Tesla Faces Challenges Amidst Mixed Quarterly Results

Electric vehicle (EV) leader Tesla (TSLA) has encountered a tough start to the year, marked by declining sales in the United States, China, and Europe. Intense competition and significant discounts have pressured demand and profit margins. Moreover, CEO Elon Musk’s political engagements have drawn investor criticism, including backlash from Democrats, resulting in damage to Tesla’s brand image. As a consequence, the company’s stock has dropped 30% year to date.

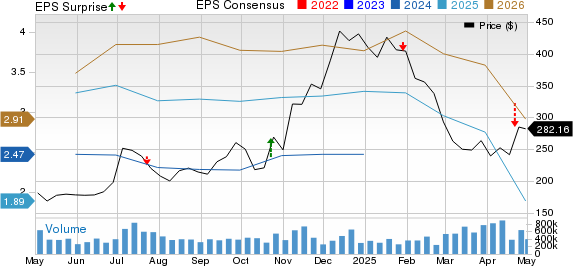

Despite this rocky beginning, Tesla’s shares have gained 18% following its latest quarterly results, which revealed a miss on both top and bottom-line expectations, along with a decline in year-over-year sales and profits. The automotive gross margin fell to 11.3%, down from 15.5% reported in the first quarter of 2024. (Find the latest earnings estimates and surprises on Zacks earnings Calendar.)

Tesla, Inc. Price, Consensus, and EPS Surprise

Tesla, Inc. price-consensus-eps-surprise-chart | Tesla, Inc. Quote

What factors have contributed to this stock rally, despite disappointing results? Here are three key elements.

Musk Reducing Political Focus

Musk Dialing Down on DOGE Time: CEO Elon Musk has announced plans to limit his involvement with U.S. President Trump’s Department of Government Efficiency (DOGE) starting this month. Previously, his political focus contributed to Tesla’s declining brand appeal. Investors remain hopeful that Musk’s renewed focus on Tesla will restore some of its former prestige.

New Affordable Model On the Horizon

Affordable Model Coming: Tesla is committed to producing a more affordable vehicle within the first half of this year. As competition for budget-friendly EVs intensifies, market sentiment appears optimistic that this new lower-priced model will enhance sales volume.

Plans for Robotaxi Program

Robotaxi Launch on Track: Investors have been keenly awaiting updates on Tesla’s pilot Robotaxi program, scheduled for Austin this summer. Following previous delays, several macroeconomic uncertainties loomed large. Musk’s confirmation that the robotaxi services will launch in June has brought renewed confidence to stakeholders.

Should Investors Be Cautious About Tesla Stocks?

While Musk plans to dedicate more of his time to Tesla, it’s important to recognize the challenges already facing the company. Several issues persist that require addressing, and Musk must prove capable of restoring investor trust.

As Tesla struggles with sales, China’s EV counterpart BYD Co Ltd. (BYDDY) is witnessing significant growth. In the first quarter of 2025, BYD delivered 416,388 battery electric vehicles, surpassing Tesla’s 336,681 units in the same period. This marks BYD’s status as the world’s leading EV manufacturer for the second consecutive quarter. BYD’s rapid expansion and advanced technology pose a formidable challenge to Tesla’s once-dominant position.

While Tesla has yet to release a low-cost EV, BYD is already succeeding with budget-friendly alternatives. Several companies have introduced or plan to introduce inexpensive models by the end of the year, raising questions about whether Tesla’s entry in this segment will make a significant impact.

Although investors are optimistic about AI-enhanced self-driving taxi services, it’s crucial to remember the urgency of the situation. Alphabet’s (GOOGL) Waymo currently leads the small but expanding autonomous ride-hailing market. With years of real-world tests and strategic partnerships, Waymo operates commercial services in multiple cities. The company has committed $5 billion to this initiative, positioning itself to strengthen its market hold.

Musk has criticized Waymo’s vehicles as being overpriced, relying on costly sensors contrary to Tesla’s camera-based AI strategy. He remains confident that Tesla’s high-volume, low-cost approach combined with in-house AI capabilities gives it a competitive edge. However, this level of confidence is typical for Musk, and investors will hope his bold assertions hold true.

What Do Analysts Predict for Tesla?

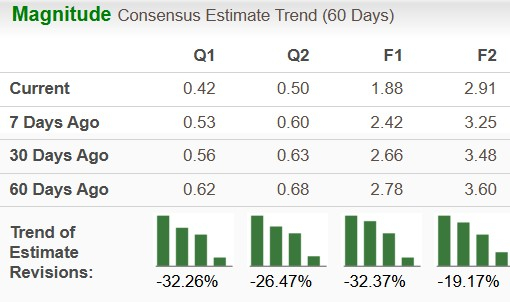

The Zacks Consensus Estimate indicates that Tesla’s 2025 EPS will decline by 22.3% year-over-year, with estimates experiencing downward revisions.

Image Source: Zacks Investment Research

Tesla’s Valuation Status

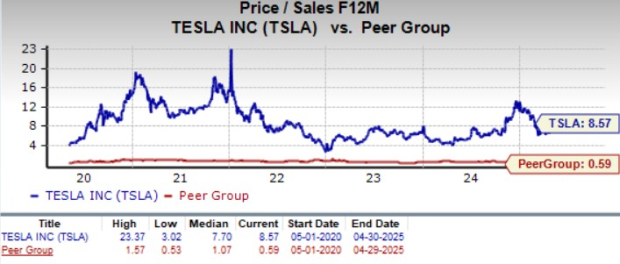

From a valuation standpoint, Tesla appears significantly overpriced. The company is trading at a forward price/sales ratio of 8.57, considerably higher than its peer group’s average of 0.59.

Image Source: Zacks Investment Research

This valuation premium is challenging to justify when examining fundamentals. The market appears to be accounting for significant success in uncertain areas like autonomous driving and humanoid robotics, both of which are high-risk ventures for Tesla at this time.

Strategic Considerations for Tesla Investors

Tesla’s core business is currently under pressure. Musk has revised his 2025 vehicle growth target from 20–30% to more conservative numbers, without reaffirming any guidance amid ongoing global tariff issues and challenges in China. The company plans to reassess its 2025 delivery volume targets in the upcoming quarterly update.

Tesla’s long-term prospects depend on successfully scaling autonomous vehicles and humanoid robots. Achievements in Full Self-Driving approvals and robotaxi development are crucial for future growth. If Tesla executes effectively, the stock may rebound significantly.

Nonetheless, it remains premature to invest solely based on these expectations. New investors might find it prudent to wait for clearer signs of progress. With downward estimate revisions, valuation concerns, and ongoing macroeconomic uncertainties, even existing investors may need to reevaluate their positions.

# Tesla Faces Downgrade Amid Concerns About Profitability

Tesla currently holds a Zacks Rank #5 (Strong Sell) and features a VGM Score of F, indicating potential challenges in its financial outlook.

Research Insights: Stock with High Potential Revealed

According to financial analysts, there are five stocks presently identified as having a significant chance of outperforming, with the possibility of doubling in value soon. Among these, Sheraz Mian, Director of Research, emphasizes a particular stock that stands out for its growth potential.

This stock belongs to an innovative financial firm that has rapidly scaled its customer base to over 50 million. Offering a variety of advanced solutions, it is seen as well-positioned for significant gains in the near future. While not every selection guarantees success, this stock has the potential to exceed notable past performers like Nano-X Imaging, which surged by +129.6% in just over nine months.

Tesla, Inc. (TSLA), Alphabet Inc. (GOOGL), and BYD Co., Ltd. (BYDDY) are also being closely monitored as part of broader investment analyses. Current data is available for those interested in in-depth assessments of these companies.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.