remains whether this downturn is merely seasonal or indicative of more fundamental issues.

Investor Anxiety Grows Over FSD Update in China

Tesla’s troubles extend beyond declining sales to include disappointments with its highly anticipated self-driving software update in China. The company has been awaiting government approval to implement more advanced automation features, seeking to bring the Chinese version of its driver-assistance system in line with the U.S. Full Self-Driving (FSD) software. However, regulatory delays have postponed the expected rollout from late 2024 to 2025, leaving Tesla customers in limbo.

Recent rumors suggested that a major FSD update was imminent, but the actual software release was met with disappointment. Although it introduced in-city navigation, it still requires full driver attention, maintaining Tesla’s system at Level 2 automation. This is a significant area of concern, especially as rivals in China are offering comparable or superior automation features at lower prices.

For instance, BYD recently unveiled its “God’s Eye” driver-assistance system included at no extra cost, while Xiaomi’s new SU7 presents its self-driving technology as standard. In contrast, Tesla continues to charge a premium for its automation features, making its pricing less justifiable as competition intensifies.

Musk’s Busy Schedule Raises Investor Concerns

Musk is currently managing numerous responsibilities, overseeing Tesla, SpaceX, and other ventures. His new role at President Trump’s Department of Government Efficiency (DOGE) has him spending a significant amount of time in Washington, D.C. Musk has begun influencing government structures, including taxpayer data, while advocating an aggressive cost-cutting initiative. Recently, he required federal workers to justify their positions or face termination, with Trump’s support despite claims of voluntary compliance. As of yesterday, Musk provided federal employees another opportunity to respond, showcasing his increasing authority.

Musk’s heightened involvement in politics is heightening investor unease. Concerns are growing that his focus on a significant government overhaul may detract from his responsibilities at Tesla during a critical phase. As competition escalates and sales slow down, investors believe Musk’s undivided attention is necessary now more than ever.

Tesla’s Price Performance and Valuation

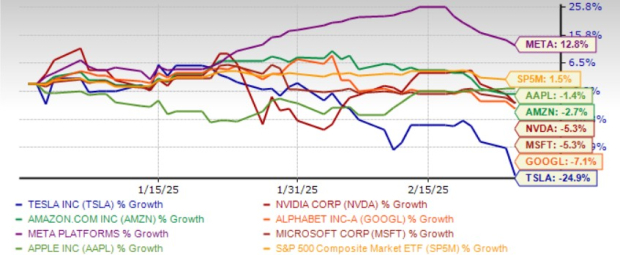

With a year-to-date decline of 25%, Tesla has underperformed compared to its Mag 7 peers. Meanwhile, the S&P 500 index has increased by 1.5% during the same period.

YTD Price Performance Comparison

Image Source: Zacks Investment Research

Tesla is losing its footing in terms of its 50-day moving average.

Image Source: Zacks Investment Research

Currently, TSLA is trading at a forward 12-month P/E ratio of 112X—almost four times the average forward P/E ratio of its peers. Given the slowdown in EV growth and execution risks, Tesla is deemed overvalued, earning a Value Score of F.

Stretched Valuation

Image Source: Zacks Investment Research

Critical Year Ahead for Tesla

Tesla is at a pivotal moment, facing significant challenges this year. As EV sales decline and the need for affordability grows, the company must fulfill its commitments to producing lower-cost models. Tesla aims to introduce an affordable EV in the first half of 2025 and expand…

Tesla Faces Challenges as Market Dynamics Shift and Solutions Emerge

Tesla is tackling several obstacles as it seeks to regain its market position, particularly in price-sensitive areas. The company’s success in overcoming these challenges may be pivotal for its market share recovery.

Focus on Autonomous Vehicles and Future Growth

Elon Musk is placing significant emphasis on Fully Self-Driving (FSD) technology and robotaxis. He regards these innovations as vital to Tesla’s future profitability. The company plans to launch unsupervised FSD as a paid service in Austin this June, with aspirations to expand into California and additional U.S. markets by the end of the year—contingent on regulatory approval. With Musk at the helm of Dogecoin, a more simplified regulatory environment could facilitate Tesla’s rollout of autonomous vehicles.

Investor Considerations Amid Price Decline

Tesla shares are currently down 37% from their peak on December 17, raising concerns for potential buyers. The company is grappling with multiple hurdles and must demonstrate its capability to meet 2025 targets. Additionally, earnings forecasts have been revised downward in the past month, which may influence investment decisions.

Image Source: Zacks Investment Research

For interested investors, monitoring Tesla’s advancements in autonomous vehicle technology will be crucial. Progress regarding FSD approvals and robotaxi initiatives is likely key to the company’s long-term growth trajectory. Current shareholders may find it prudent to wait for a more favorable exit point, given the risks present in the near term, although Tesla’s long-term prospects remain intriguing.

Tesla currently holds a Zacks Rank #3 (Hold). Investors can view the complete list of Zacks #1 Rank (Strong Buy) stocks here.

Zacks’ Research Chief Highlights Potential Stock Doublers

Our research team has identified five stocks that may have the potential to gain +100% or more in the near future. Among these, Sheraz Mian, Director of Research, has highlighted one Stock that appears poised for substantial gains.

This standout stock comes from an innovative financial firm boasting a rapidly expanding customer base of over 50 million, along with a diverse range of cutting-edge solutions. While past picks haven’t all performed well, this stock could notably exceed previous Zacks highlights, such as Nano-X Imaging, which rose +129.6% in just over nine months.

Free: see Our Top Stock And 4 Runners Up.

For the latest recommendations from Zacks Investment Research, you can download our report on the 7 Best Stocks for the Next 30 Days here.

Tesla, Inc. (TSLA): Free Stock Analysis report

Byd Co., Ltd. (BYDDY): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.